Bitcoin Holds Steady at $29,300 Ahead of FOMC Meeting

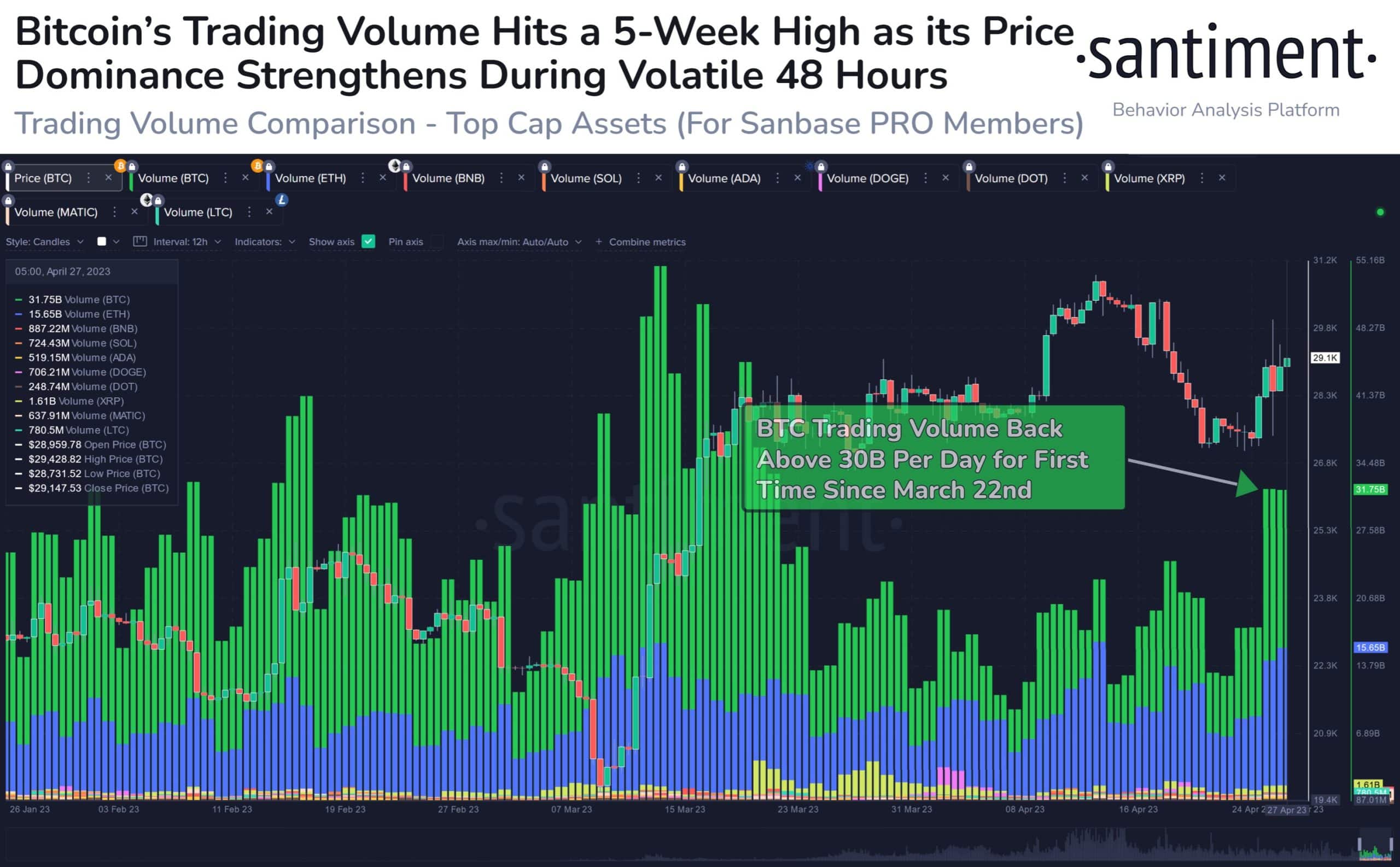

- After two days of volatility, Bitcoin’s daily trading volume has risen to over $30 billion, showing strength.

- Investors will be watching the Fed meeting ahead of next week and expect the third rate hike of 25 basis points.

The world’s largest cryptocurrency Bitcoin has regained the lost ground from the buggy Mt. Gox event earlier this week on Wednesday. As of press time, Bitcoin (BTC) is trading up 1.73 percent to a price of $29,482 and a market cap of $570 billion.

However, the recent price volatility in Bitcoin has pushed investors to the edge and created confusion about what could be the next direction of price movement for Bitcoin. Up more than 75 percent year-to-date, Bitcoin and the broader crypto market have shown strong resilience to the global macro environment as well as the banking crisis in the US and Europe.

On the opening day of the Consensus 2023 conference, Michael Sonnenshein, CEO of crypto asset management company Grayscale Investments, said:

The operative word here is resilience. Despite recent setbacks, whether it’s trust or certain businesses once integral to crypto that no longer exist, what we’re seeing is resilience. It’s really encouraging time and time again when this industry is challenged, it shows its strengths and comes out stronger.

Along with Bitcoin (BTC), other digital assets have also shown signs of revival today. Ether (ETH) has once again moved above the $1,900 level while Ripple’s XRP is making a move near $0.50. Cardano’s ADA is holding above $0.40 while Polygon’s MATIC has also shot past $1.0. Currently, Solana is the biggest gainer in the last 24 hours with 3.22 percent up to a price of $22.40.

Where is Bitcoin going from here?

On-chain data shows that after two days of strong volatility, Bitcoin’s trading volumes have re-emerged and are showing strength. In its latest report, the data from Santiment notes:

Bitcoin’s trading volume has re-emerged above $30 billion per day as large price swings have ebbed and flowed $BTCits price between $27.4k and $30.2k. #Altcoins are attracting less and less interest as their prices have faded in comparison #cryptoits top capital asset.

Politeness: Sentiment

For the next leg of the rally for Bitcoin, investors will focus on the interest rate decision by the Federal Open Market Committee (FOMC) before next week. According to the CME FedWatch Tool, there is an 87 percent probability of the third rate hike of 25 basis points.

According to Edward Moya, senior market analyst for foreign exchange market maker Oanda, the Fed is likely to continue with one or two rate hikes before stopping. Moya wrote.

No spam, no lies, just insight. You can unsubscribe at any time.

Today’s economic data painted a picture of an economy slowing, inflation temporarily accelerating and the labor market softening.

Crypto News Flash does not endorse and is not responsible or liable for the content, accuracy, quality, advertising, products or other materials on this site. Readers should do their own research before taking any action related to cryptocurrencies. Crypto News Flash is not responsible, directly or indirectly, for any damages or losses caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned.