Kevin Helms

An Austrian economics student, Kevin found Bitcoin in 2011 and has been an evangelist ever since. His interests lie in Bitcoin security, open source systems, network effects and the intersection of economics and cryptography.

all about cryptop referances

Fidelity’s director of Global Macro has shared his bitcoin and ether price outlook. His analysis shows that bitcoin is cheap, but ether can be even cheaper. “Ethereum may be near the bottom,” he added.

Jurrien Timmer, director of Global Macro in Fidelity Investments’ global asset allocation department, shared his bitcoin and ether price analysis in a series of tweets on Friday. Timmer specializes in global macro strategy and active asset allocation. He joined Fidelity 27 years ago as a technical research analyst.

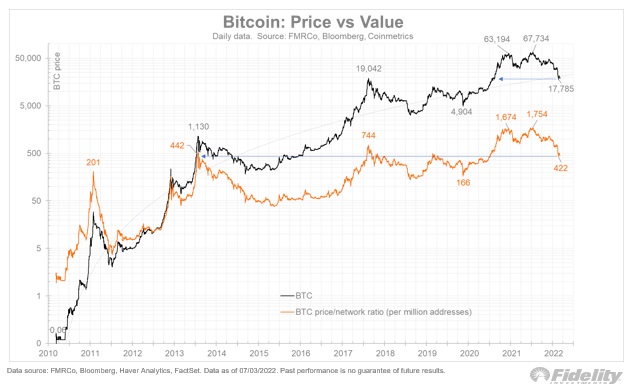

He explained why bitcoin is cheap. “I use the price per million of non-zero addresses as an estimate of bitcoin’s valuation, and the chart below shows that valuation is all the way back to 2013 levels, even if the price is only back to 2020 levels,” he said in detail, and underlined:

In other words, Bitcoin is cheap.

“At the last lowest level of $ 17,600, bitcoin is now under even my more conservative S-curve model, which is based on the Internet adoption curve,” the Fidelity director added.

Timmer noted that it is clear from looking at Bitcoin’s network growth that “the adoption curve tracks the more asymptotic internet adoption curve, rather than the more exponential mobile phone curve.” He continued: “According to Metcalfe’s law, slower network growth suggests a more modest rise in prices.”

However, “based on a simple power regression line, Bitcoin’s network appears to be intact,” the director said. “The continued growth of Bitcoin’s network, combined with lower prices, means that Bitcoin’s valuation is falling.”

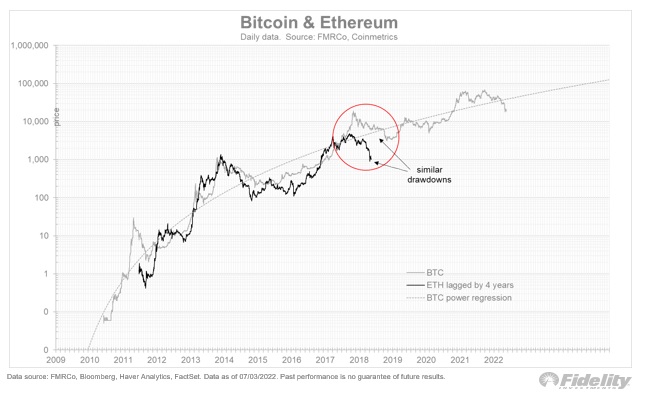

The fidelity director of Global Macro continued to share his ethereal price outlook and tweeted:

If bitcoin is cheap, then maybe ethereum is cheaper. If ETH is where BTC was four years ago, the analogue below suggests that ethereum may be near the bottom.

At the time of writing, bitcoin is trading at $ 21,584, up 11% over the last seven days but down 29% over the last 30 days. Ether trades at $ 1,217, up 14% over the last seven days, but down 32% over the last 30 days.

What do you think of the Fidelity director’s analysis of bitcoin and ether prices? Let us know in the comments section below.

Photo credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the Company nor the author is liable, directly or indirectly, for any damage or loss caused or alleged to have been caused by or in connection with the use of or reliance on the content, goods or services mentioned in this article.