Bitcoin is a commodity; It will continue to decline like any other commodity

adventtr/iStock via Getty Images PETER DAG PORTFOLIO STRATEGY AND MANAGEMENT

The critical phase of the business cycle is phase 4. The length depends on how long it takes to bring inventories in line with sales, to lower inflation and interest rates prices to levels that consumers need to become more positive about the future, and to bring down costs to improve business profitability. The longer it lasts, the more severe the economic weakness will be.

The beginning of Phase 1 signals a period of economic expansion driven by increased production to build up inventories to match sales. This decision involves hiring new people, buying raw materials and borrowing more to improve and expand capacity.

This is the time when interest rates and commodities bottom out. They will begin to rise again as the business cycle moves into Phase 2 as the economy gains momentum.

Towards the end of Phase 2, raw materials and inflation increase as the business continues to increase production to replenish inventories. The ratio of inventory to sales is now falling rapidly as sales increase faster than inventory.

However, there is a point towards the end of phase 2 when consumers start to feel the impact of rising interest rates and inflation. The first signal is weakness in the housing sector. Demand for big tickets is starting to wane. Finally, the total sales are flapping.

The economy is now entering phase 3. Inventories are starting to rise faster than sales. At some point in phase 3, the business decides to reduce production to bring inventory under control. They will therefore reduce the purchase of raw materials, reduce employment and borrow less.

This process continues into phase 4 with commodities, inflation and interest rates peaking and then falling.

Let me summarize.

- In phase 1 raw materials and interest rates bottom out. Inflation has fallen enough to improve consumer optimism.

- In phase 2 raw materials, interest rates and inflation rise.

- In phase 3 raw materials, interest rates and inflation peak.

- In phase 4, interest rates and inflation fall.

Now let’s see what happens in real life.

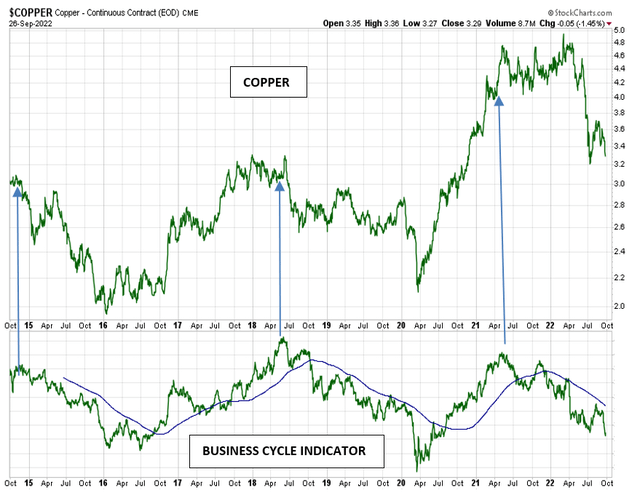

COPPER (PETER DAG-PORTFOLIO STRATEGY AND MANAGEMENT, STOCKCHARTS.COM)

The chart above shows the price of copper (top panel) and the business cycle indicator (bottom panel). The economic indicator is a proprietary gauge calculated in real time and published in each issue of The Peter Dag Portfolio Strategy and Management.

The chart shows copper gains as the economic indicator rises, reflecting improved business conditions led by inventory accumulation.

Copper falls when the business cycle declines, reflecting a weakened economy due to the inventory correction caused by a decline in sales.

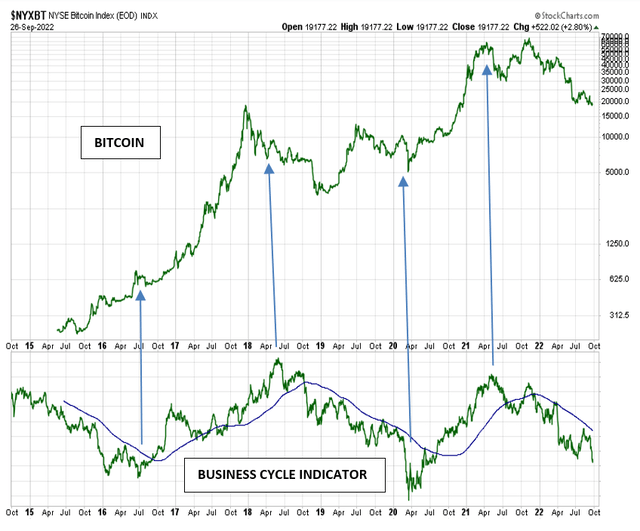

BITCOIN (PETER DAG-PORTFOLIO STRATEGY AND MANAGEMENT, STOCKCHARTS.COM)

The chart above shows the price of Bitcoin (BTC-USD) (top panel) and the business cycle indicator (bottom panel). The economic indicator is a proprietary gauge calculated in real time and published by The Peter Dag Portfolio Strategy and Management.

The graphs show that the price of Bitcoin behaves like the price of copper and the price of most other commodities. The price rises when increased liquidity and a stronger economy increase prices. The price of Bitcoin is falling as Fed tightening is accompanied by a slowdown in business activity – as of now.

Important takeaways

- The business cycle is slowing and is currently in phase 4. The tightening by the Fed and the inventory correction will force commodity and Bitcoin prices to continue to decline.

- The price of Bitcoin will bottom out as the business cycle moves into Phase 1 as businesses begin ramping up production to rebuild inventories. This is the time most other commodities also rise, reacting to the Fed’s easing that took place in Phase 4.