Bitcoin: Is CPI Report Bearish For Crypto Forecast? (BTC-USD)

atakan/iStock via Getty Images

Thesis

Bitcoin (BTC-USD) may be setting up for another bull run, even in the face of a warmer than expected January CPI report. So far, there is little evidence that high inflation is bad (or good) for Bitcoin. I look instead to other factors such as the four-year halving cycle and adoption metrics to predict Bitcoin’s price movement.

The CPI report

The January CPI report was released on Tuesday 14 February. Inflation rose 0.5% month-on-month (0.4% expected), up 6.4% from last year (6.2% expected). Excluding food, energy and shelter (because who needs that, right?), inflation rose more slowly at 0.2% month-on-month and 4% year-on-year.

Although inflation is still trending down from recent highs above 8%, it remains very high and this month surprised to the upside. Obviously, high inflation is bad for the average consumer, but so what about for investors?

PEACE

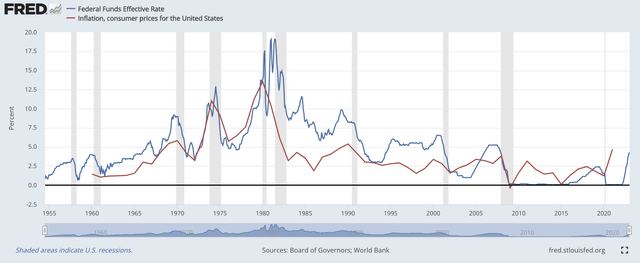

Investors have probably heard many times that falling inflation is likely to be good for stocks (and arguably cryptocurrency) because it means the Fed can start cutting interest rates. As shown in the chart above, the Fed Funds rate is often set slightly above the rate of inflation. In earlier periods when the inflation rate rose and exceeded the Fed Funds rate (namely the 1970s), inflation did not peak until the Fed Funds rate passed it.

This chart is somewhat behind, as the current Fed Funds rate is 4.5%-4.75%. While I could venture to predict that this means the Fed will raise interest rates to at least 6.4% to match the current rate of inflation, it’s hard to say for sure. After all, inflation is already falling despite the Fed Funds rate being lower than the inflation rate, and that didn’t happen in the 1970s.

I think it is likely that because inflation rose faster than analysts expected this month, it is also likely that analysts will raise their inflation targets/Fed funds rate targets and lower their stock price targets in the near term. Despite this, I still think it’s likely that rates will peak this year, regardless of whether it’s closer to 5% or 7%. This means stocks could have bottomed out already, although no one can say for sure. (It should also be noted that stocks had positive returns in the 1970s despite high prices/high inflation.)

Does the CPI affect the crypto forecast?

The theoretical correlation between share prices and the Fed Funds rate (and thus the CPI) is well documented. But will the cryptocurrency market be similarly affected?

Crypto is barely a decade old, so we can’t look back to the 1970s for a historical example of what crypto does in a period of high inflation. Over the past decade, the potential use cases for Bitcoin and other cryptocurrencies have been quite varied, including:

- A risky asset (inflation is bad)

- A small store of value (inflation is good)

- A payment method (inflation is no doubt good)

- A new asset class that is not correlated with existing classes (inflation is irrelevant)

Despite some use cases that would make inflation good for Bitcoin, this has not been the case so far. 2022 was the most inflationary year since Bitcoin was created, but Bitcoin’s value was halved from $48K in early 2022 to $24K today. And as the belief that inflation peaked became popular this year, Bitcoin started the year strong after bottoming out below $16K. The small amount of history so far certainly suggests that inflation is bad for Bitcoin.

Google News

However, it is dangerous to make such sweeping assumptions from a small amount of data. For example, looking at just one day of data depicted above, one can conclude that warmer-than-expected inflation will be good for Bitcoin and bad for stocks. That is the exact opposite of what one would conclude about Bitcoin in 2022. Overall, Bitcoin’s short-term movement following CPI reports has been difficult to predict. There is some evidence that sustained high inflation would be bad for Bitcoin, but not enough evidence to say this definitively.

What is the crypto forecast?

Rather than looking at the CPI to determine what Bitcoin’s price will do, I prefer to look at other factors that I believe are more relevant. Over the past decade, crypto has been one of the best performing asset classes, despite tests like the COVID-19 crash and the tech wreck of 2018. By many metrics, crypto has been adopted as quickly as the internet, and its use cases have expanded quickly to include applications such as money transfers and collectibles. The long-term trend looks good for crypto.

Like previous crashes, the recent crash has some questioning whether crypto will continue to be adopted quickly going forward. But unlike previous crashes, this one hasn’t raised many meaningful concerns from a usability perspective.

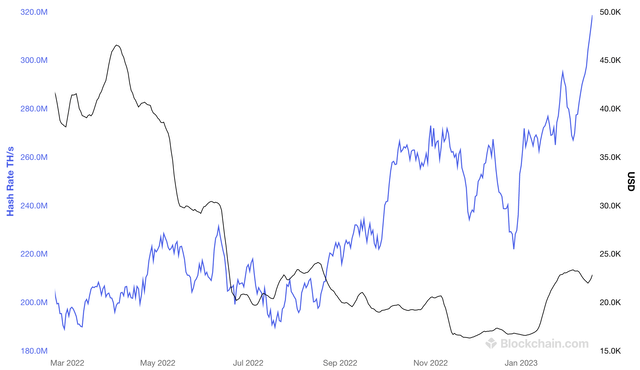

Blockchain.com

The chart above shows Bitcoin’s hash rate over time. The hash rate in terahash/second (purple line) has steadily increased and is now at its highest value ever. As I have previously written, a higher hash rate equals more mining and better network security.

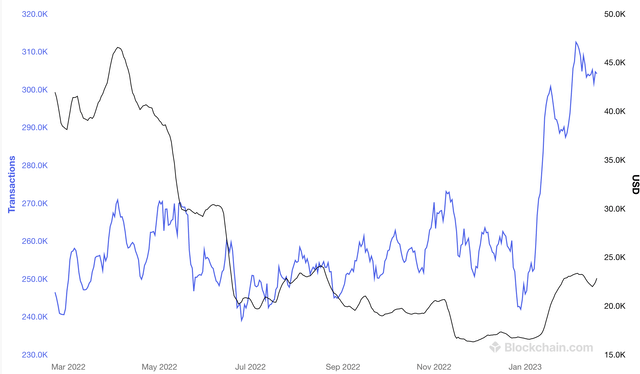

Blockchain.com

It’s a similar story when it comes to transactions per day, which is arguably a more important metric. The number of transactions per day (purple line) remained stable even when Bitcoin’s price crashed early last year, and its value recently rose to new highs.

Why would Bitcoin’s price fall despite these strong usage targets? It is well documented that Bitcoin since its inception has rallied going into its halving event and then crashed shortly after the halving is complete. With the last halving completed in mid-2020, it seems that Bitcoin once again followed this cycle. While this pattern is unlikely to hold forever, investors should hope that Bitcoin once again rallies and enters the next halving event in early 2024. I believe that the chances of a rally are higher if the use of the network continues to increase.

Admittedly, it’s also possible that external factors—including high CPI reports and the stock market selloff they allegedly caused—partly contributed to Bitcoin’s recent price decline. Bitcoin certainly won’t be the only high-tech asset to see its value reduced despite strong growth in recent years. Based on what we’ve seen in Bitcoin’s short history, Bitcoin investors should cautiously hope that inflation drops and stocks rise. However, I want to emphasize again that I do not think inflation is the most important factor for Bitcoin in the long term.

Conclusion

Bitcoin has been a top-performing asset despite last year’s selloff, and the underlying story of Bitcoin being a stable, decentralized and scarce asset hasn’t changed at all. Although there is some evidence that high inflation is bad for Bitcoin, rapid adoption of the Bitcoin network has continued even in the face of the recent price crash. Thus, I continue to hold Bitcoin – as well as correlated cryptos Ethereum (ETH-USD) and Flow (FLOW-USD) – in anticipation of another bull run starting at an unpredictable time in the near future.