Bitcoin marginally higher this week, but still below $30K

D-Keine/iStock via Getty Images

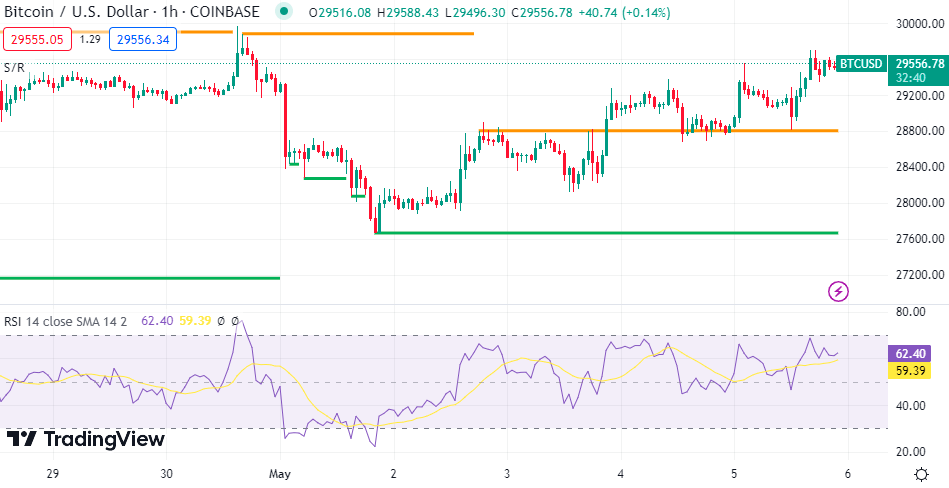

Bitcoin (BTC-USD), which is struggling to get past $30,000, held in range during a week that saw the Federal Reserve signal a pause in tightening policy and a jobs report that showed a stubbornly tight labor market.

The best cryptocurrency is close to a weekly gain 1%but ether (ETH-USD) is set to end the week 5.3% higher.

The Fed raised its benchmark interest rate by 25 basis points, as expected, softening its stance slightly to signal that the central bank does not necessarily expect further tightening. However, the latest jobs report could push the Fed to consider another rate hike, or at least keep rates high for longer.

These events had limited impact on bitcoin (BTC-USD), which continued to trade in the $27.68K-$29.95K range.

“Bitcoin (BTC-USD) prices have been trading in a narrowing triangle about to be broken to the upside,” said Markus Thielen, head of research at Matrixport. “While trading volume has fallen recently, the path higher sees only limited resistance. Transactions on the BTC network have reached new all-time highs.”

Thielen noted that the number of active addresses on the BTC network is approaching 1M.

The total crypto market cap was $1.22T, up 2.7% over Thursday, according to CoinMarketCap.

Even as regulatory uncertainty continues, New York Attorney General Letitia James has proposed a new bill that would increase New York’s financial watchdog’s authority in controlling the crypto industry. The bill will, among other things, require independent public audits of crypto exchanges.

In other news, Coinbase (COIN) rose after Q1 results beat expectations. But the exchange guided for a sequential decline in subscription and service revenue for Q2 due to the decline in USD Coins (USDC-USD) market cap since Q1.

Coinbase (COIN) also launched an international crypto derivatives exchange in Bermuda as it continues to expand outside the US amid regulatory heat. Needham believes this could be a $30-$200M a year revenue opportunity.

Remarkable news

- MicroStrategy ( MSTR ) Q1 results beat estimates as the company’s losses on crypto writedowns narrowed significantly.

- BNP Paribas, in partnership with the Bank of China, is promoting the use of the country’s CBDC by linking digital yuan wallets to bank accounts.

Bitcoin, Ether Prices

- Bitcoin (BTC-USD) rose 2.7% to $29.55,000 at 6:30 PM ET and ether (ETH-USD) climbed 6.2% to $1.99K.

- As for bitcoin (BTC-USD), SA contributor and investment group leader Mike Fay believes investors should be cautious rather than aggressive at this time. “I think in the shorter term, bulls looking to aggressively scale a position rather than dollar cost averaging over time can probably be patient and wait for a better price.”

More about Crypto

The State of Crypto ETFs in 2023

Crypto continues to climb amid the banking crisis

The Big Problems Dogging Coinbase (Aside from the SEC)