Bitcoin leads the hunt for a green October in crypto

Bitcoin may be returning to the bottom of its current range; trapped for months, BTC may not be able to push higher. Driven by macroeconomic forces and uncertainty, sideways price action has reduced volatility across global financial assets.

At the time of writing, Bitcoin (BTC) is trading at $19,400 with sideways movement across all timeframes. Earlier today, the cryptocurrency hinted at more gains, but bulls have been unable to sustain the momentum, giving up BTC’s gains from last week.

Bitcoin goes quiet, macro forces take the wheel

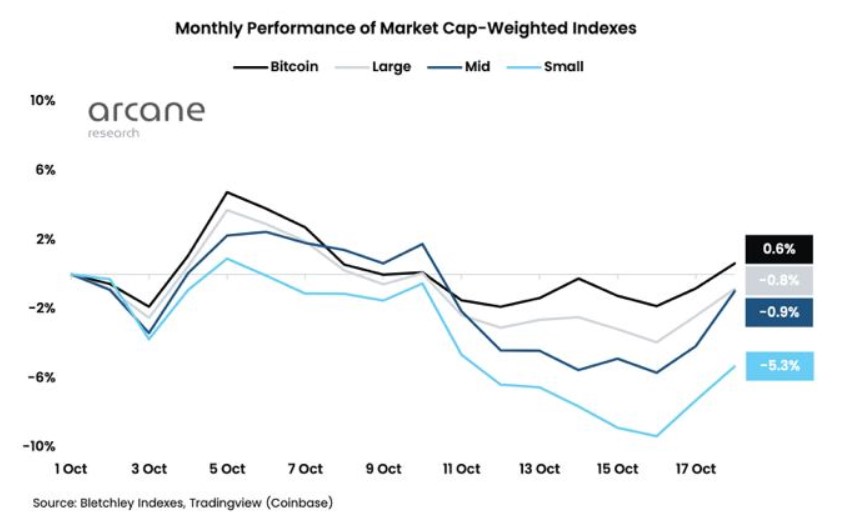

According to Arcane Research, Bitcoin has seen no clear direction in October. The cryptocurrency has been the best performing asset in terms of sideways moving assets during this period.

The chart below shows that the benchmark cryptocurrency recorded a gain of 0.6% over the past 30 days, while other cryptoassets trended slightly to the downside. Smaller tokens were the worst performers, with a 5% loss in October.

Smaller cryptocurrencies often suffer the most in a choppy and uncertain market; investors usually seek shelter in Bitcoin and stablecoins, as measured by BTC dominance and USDT dominance. These metrics have been rising after seeing a massive drop in mid-October.

The spike in stablecoin and BTC dominance suggests more sideways price action as the crypto market enters a new stage of uncertainty until the ensuing macroeconomic event triggers an explosion in volatility. Arcane Research noted the following about BTC’s current price action:

Still no clear trend in October as the crypto market remains flat. Bitcoin and ether are gaining market share compared to the other big companies this week, while small companies are struggling (…). The crypto market is still very much in line with the stock market this month. Both Bitcoin and Nasdaq are up 1% in October, and the correlation remains at record high levels.

What happens when BTC goes quiet?

Additional data from research firm Santiment indicates that Bitcoin whales may be accumulating BTC at their current levels. The cryptocurrency is moving near its 2017 all-time high. Historically, these levels have provided long-term investors with the best opportunity to increase their holdings.

As BTC price trends sideways, Bitcoin addresses holding between 10,000 to 100,000 BTC hit their highest level since February 2021. At the time, the cryptocurrency was preparing to re-enter price discovery mode after a major bull run that took it from below $20,000 in the low $30,000s.

The research firm noted:

(…) addresses with 10 to 100 $BTC have reached their highest number of respective addresses since February 2021. As the number of addresses on a network increases, the tool should follow suit.

Despite this data, the current macroeconomic conditions may be unfavorable for a Bitcoin rally, leading the cryptocurrency into long periods of accumulation and consolidation around the 2017 ATH and its yearly low of $17,600.