Bitcoin: Is this the end of winter as analysts say BTC is poised to…

- Bitcoin could head for one more drop before accumulation effects change to the market

- Sellers were exhausted as profit and loss maintained the maximum difference

Endurance, stormy sessions and repeated surrenders – these three are some of the things Bitcoin [BTC] investors have been holding out since the crypto winter began. But as 2022 draws to a close, the hopes of these investors would be stuck in offering respite.

Ironically, BTC may have to deal with another dive before the bears can offer a respite, says CryptoQuant analyst Joaowedson thought.

Read Bitcoins [BTC] price prediction 2023-2024

Movements of inertia as history can repeat itself

The analyst, via his publication, revealed that Bitcoin long-term holders moved their coins again. This time to sell. This influenced the average rest to increase.

The circumstances surrounding the average dormancy rise meant that the number of Coin Days Destroyed (CDD) was also affected. Therefore, this could lead to another BTC price drop. This projection is aligned with one previous forecast that BTC could have one last bearish call.

Source: CryptoQuant

Of course, the increase in dormancy signaled a potential decline in value, combating losses was not the only possible outcome. History, as in 2021, showed that a change in previously unmoved assets could trigger an end to the bear market.

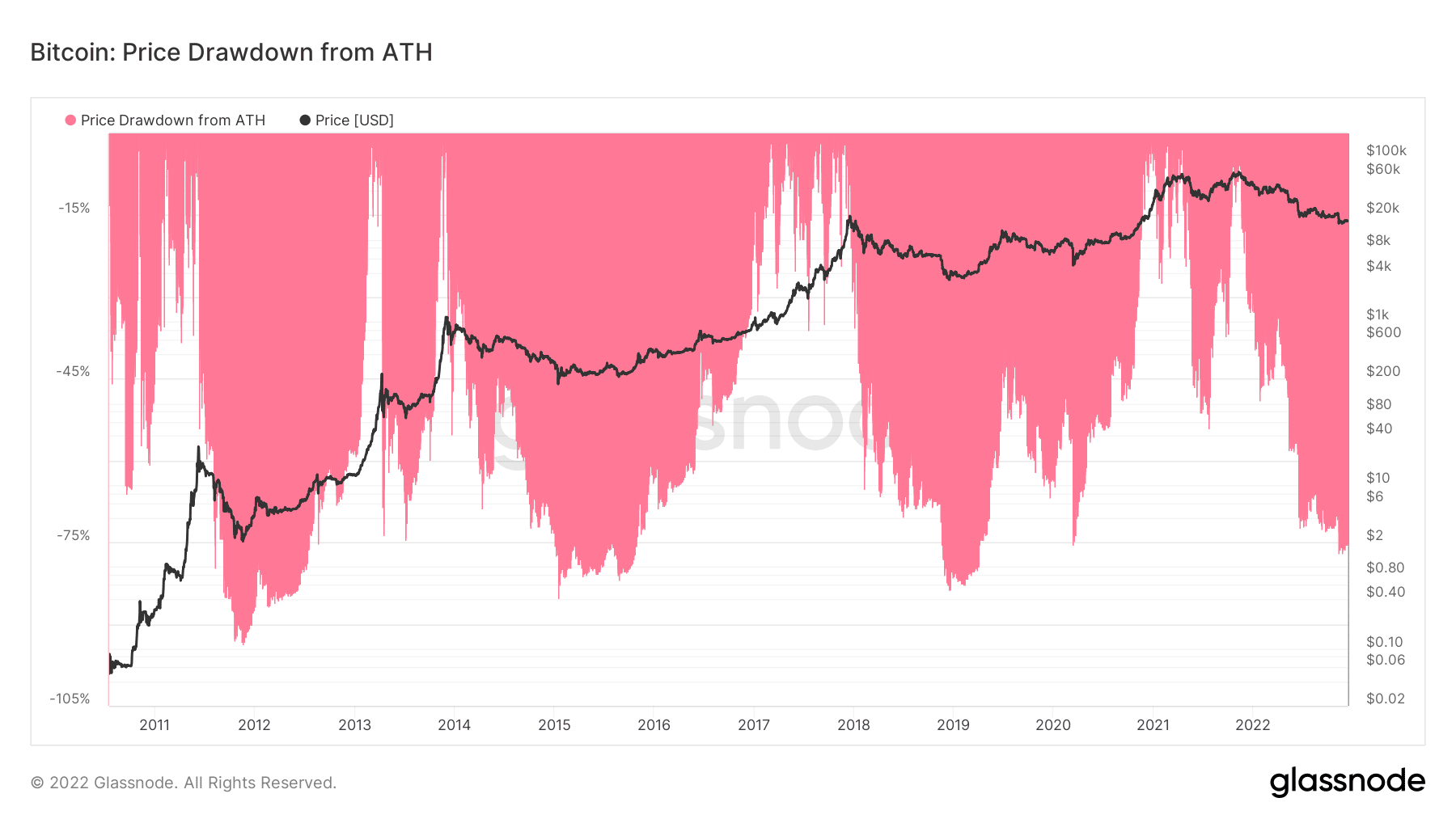

In this case, BTC could follow the steps of the old teams. Still, that didn’t dampen the notion of increased volatility if the coin approaches another bottom. When assessing the price decline from the All-Time High (ATH), Glassnode knew that it was -75.30%.

Historically, BTC was at a similar level in 2012 (-75.98%), 2015 (-79.29%) and 2020 (-75.46%). In all these previous cycles, BTC did not immediately skyrocket when it hit the bottom. On that account, BTC can probably withstand consolidations as a rapid uptrend may not start in the meantime.

Source: Glassnode

Administration of antidotes

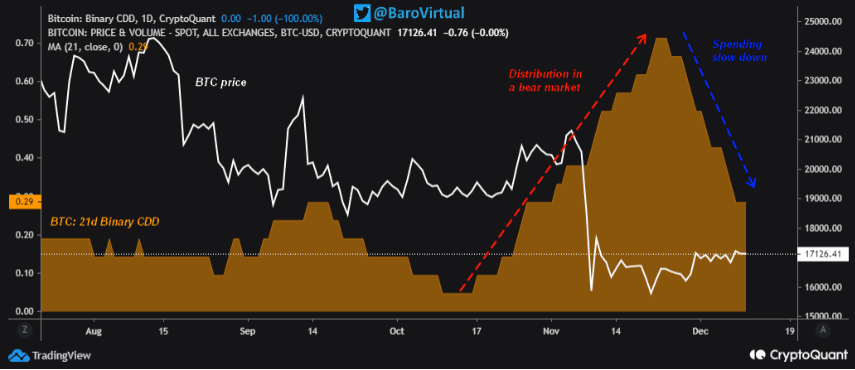

In another CryptoQuant publication, analyst BaroVirtual said that the much-anticipated accumulation season was closer than expected. Backs up his claimthe analyst pointed to the 21-day binary CDD.

According to him, the calculation showed distribution actions that paved the way for BTC’s rise to ATH. BaroVirtual said,

“According to the 21d Binary CDD, from July 9, ’22 to October 16, ’22, we observed a period of local accumulation of Bitcoin. Nevertheless, from October 17, ’22 to November 24, ’22, Bitcoin experienced another local distribution phase, which was even more potent than the distribution phase that preceded the highest price of $69,000.”

Source: CryptoQuant

The CDD status suggested seller fatigue. Therefore, it can lead to an all-round market recovery, and accumulation wouldn’t slow down.

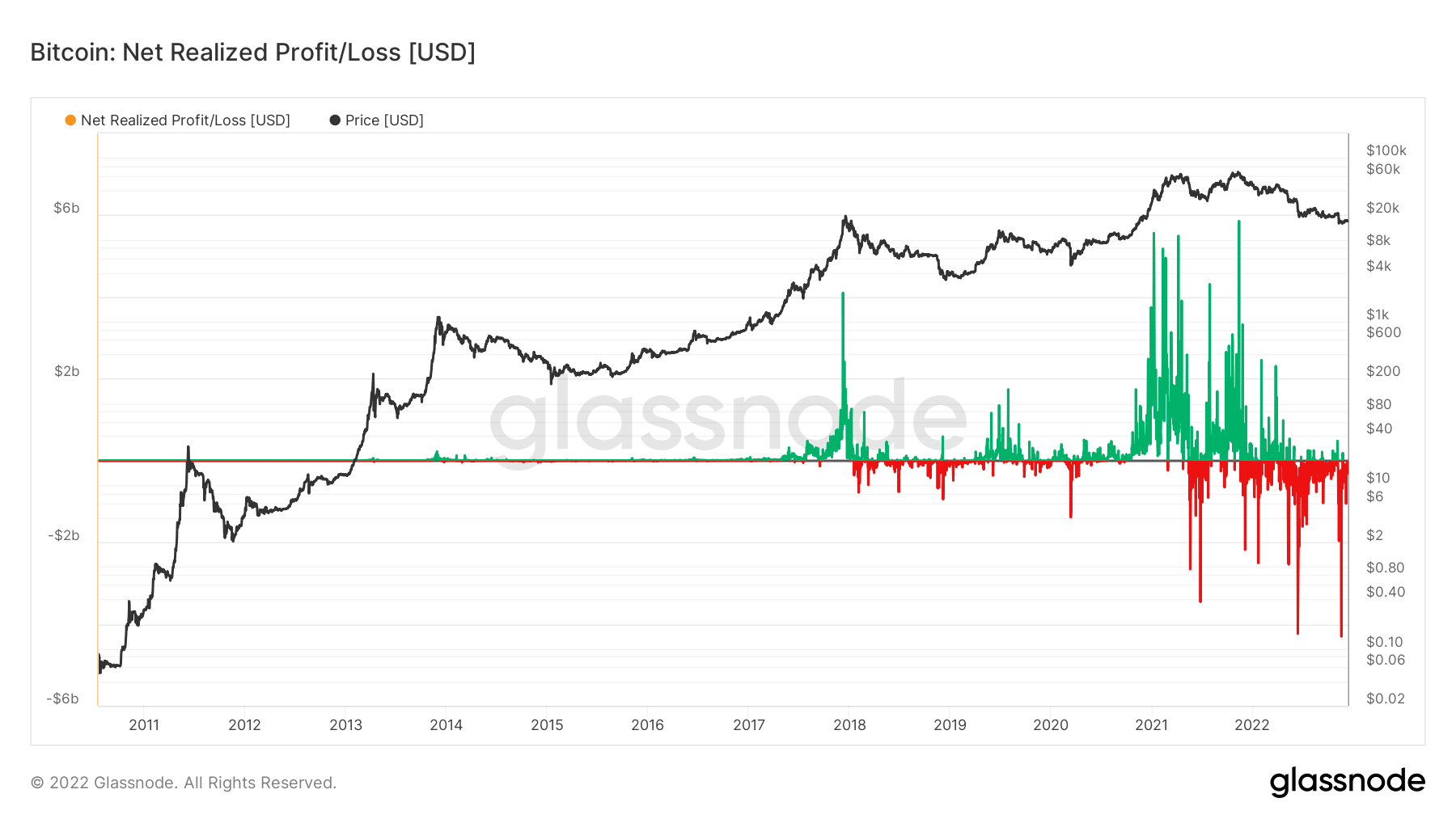

Furthermore, Bitcoin net realized profit and loss disclosed that difference in devaluation and the gains were extreme. According to Glassnode, the net loss was over 600 million dollars, while the profit was far less.

In particular, realized profits and losses were one of the lowest. This indicated that Bitcoin would require a tender situation regarding this metric before Bitcoin affects the end of the bear market.

Source: Glassnode