Bitcoin inches up after report shows slowing US job growth

-

Price point: Bitcoin rose on Friday after the US Labor Department reported that job growth slowed dramatically last month, which is seen as a boost to the prices of risky assets as it eases pressure on the Federal Reserve to raise interest rates aggressively.

-

Market movements: A look at how derivatives are dominating the ether markets ahead of the Ethereum blockchain’s Merge.

-

Today’s chart: US inflation-adjusted bond yields are at their highest since mid-July.

This article originally appeared in First MoverCoinDesk’s daily newsletter that contextualizes the latest moves in crypto markets. Subscribe to get it in your inbox every day.

Price point

Bitcoin (BTC) traded back just above $20,000 on Friday, after falling to $19,500 during the week as stock markets in Europe opened in the black after a negative week.

The biggest cryptocurrency got an extra boost from a US government report showing the world’s largest economy added 315,000 jobs in August – down from the 526,000 reported for July, but still above economists’ estimates for a gain of 300,000. The data could lead traders to dial back expectations of interest rate hikes by the Federal Reserve, which is generally positive for the prices of risky assets such as cryptocurrencies.

Ether (ETH), the second largest cryptocurrency by market capitalization, was up 2% on the day. It has increased by 6% in the last seven days. The network’s Merge, a major software update, is now less than two weeks away.

IN the altcoin market, Lido DAO, a liquid staking tool for Ethereum, was up 8%. The platform has nearly $7 billion in total value locked up and a market cap of $1.2 billion. Polygon’s MATIC was up 7%.

In the news, Reuters reported on Thursday that in late 2020, US federal prosecutors requested crypto exchanges Binance to submit internal documents related to its money laundering checks and communications involving CEO Changpeng “CZ” Zhao.

Futures exchange FTX.US Derivatives Thursday said that Jill Summers, a former commissioner of the Commodity Futures Trading Commission, has joined the board in a move to help bolster the firm’s regulatory efforts. The appointment comes as FTX has previously pitched the CFTC to directly clear its customers’ crypto swaps.

The International Monetary Fund has requested one global platform for cross-border paymentsand repeated calls to regulate a crypto sector that officials say is unstable, inefficient and riddled with fraud.

Cryptocurrency exchange Crypto.com has pulled out of a five-year sponsorship deal worth $495 million with the UEFA Champions League, Europe’s elite soccer league, according to a report in SportBusiness.

Biggest winners

Biggest losers

Market movements

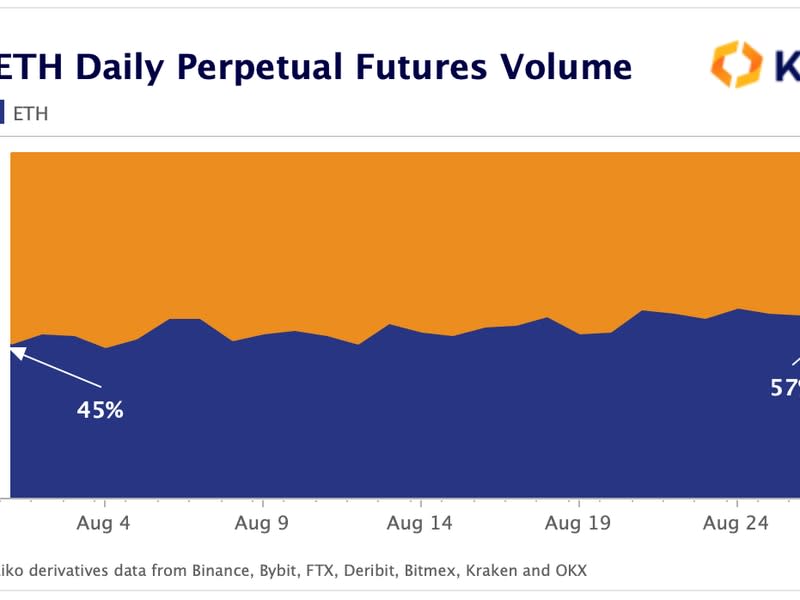

Ether derivatives markets continue to heat up ahead of the merger

As the long-awaited merger approaches, data from Kaiko, a crypto data provider, shows that ether derivatives markets are heating up.

New money is returning to the perpetual futures markets more ferociously than ever, especially for ETH, with open interest recently breaking all-time highs and an increase in volume in ETH perpetual futures as investors on either side of the debate look to position themselves ahead of the merger.

The share of perpetual futures volume between bitcoin and ether had ETH at 45% of volume at the beginning of August and rose to 57% at the end of August as this month’s merge approaches, according to Kaiko.

Spot vs. perpetual futures volume

An increasing number of ETH perpetual futures trades are being made compared to spot market trades and are starting to have an outsized influence on sentiment around ether, according to Kaiko.

According to Kaiko’s report, volume typically correlates with price movements, and if futures markets see a larger increase in volume than spot markets, the correlation may signal that the futures market is leading price discovery.

“When markets were at all-time highs last November, perps only did 4x the volume of spot markets,” the report said.

“Now, with 7x the volumes and with open interest at all-time highs, it appears that investors and institutions are turning to perpetual futures to place their bets on ETH, which, as we’ve seen over the past month, has mainly been biased to short. side.”

Based on ETH’s perpetual future daily volume over the past year, that’s an increase from $19 billion to over $33 billion. Daily spot volumes rose to $4.8 billion from $3.7 billion in just over a year.

Today’s chart

US inflation-adjusted bond yields at highest since mid-July

By Omkar Godbole

-

The inflation-adjusted 10-year U.S. Treasury yield jumped to 0.67%, its highest level since July 11, according to data from charting platform TradingView.

-

Like gold, bitcoin tends to move in the opposite direction of real returns.

-

Bitcoin’s 90-day inverse correlation with the real yield hit a record -0.95 in July and remained high at press time.