Bitcoins BTCUSD,

impressive rally has brought it to within shouting distance of its true value. As late as November 2022, it was traded at a 40% discount.

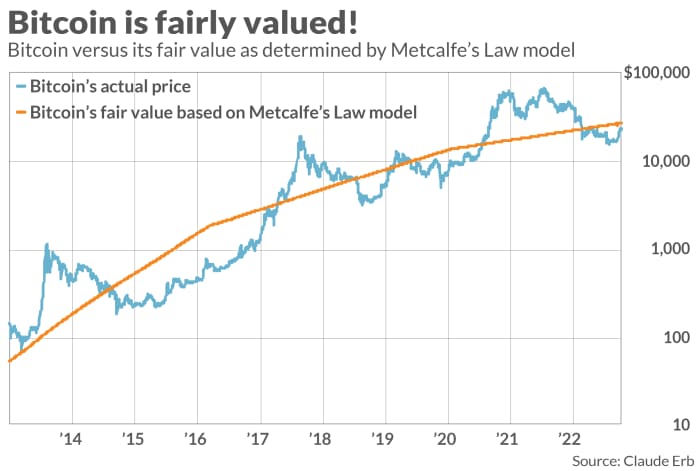

That’s according to the only bitcoin valuation model I know of, which is based on something called Metcalfe’s Law. Claude Erb, a former commodity portfolio manager at TCW Group who has applied Metcalfe’s Law to bitcoin, calculates that its real value is currently just over $27,000 — against a current price of around $22,000.

Metcalfe’s law states that the value of a network is proportional to the square of the number of users. To apply this law, Erb assumes that each bitcoin that has been mined represents one user in the network. Overall, after reviewing the accompanying chart, it’s clear that Erbs Metcalfe’s law-based model has done an admirable job of throwing cold water on bitcoin’s extreme highs and providing encouragement as the cryptocurrency falls to unwarranted lows.

Bitcoin’s future

Since the number of bitcoins that can ever be mined is limited, along with how quickly they can be mined, Erb’s Metcalfe’s Law model is able to calculate what its real value will be in the future. In 2140, for example, which is when the last allowed bitcoin is projected to be mined, its real value will be around $74,000, according to Erb’s calculations.

Given where bitcoin is trading today, that equates to a return over the next 117 years of 1.0% annually.

When informed of this, investors usually fall into two extreme camps. Those who believe that bitcoin is worthless argue that any real value above $0 – much less as much as $74,000 – is ridiculous. In contrast, those who believe bitcoin’s potential is much higher than $74,000 are sure that this estimate of real value is far too low.

Erb’s model takes a middle way between these two extremes. There is a reason it has worked so well. Like any other asset, bitcoin’s price fluctuates wildly between the extremes of bullish euphoria and bearish despair. Any valuation model that avoids these extremes—not just Erb’s model—is therefore at least a step toward discouraging investors from buying high and selling low.

This is the key to understanding Erb’s model. In an email, Erb said he does not believe his Metcalfe’s law-based model is the final word on bitcoin valuation. Instead, he offers it in the same vein as those statisticians who like to say that “all models are wrong, but some are useful.” His particular model is “a way to anchor a conversation” about cryptocurrency valuation that is sufficiently “intriguing” to warrant our serious consideration.

“If someone wants to come up with a better estimate of the fair value of bitcoin than Metcalfe’s Law, fantastic,” he said.

I first wrote about Erb’s valuation model in December 2020. So Erb’s invitation to come up with a better fair value estimate is now over two years old. He is still waiting. Meanwhile, according to his model, there is not a valuation-based argument to believe that bitcoin will either rise sharply from current levels or fall sharply.

Mark Hulbert is a regular contributor to MarketWatch. Hans Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: These 20 AI stocks are expected by analysts to rise up to 85% over the next year

In addition to: Bulls may be losing enthusiasm for stocks, but these 3 potential takeover plays could end up in the money