Bitcoin is suffering from its worst month ever, while these Web3 / DeFi tokens are shining

The value of Bitcoin fell by 38% in June, the worst month since the flagship cryptocurrency became available on stock exchanges in 2010.

Meanwhile, the world’s second largest cryptocurrency by market value, Ethereum, ended down 45% in June.

The crypto market has been wiped out by $ 2 trillion in a matter of months. However, extreme price volatility is a natural part of the digital asset market. Over the past decade, Bitcoin prices have gone through two expanded bear markets. In the previous cryptocurrency winter of 2018, Bitcoin lost over 80% of its value before regaining it, reaching a record high of around $ 69K in November 2021. Right now, BTC is 71.8% away from this milestone.

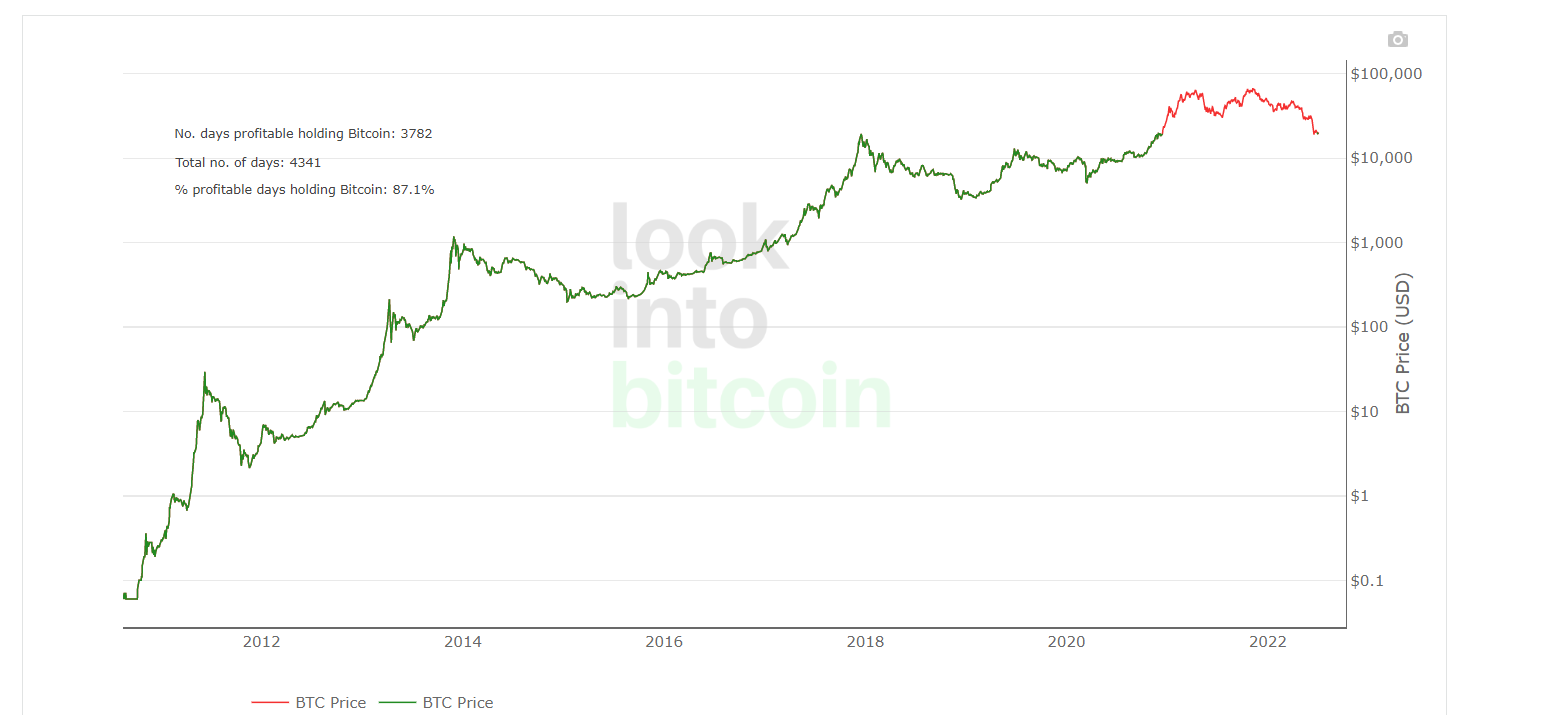

Bitcoin profitable days. The number of days in Bitcoin’s history when you held it was profitable compared to today’s price.

Source: LookIntoBitcoin

This drastic decline has frightened many people, with Bank of America reports that the number of active US cryptocurrencies fell by more than half from 1 million in November 2021 to less than 500,000 in May.

However, some see this as an opportunity to store Bitcoin, in memory of the recent triumphant upswing. MicroStrategys Michael Saylor announced that the company had bought another 480 BTC for around $ 10 million, which brought MicroStrategy’s total holdings of Bitcoin to around $ 4 billion. El Salvador’s President Nayib, who is a big fan of the number one cryptocurrency, announced that the country’s Bitcoin reserves had been replenished with 80 more bitcoins for a total of $ 1.52 million. tweeting: “Bitcoin is the future. Thank you for selling cheap.”

Bitcoin can be a hedge against monetary inflation

Despite the fact that it was once seen as a hedge against consumer inflation, which then turned out to be wrong, it is a matter for Bitcoin to act as a hedge against money inflation.

M2 money supply vs. Bitcoin price

Source: FRED

A money unit M2 includes all currency in circulation, operational deposits in a central bank, money in current accounts, savings accounts, money market deposits and small certificates of deposit.

During the first half of 2020, the percentage change in M2 increased rapidly in a short time. The percentage change in Bitcoin’s price from year to year followed with a delay. Bitcoin’s price reached new heights after the flash crash that year, and the M2 also reached new heights. The year-over-year growth in M2 peaked at the end of February 2021; The Bitcoin price peaked shortly after in mid-March 2021. In other words, the Bitcoin price has served as a lagging indicator of M2 money supply over the past two years. In this case, Bitcoin can act as a hedge against money inflation.

Bitcoin is no longer the most popular blockchain

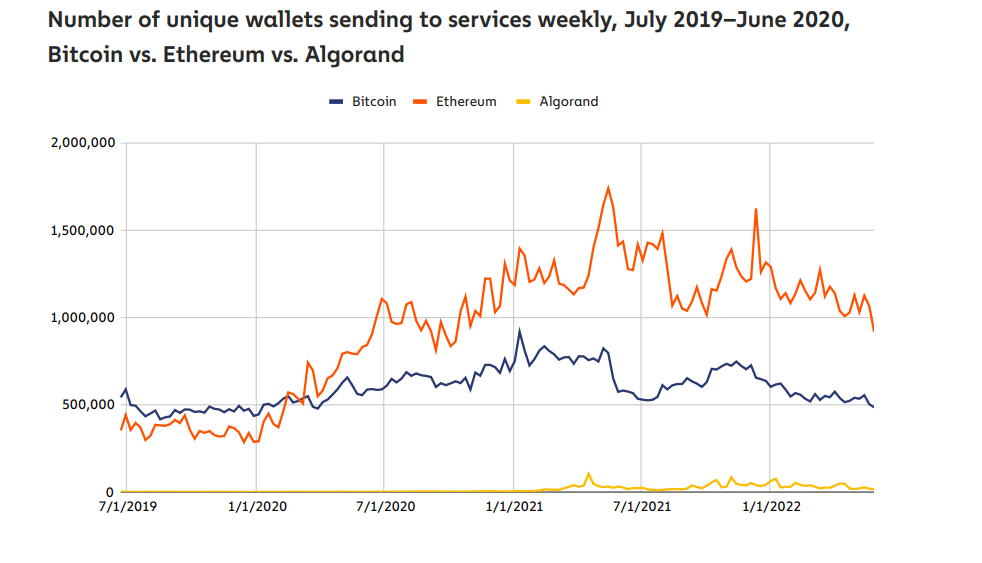

As Chain analysis report shows the number of unique wallets that send each currency to services over time, it seems that Bitcoin led in terms of unique users until March 2020, when Ethereum surpassed it. It is logical that this growth corresponds with DeFi’s growth, as the emergence of DeFi led to the creation of many services that accept Ethereum and other tokens built on the blockchain.

Source: The Chainalysis State of Web3 Report

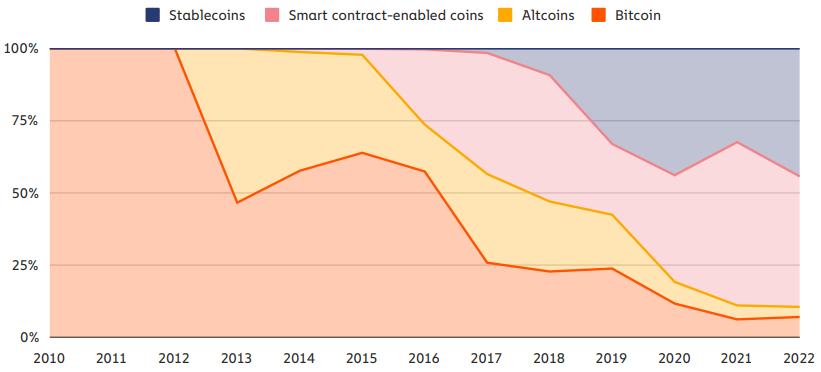

Bitcoin used to dominate the total transaction volume, but it is now dominated by a number of smart contract-activated coins such as Ethereum.

Share of total transaction volume by currency type, 2010–2022

Source: The Chainalysis State of Web3 Report

So far in 2022, BTC has represented just over 10% of the total cryptotransaction volume. Much of it is from stack coins, but 45% now comes from Web3 and DeFi cryptocurrencies.

The most promising Web3 and DeFi coins

With that in mind, let’s take a closer look at Web3 and DeFi and coins that are currently showing strong performance or that may increase in the near future.

Stratis (IMMEDIATELY)

Over the past two weeks, the price of STRAX, the original token for Stratis’ blockchain, has risen above 50.5% as the project’s most appealing initiatives have been announced, including the launch of a stablecoin linked to GBP. Stratis-backed Sky Dream Mall, a metaverse run by the Stratis blockchain, is also scheduled to launch soon.

The company works with Price Waterhouse Coopers (PwC) to secure the necessary licenses from the Financial Conduct Authority (FCA). Stratis is also developing a ticketing system that will create non-fungible tokens (NFT) that will be used to validate entrances to various events and arenas.

Source: CoinGecko

The project aims to provide C # and .NET (Microsoft) developers with a suite of products and solutions to help them leverage blockchain technology and migrate their existing applications, so it seems to have a solid foothold in the market .

Cypherium (CPH)

Cypherium is another Web3-ready blockchain that bridges the gap between CBDC, DeFI and Web3 through protocol interoperability. It is a hybrid consensus system that maximizes both decentralization and scalability without sacrificing one over the other through its Proof-of-Work and HotStuff consensus mechanisms.

Developers can build groundbreaking apps by using Cypherium’s comprehensive platform to shape the future of business, law and enterprise solutions.

With its FedNow Service Provider status, Cypherium will continue to work with financial regulators to develop CBDC applications and regulated DeFi projects, placing it among other promising projects.

A significant increase in the context of general market declines, the CPH token grew by 49.6% in the last two weeks and 29% month-over-month.

Source: CoinGecko

Stave (STAV)

Spell Token (SPELL) is part of the lending platform abracadabra.money, where interest-bearing tokens (ibTKNs) are used as collateral to borrow the USD-denominated stack coin, Magic Internet Money (MIM). Thanks to SushiSwaps Kashi Lending Technology, Abracadabra’s isolated lending markets have driven decentralized financial innovation (DeFi). In isolated lending markets, risk is not shared. In case a currency pair loses its liquidity or something goes wrong with the smart contract, only the pair is affected, not the platform as a whole. In this way, Abracadabra can offer a wide range of pairs that are not supported by most other decentralized exchanges (DEX).

Source: CoinGecko

Over the last two weeks, SPELL has been up 22%. It was up 116.6% on an annual basis – a very impressive gain in today’s market environment.