Tags in this story

Bitcoin, bitcoin backlog, Bitcoin transactions, Bitcoin users, capacity, clearnet, lightning network, Mempool, Network Congestion, onchain fees, Tor, unverified transactions, unique channels

all about cryptop referances

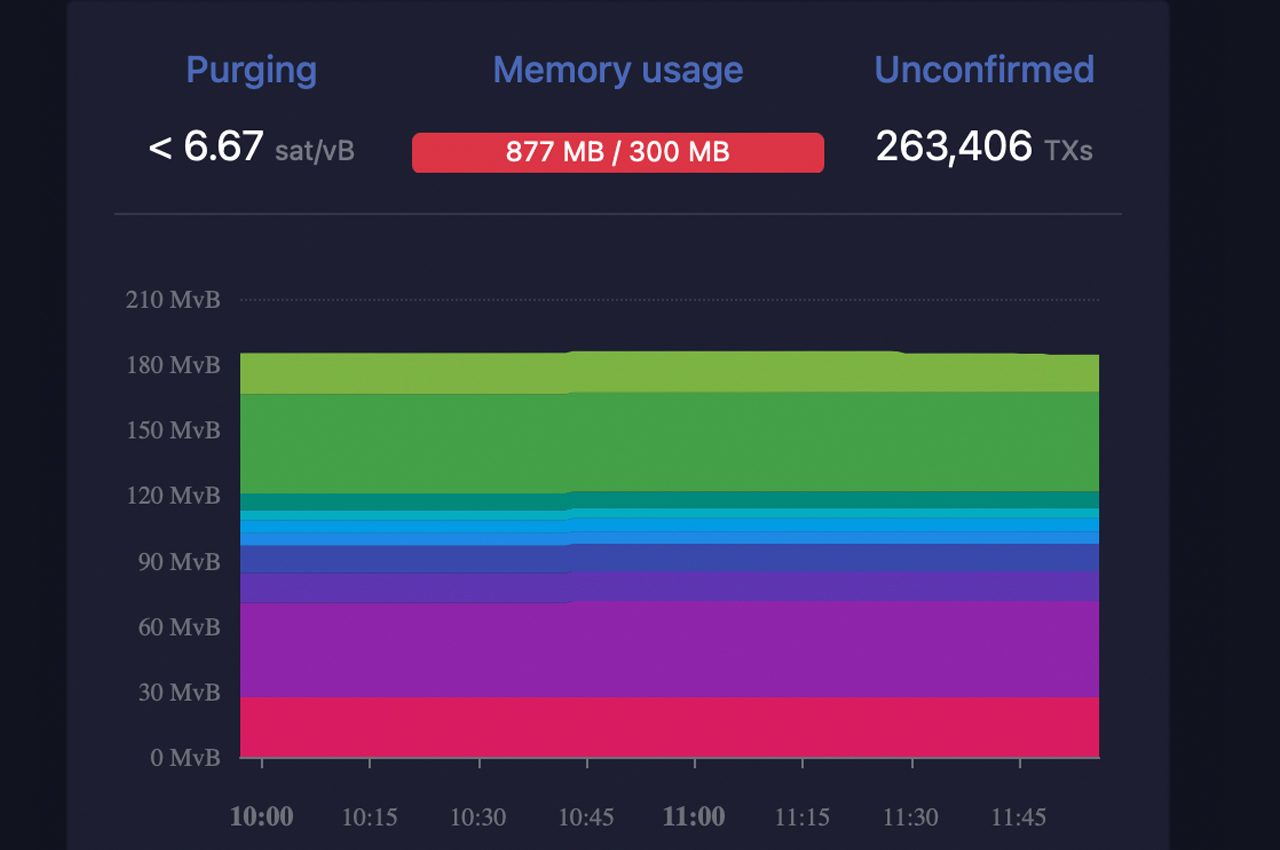

Over the past week, the Bitcoin network has made progress in resolving congestion issues. On May 7, 2023, the number of unconfirmed transactions reached an all-time high of over 500,000 transfers, leading to a large backlog. But as of today, this number has been reduced to 263,406. Currently, 184 blocks need to be flushed to process the majority of transactions still stuck in the network’s mempool.

The long queue of transactions is finally starting to slow down as bitcoin miners have started to catch up some of the backlog. As we reported three days ago, Bitcoin.com News noted the beginning of the clearing process, with unconfirmed transactions falling from over 500,000 on May 7th to just over 300,000 on Thursday, May 11th.

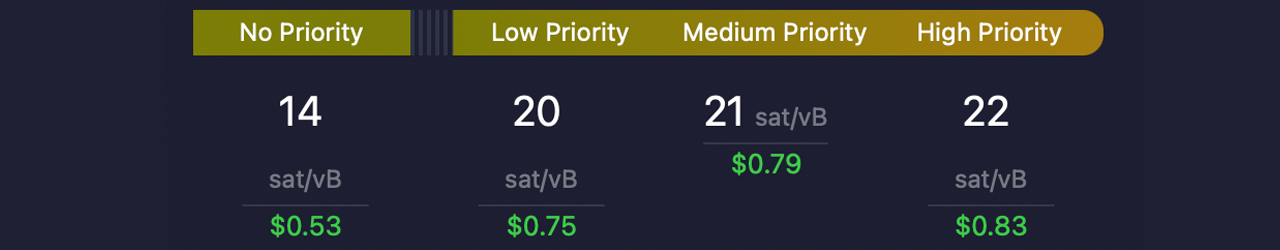

According to mempool.io statistics, high-priority transactions were priced at $3 per transfer, while low-priority transactions cost $2.23 per transfer at the time. Current statistics as of May 14 show that onchain fees have dropped significantly on the Bitcoin blockchain over the past three days. Just a few days ago, a high priority transaction would have cost $3, but today this fee has dropped to $0.83.

A medium priority transfer is now priced at $0.79, while a low priority transaction can cost around $0.75. This is a significant improvement, with high-priority onchain fees dropping by 72.33% in the last 72 hours. In addition, the number of unconfirmed transactions stuck in the queue has reduced to 263,406, which is just over half of what it was on 7 May.

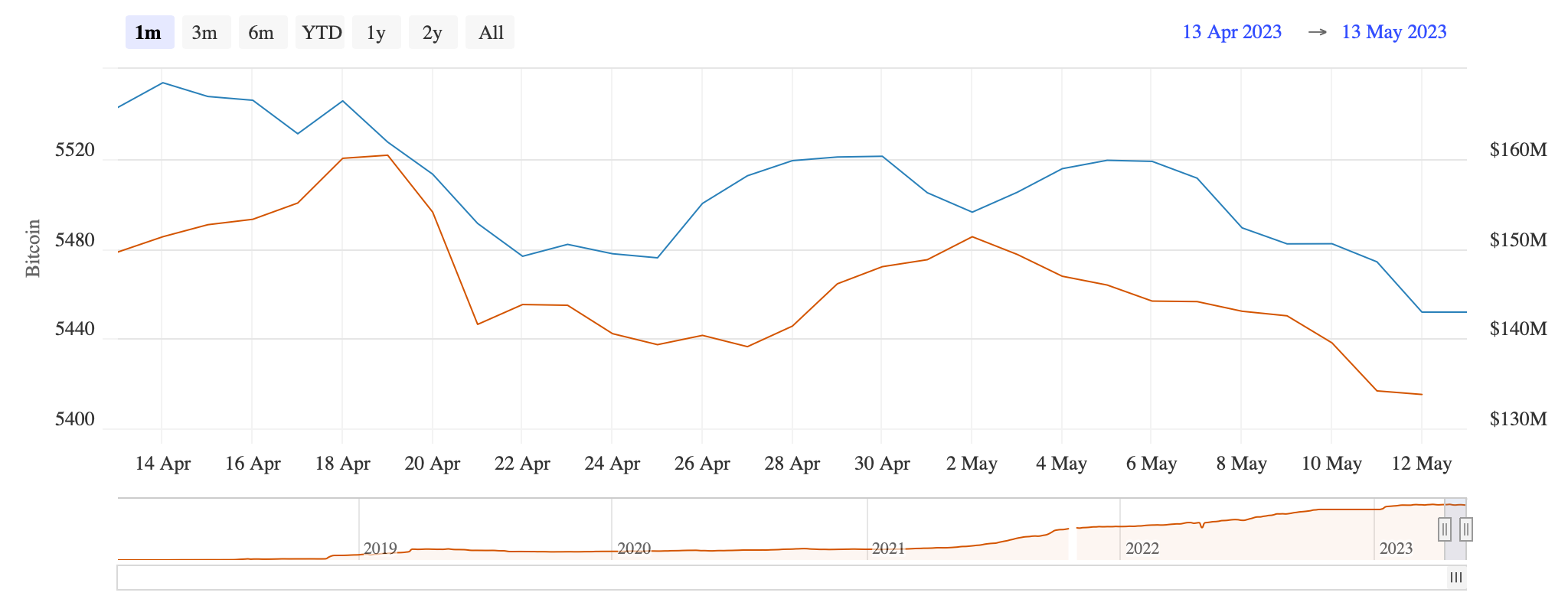

On May 9, the number of transactions was around 413,420, which means that 36.28% of the backlog has been cleared in the last five days. While fees skyrocketed to about $30 per transaction on May 7 and have been fairly volatile lately, the Lightning Network’s capacity didn’t improve. In fact, the number of BTC locked into the Lightning Network dropped from 5,463 BTC on May 5th to today’s capacity of 5,415 BTC on May 14th.

The drop indicates that approximately $1.28 million in value left the Lightning Network amid the chaos of transaction backlogs. On May 8, the Lightning Network boasted 73,352 unique channels. However, this number has since dropped to today’s 71,286 unique channels. According to mempool.space’s Lightning Network metrics, about 5,057 BTC of capacity is on the clearnet, while 253 BTC of capacity is using Tor. The remaining Lightning Network capacity is identified as “other”.

What are your thoughts on the latest developments in the Bitcoin network and the Lightning Network’s capabilities? Share your insights in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.