Bitcoin markets are slowly moving out of bear territory

Bitcoin markets have been in retreat since mid-February and recent psychological price rejections. However, they remain in a transition phase according to chain analysis.

In its “Week On-chain” report on March 6, blockchain analytics provider Glassnode noted that Bitcoin prices had rejected a number of psychological levels on the chain.

It added that the decline was related to “older hands from the 2021-22 cycle,” and the whale cohort. In addition, last month’s BTC pump to $25,000 was also rejected at least four times.

BTC has been range-bound at current levels on very little volume since Friday’s dump to a weekly low of $22,200.

Bitcoin markets still weak

The report also noted that the $23,500 price level acted as a psychological barrier. It will result in a return to profit for virtually all Bitcoin holders.

“Price break above $23,500 will reflect a rally above the Old Supply Realized Price, putting the average holder in all cohorts back into profit.”

Net unrealized profit/loss (NUPL) calculation can be used to indicate market transition phases. Average BTC owners now have a net unrealized profit of around 15% of market capitalization.

Glassnode concluded that current market conditions resemble those at the end of a bear market.

“The current state of the market can reasonably be described as resembling a transitional phase, which usually occurs in the later stages of a bear market.”

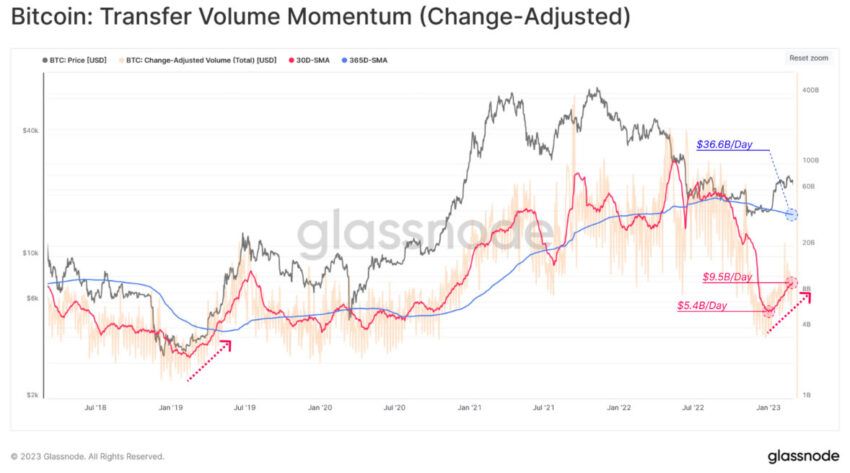

In addition, transfer momentum has increased, which is a sign of increasing adoption and the supply of new capital to the market.

Transfer volume has grown since January, but remains below the annual average. A break above the 356-day 30-day moving average would signal the return of “strong capital tides.” However, there is still a long way to go before this happens again, according to the chart.

BTC Price Outlook

The Bitcoin price has remained largely flat since March 3, when it fell more than 5% in an hour. There have been a couple of breaks above $22,500, but they were quickly rejected.

BTC is currently trading up half a percent on the day to $22,525 at press time.

The asset is currently facing resistance again and needs to break through this to prevent a drop to low $22,000 levels. It is currently down 9.2% in the last fortnight and remains in a short-term weekly downtrend.

Sponsored

Sponsored

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use all such information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.