Bitcoin is breaking out – but guess which blockchain added the most users this year

As you may have heard, Bitcoin (BTC-USD) broke out at $24,000 today! As you might NOT have heard, there is also good news from both “cryptobank” – and Solana (SOL USD). Let’s dive in.

Injective Protocol (INJ) cryptocurrency coin symbol. Blockchain technology. INJ in bubble

Bitcoin breaks above month-long range

The last time I showed you the chart – just two days ago – BTC was trading at the top of its month-long range. It was $22,000 (with the bottom down around $18,000). I also mentioned that our Crypto Investor Network experts “looked for BTC to break out near $23,000.”

Well, today BTC broke through $24,000. Bitcoin is the orange line in the chart below; the blue line is ETH – which has made even more ground:

Source: TradingView

In Ethereum’s case, people seem to be celebrating progress towards the big “Merge” with its Beacon Chain, which will move Ethereum from proof-of-work to proof-of-stake. The merger is now expected on 19 September.

The narrative of bitcoin is about the Federal Reserve. Yes, the Fed is likely to continue raising interest rates, as it has been doing since March (for the first time since 2018). No, this has not been good for crypto prices… or stocks, for that matter.

But this next rate hike is looks smaller than previously thought. Last week, Fed watchers overwhelmingly expected a +1% increase. Now most of them expect +0.75% (to a target range of 2.25%-2.50%). My colleague Jeff Remsburg has a great quick overview Why people expect less aggressive rides on Fridays InvestorPlace Digest.

Next date to watch: Wednesday 27 July. It is the official policy statement of the Federal Open Market Committee. We also just got a whole bunch of economic reports on housing, manufacturing, supply/trade and more… And as I’ve written before, the macroeconomic news seems to have the biggest impact on bitcoin, in particular.

Guess which Blockchain added the most users this year

If you guessed Solana (SOL USD)… You are 100% correct! Ethereum didn’t even come close; actually lost the new daily addresses, according to CoinMarketCap:

#Ethereum, #BNBChainor #Solana: How Do These L1 Handle Bear Market?

– (p5)

The number of new network participants has gradually decreased since November 2021 for both #Ethereum & #BNBChainbut #Solana have managed to stop the trend.

<1/3> pic.twitter.com/eZZEza6DFz

— CoinMarketCap (@CoinMarketCap) 19 July 2022

Binance chain (BNB-USD) remained fairly stable during this time – while Solana multiplied its user base.

Even after new daily addresses on Solana dropped during network outages/congestion – just as the crypto market began to collapse in May…

“Solana saw their new daily active addresses rise by 58.6% [in 2022 to date]making it the only major tier-1 to consistently grow its user base throughout the bear market,” according to CoinMarketCap.

On the other side: Solana may be the #2 blockchain by new users… (Binance Chain is #1.) But “the activity did not amount to an influx,” notes CoinDesk:

“Total Value Locked (TVL) on decentralized finance (DeFi) applications running on Solana fell to $2.9 billion this week. That compares to $14.9 billion at the beginning of December!

That’s a steeper drop than Ethereum or Binance Chain have had. Both are down -65% since their peak in December – but Ethereum remains the undisputed king of DeFi, with $55.4 billion TVL. The same goes for NFT sales… Although Flow (FLOW USD) and WAX (WAXP USD) has actually surpassed even Ethereum in total NFT transactions, according to CryptoSlam.

Even at such high speeds and road cheaper fees, Solana has had a hard time matching the “network effect” of Ethereum for selling NFTs. The sales volume on Solana remains like a tenth of Ethereum’s… And transactions are about half of what has been traded on Ethereum to date. (However, the latter metric has improved considerably over the past 30 days, as Solana has actually completed more NFTs than anyone else!)

Bottom line: Solana needs to get the network issues together in time for the Ethereum merger to change the game. While the merger is unlikely to reduce “gas” fees, Ethereum’s upgrades should make it faster and more scalable, which is the other selling point of “Ethereum killers” like Solana.

Bitcoin “Crypto Bank” Reports +33% Earnings Beat

Feels like forever since I’ve seen much positivity in the crypto banking space… But hey, look: Silvergate capital (SNEEZE:SAY) just exceeded expectations for both revenue and earnings in yesterday’s Q2 report!

Specifications: Revenue rose to $79.8 million, which was +13% higher than analysts had expected – and +88% year-over-year!

Diluted earnings per share were $1.13, which “beat the street” by +33% – and were +41% year over year.

If you are surprised: That’s because of Silvergate’s business model. Instead of offering savings accounts where you deposit cryptocurrency and earn crypto in return (with high returns)… Silvergate clients usually want to deposit bitcoin or ETH – and then get a loan in US dollars.

For example: In March, a Micro strategy (NASDAQ:MSTR) subsidiary borrowed $205 million from Silvergate Bank and secured it with bitcoin. Silvergate has been in this game for years – while Goldman Sachs, for example, got into it in April.

In fact, most of these Silvergate clients are crypto miners… Although institutions – namely crypto exchanges – can use Silvergate to settle transactions in US Dollars (or Euros) with other clients in the “Silvergate Exchange Network” (SEN). Settlement is “near real time” with “immediate availability”, even on evenings, weekends and holidays. No banking hours in crypto!

But: Although Silvergate’s digital currency customer base grew +29% year-over-year, the transaction revenue they paid fell -22% in crypto crash. Correspondingly, transfers of special education decreased by -20% from year to year.

Fortunately, Silvergate is first and foremost a lender. Most of the income comes from interest paid on the loans… And net interest income increased by +132% year-on-year! The net interest margin rose from 1.16% to 1.96%. In this rising rate environment, Silvergate is simply charging higher interest rates to these crypto miners, etc. And they may need more loans the longer this bear market lasts.

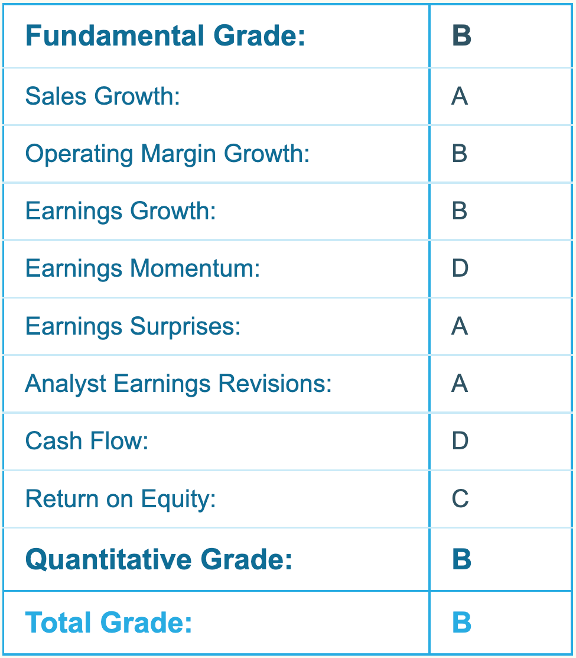

Bottom line: While cryptomining stocks get a “Hold” or “Sell” rating in our Portfolio Grader by Louis Navellier… Their bank gets a “Buy” rating. I’ve included Louis’ full report card on Silvergate Capital below. He makes this tool free and publicly available, so go here to link to any stock to see its fundamentals and quantitative grades.

Source: Portfolio Grader

As of the date of publication, Ashley Cassell did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the author, subject to InvestorPlace.com Guidelines for publication. To get more news from The New Digital World delivered to your inbox, click here to sign up for the newsletter.