Bitcoin: Investment vehicles are quite bearish

Vertigo3d

Investment thesis

While Grayscale Bitcoin Trust (OTC:GBTC) has been trading at a significant discount, some trusts and ETFs have been encouraged to reduce their Bitcoin holdings, and the daily trading volume in these assets has fell steadily. For a while, the Sharpe ratio shows that GBTC’s return on investment is quite low and this asset appears to be quite risky.

Negative sentiment is spreading across the stock markets

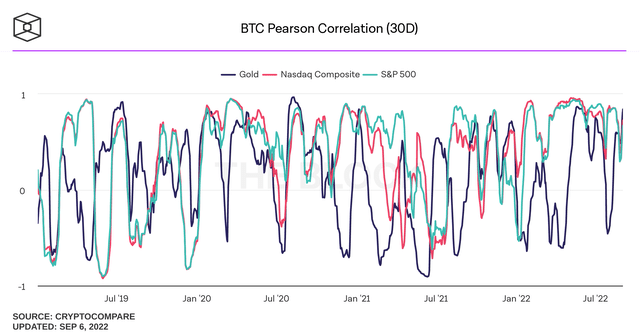

Since November 2021, the value of Bitcoin (BTC-USD) has fallen almost 70% in value from its all-time high, which has many investors on edge. Meanwhile, many analysts believe a major recession is on the way, making market sentiment more negative than ever. The weakness in the stock markets shown in the S&P 500 and Nasdaq 100 indexes makes this most obvious, which significantly affects investment behavior in Bitcoin through regulated markets.

The 30-day Pearson correlation to Bitcoin for the S&P 500 and Nasdaq 100 indices has been relatively high since early 2022. (The Block)

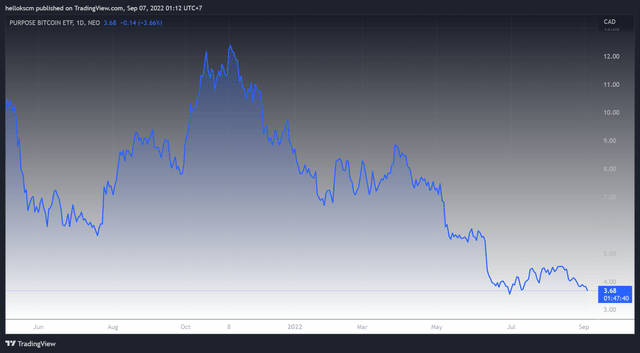

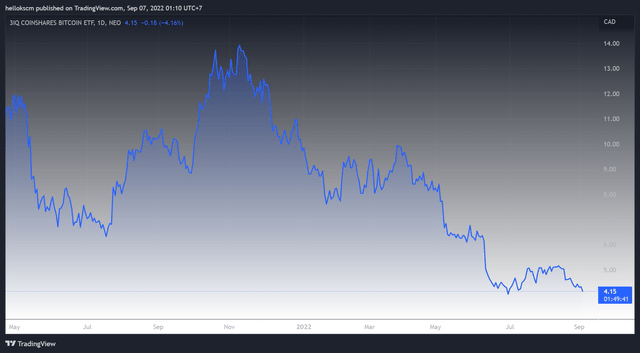

Looking at Grayscale Bitcoin Trust, the share price has fallen deeply to $11.94 since peaking at around $56. At the same time, the 3iQ CoinShares Bitcoin ETF (BTCQ:CA) and the Purpose Bitcoin Canadian ETF (BTCC.B:CA) have also experienced a rapid fall in share value. Therefore, investors should seriously take it into account when analyzing markets and making investment decisions.

Grayscale Bitcoin Trust (GBTC) has fallen deeply to $11.94 since the peak. (Chart: Dang Quan Vuong – Source – TradingView) The Purpose Bitcoin Canadian ETF stock has also experienced a rapid decline in value. (Chart: Dang Quan Vuong – Source: TradingView) The 3iQ CoinShares Bitcoin ETF stock has experienced a rapid drop in value. (Chart: Dang Quan Vuong – Source: TradingView)

Waning interest in Bitcoin investment tools regardless of a huge discount in the stock market

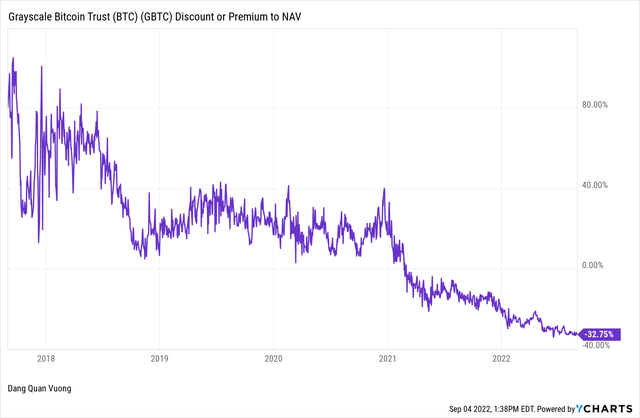

Meanwhile, the discount or premium to NAV (Native Asset Value) is -32.75%, which means that the trust value in the stock market is cheaper than the underlying value of the Bitcoin asset of approx. 32.75%. This massive discount allows institutional investors to buy Bitcoin on the stock market at a lower price than its actual value.

The trust value of the stock market is lower than the underlying value of the Bitcoin asset around 32.75%. (Chart: Dang Quan Vuong – Source: YCharts)

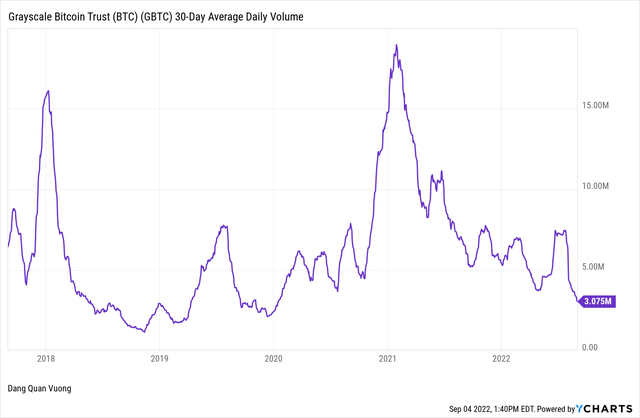

However, the daily trading volume of GBTC has fallen sharply to 3.075 million regardless of the generous discount on the shares. This means that institutional investors may be pessimistic about Bitcoin-related investment vehicles in the regulated market, or they may simply think that the Bitcoin downturn is not over yet.

The daily trading volume of GBTC has fallen sharply to 3.075 million despite the generous discount on the shares. (Chart: Dang Quan Vuong – Source: YCharts)

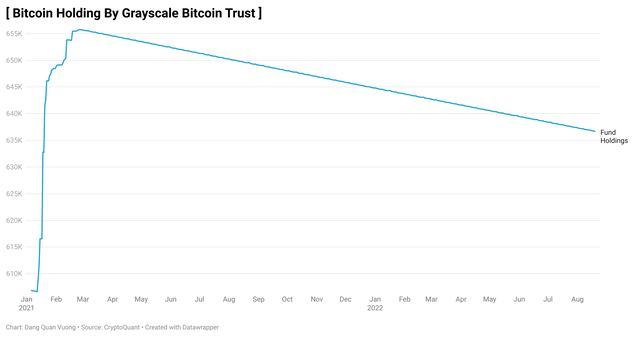

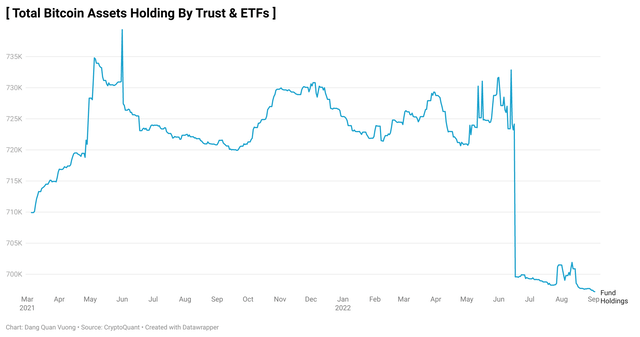

In addition, some trusts and ETFs are gradually disposing of their Bitcoin holdings under prevailing market conditions. As an example, the total number of Bitcoins held by the Grayscale Bitcoin Trust has moved downwards from its peak in February 2022. Not only that, but the total amount of BTCs held by various trusts and ETFs has also plunged since May 2021 when the market reached the top.

The total number of Bitcoins held by Grayscale Bitcoin Trust has been falling since May 2021. (Chart: Dang Quan Vuong – Source: CryptoQuant) The total number of Bitcoins held by trusts and ETFs has been falling since May 2021. (Chart: Dang Quan Vuong – Source: CryptoQuant)

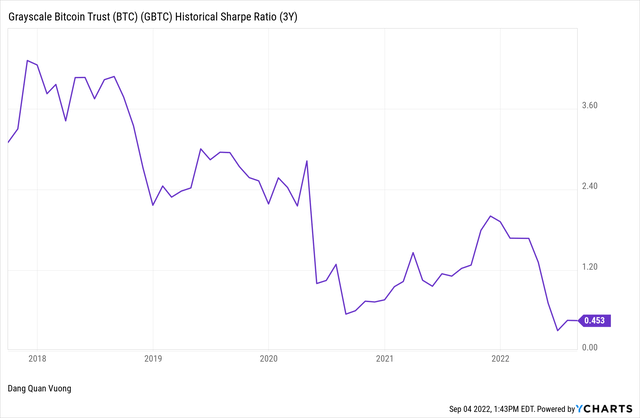

Bitcoin Trust has poor risk-adjusted performance

In terms of return on investment, the Sharpe ratio tells us that GBTC is a poor asset with very low risk-adjusted performance. In fact, the value of the Sharpe ratio has gradually decreased over time and recently decreased to 0.453. It suggests that the expected return on GBTC investment is relatively low while the volatility is quite significant.

The Sharpe ratio tells us that GBTC is a poor asset with very low risk-adjusted performance. (Chart: Dang Quan Vuong – Source: YCharts)

Conclusion

The current Bitcoin investment vehicles in regulated markets such as trusts and ETFs have shown the bearish signal to some extent. Although GBTC has been trading at a significant discount, daily trading volume continues to decline, and some trusts and ETFs, including the Grayscale Bitcoin Trust, have been encouraged to divest their Bitcoin holdings. Because the shares of GBTC sold or bought by institutional investors are reported quarterly, many recent trades may not have been noted yet. However, these numbers above can give us some clues about what is actually happening with Bitcoin behind the scenes. For example, some institutional investors had bought GBTC in late June just before the July rally, and traders may only know that there is a local bottom after it happened. Most importantly, the Sharpe ratio indicates that the return on investment for GBTC is quite low and this asset looks quite risky. Investors will therefore be prepared to start hedging against the increasing downside risk of Bitcoin at this time.