Bitcoin Holds Steady Above $23K, White House Urges Congress To ‘Step Up’ Crypto Regulation

Latest prices

CoinDesk Market Index (CMI)

1,092.39

+6.2 ▲ 0.6%

Bitcoin (BTC)

$23,144

+66.7 ▲ 0.3%

Ethereum (ETH)

$1603

−0.8 ▼ 0.0%

S&P 500 daily close

4,070.56

+10.1 ▲ 0.2%

Gold

$1,928

−0.7 ▼ 0.0%

Treasury Yield 10 years

3.52%

▲ 0.0

BTC/ETH prices per CoinDesk indices; gold is the COMEX spot price. Prices from approximately 4:00 PM ET

Bitcoin (BTC): The largest cryptocurrency by market capitalization recently traded at $23,100, up 0.4% in the past 24 hours, as traders awaited next week’s Federal Open Market Committee decision on interest rates. BTC is up nearly 40% since January 1, on track for its best opening to a year since 2013 when it rose 51%.

Stock closed up as traders processed the latest personal consumption expenditure (PCE) report, which showed a slowdown in inflation at the end of last year. The technology-heavy Nasdaq Composite rose 0.95%, while the S&P 500 and Dow Jones Industrial Average (DJIA) were up 0.25% and 0.08% respectively.

Would you like to receive our daily market updates in your email inbox every day? Subscribe to our First Mover newsletter here.

Top story

Four senior officials in the Biden administration published a statement on Friday urging Congress to “step up efforts” in regulating the cryptocurrency market.

-

The officials – Brian Deese, director of the National Economic Council; Arati Prabhakar, director of the White House Office of Science and Technology Policy; Cecilia Rouse, Chair of the Council of Economic Advisors; and National Security Adviser Jake Sullivan — wrote that Congress “should expand regulators’ authority to prevent misappropriation of customers’ assets … and to reduce conflicts of interest.”

-

Other proposals for Congress in the statement included strengthening transparency and disclosure requirements for crypto companiesstrengthen penalties for breaches of illicit financial rules and work more closely with international law enforcement partners.

-

The officials also offered suggestions on what Congress should not do when it comes to crafting new crypto regulation, including “green light[ing] mainstream institutions, such as pension funds, to dive headlong into cryptocurrency markets.”

-

To do so, the officials warned, “would be a serious mistake” that “deepens the ties between cryptocurrencies and the broader financial system.”

Token Roundup

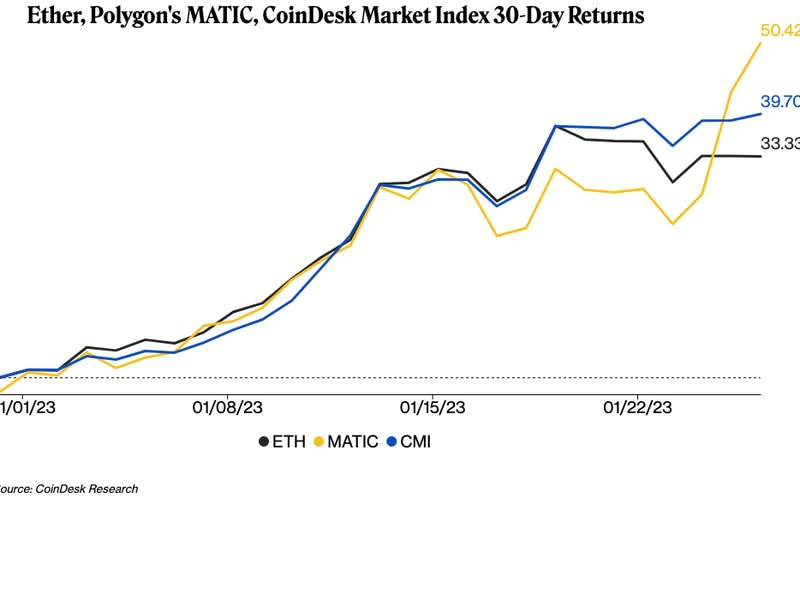

Ether (ETH): ETH was up 0.2% to recently trade at $1,600.

Polygon (MATIC): The MATIC token recently rose 8% to $1.1 on Friday. The price has risen 55% since December 31, amid a surge in daily transactions.

Gains Network (GNS): The decentralized exchange’s original token gained more than 7% to trade at $6.20 on Friday, according to data from CoinGecko. Gains Network has recorded over $1.5 billion in trading volume on the Arbitrum blockchain nearly a month after being deployed.

Vela Exchange (DXP): The utility token of the Arbitrum-based decentralized trading platform recently gained around 50% on Friday as the project prepares to release its long-awaited beta version next week. DXP had rebounded to a 26% advance, trading around $2.20 at press time, according to data from CoinGecko.

Crypto Market Analysis: Bitcoin, Ether Trading activity slows as investors await FOMC’s next rate hike

By Glenn Williams Jr.

Markets next week will look to the Federal Open Market Committee’s (FOMC) interest rate decision, which is widely expected to be a 25 basis point (bps) increase.

BTC’s correlation with the S&P 500 has eased slightly over the past week, falling to 0.69 from 0.89 on January 11. The correlation with the tech-heavy Nasdaq Composite remains high at 0.89, underscoring “bitcoin trades like a high-beta tech stock”. narrative.

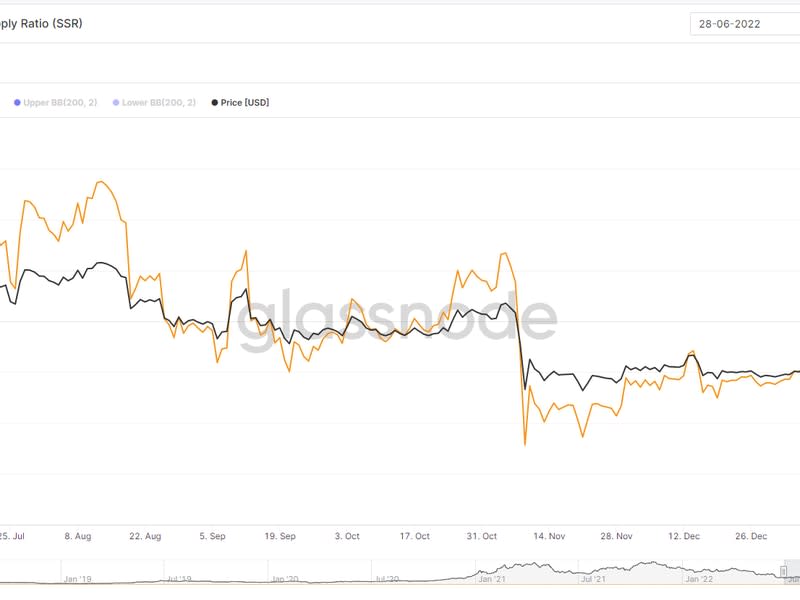

Meanwhile, bullish investors should be wary of the stablecoin supply ratio (SSR).

SSR measures the ratio between the supplies of bitcoin and stablecoins. Since stablecoins represent purchasing power, a reduction in SSR implies that investors are sending stablecoins to exchanges, likely for the purpose of buying bitcoin. Since January 11, SSR has increased by 32%. So while BTC’s price has risen, investors don’t seem to be sending stablecoins to exchanges en masse to add to long positions.

Read the full technical overview here.