Bitcoin in accumulation phase despite macro headwinds, chain data indicates

Long-term investors in bitcoin are increasing their holdings as prices fall, despite the generally bleak macroeconomic outlook, with some models suggesting the world’s largest cryptocurrency may be undervalued at its current $20,000-$21,000 price range.

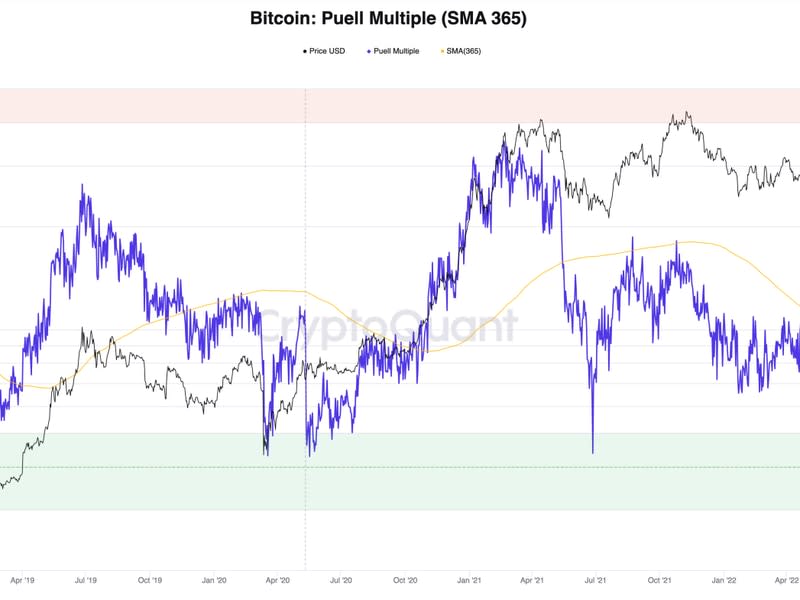

The Puell Multiple, a tool that measures one-year earnings growth among bitcoin miners, indicates that there is buying interest among investors, and a reading of 0.5 places bitcoin in a so-called green zone for those looking to build long-term exposure to the coin, said CryptoQuant analysts to CoinDesk. The metric entered the green zone in the final leg of the previous bear market, which preceded weeks of price consolidation and a subsequent revival, as reported.

The Puell multiple, calculated by dividing the daily issuance of bitcoins in US dollars by the 365-day average of its value, indicates that newly minted coins are undervalued relative to the annual average. To some observers, this shows that the current profitability for miners to sell bitcoin is relatively low – a feature that has previously marked price bottoms.

However, the CryptoQuant analysts warned that a price bottom is likely “still far” from being formed, citing fundamental concerns.

“The macro environment is not supportive of the bitcoin price as US economic data continues to come in worse than expected,” they said. “Economic activity is slowing faster than expected.”

The US central bank is expected to continue raising interest rates aggressively, with some officials saying it is “unrealistic to expect easing anytime soon” – a sentiment that has raised concerns among investors.

Market analysts from crypto exchange Bitfinex said in a Monday note that bitcoin and ether are currently experiencing growth in the number of addresses holding the two cryptocurrencies.

The balance of holders has reached a record 12.92 million bitcoin and more than 60% of all bitcoin is stored by addresses that have held these spot positions for more than a year, the analysts said. The number of addresses holding between 1-10 bitcoins is about 750,000 and growing, they added.

“This sustained accumulation of bitcoin through bear markets demonstrates the strong commitment and long-term belief of the many holders in cryptocurrency,” Bitfinex’s analysts concluded.

Bitcoin was trading at around $19,700 at press time, and is down 0.3% in the last 24 hours.