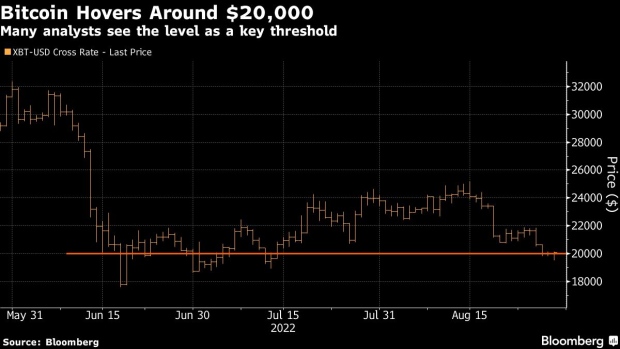

Bitcoin hovers around USD 20,000 as hawkish Fed weighs on crypto

Bitcoin is hovering around $20,000 as risk appetite falters after Federal Reserve Chairman Jerome Powell stressed that interest rates may need to stay high to stem inflation.

The largest token rose as much as 0.8 percent on Monday to $20,142 after trading below this key threshold over the weekend. Other cryptocurrencies fell, with Avalanche seeing one of the biggest moves in the space with a nearly 6 percent decline. Stocks also fell across Asia and Europe, as well as in the United States, with the S&P 500 down 0.5 percent as of 9:51 a.m. in New York.

“Money flows out of risky assets. Crypto followed the sharp adjustment of the US stock market” after Powell’s remarks, said Cici Lu, managing director of consulting firm Venn Link Partners. “The markets didn’t like what he had to say and Bitcoin is resuming as a high-beta asset.”

The USD 20,000 level served as support for Bitcoin as it hit lows in recent months, but the cryptocurrency had been working higher in recent weeks. Before Saturday, it had not been below this mark since July 14, and had even crossed above $25,000 earlier in August. This mini-rally was cut short as concerns about interest rate hikes intensified, and Bitcoin has fallen around 20 percent since August 15.

The gyrations have come amid uncertainty about the path and scale of Fed rate hikes, and the effect they could have on riskier assets.

Riskier assets had a tough few days as traders digested comments from Fed Chair Powell, who reiterated that the central bank is willing to keep raising interest rates, even at the risk of an economic slowdown.

“Now that Powell came out with a firm stance on inflation, the likelihood of a crypto crash has increased significantly,” wrote Peter Tchir, head of macro strategy at Academy Securities.

Numerous strategists have flagged USD 20,000 as a key point for Bitcoin, although the support level could also lie lower.

Fairlead Strategies’ Katie Stockton sees long-term support in the $18,300-$19,500 area. Fundstrat strategist Mark Newton has flagged some key areas in the $19,000 area, with a “real important area” around $17,500, near the lows levels in June, and that would allow a 100 percent alternative wave projection of the latest decline from mid-August, he said in a note on Friday.

“If Bitcoin doesn’t hit $20,000, then $18,900 comes into play before a date with the June intraday low of $17,600,” Antoni Trenchev, co-founder and managing partner of Nexo, said in a note on Sunday. “Close below that and it doesn’t look pretty.”

The last two Fridays have been tough in the crypto market, with USD 288 million of crypto loans liquidated on the last one, according to data from Coinglass. On August 19, US$562 million of longs were liquidated, the most since June 13.

Ether, the second-largest token, tumbled as much as 4.1 percent on Monday to $1,422.67, continuing a decline from around $2,000 a couple of weeks ago. It has varied ahead of the long-awaited Merge upgrade, which is due in mid-September.

“Ethereum’s fall ahead of the impending merger is also important as bearish sentiment appears to be taking hold of all so-called risk assets,” analysts at Bitfinex said in a note on Friday. “The volatility that has become so characteristic of the digital token space shows no sign of abating.”