Bitcoin holds at $25,000 as producer price index hints at decline

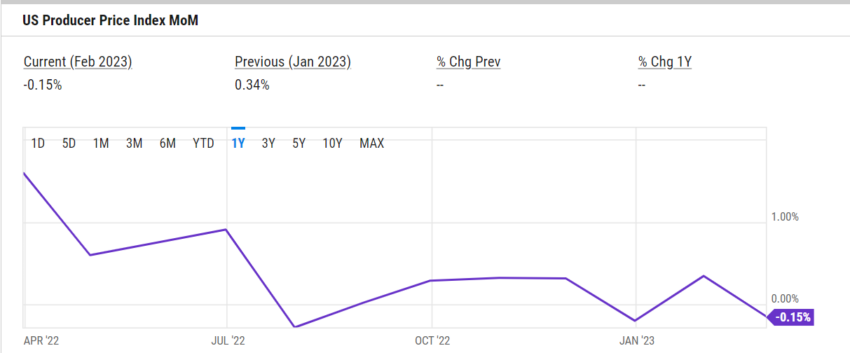

Bitcoin is holding the $25,000 resistance level after wholesale inflation fell 0.1% month-on-month in February 2023, below analysts’ estimates of 0.3%.

The US producer price index rose 4.6% annually, down 1.1% from January 2023 and 0.8% below analysts’ forecasts.

Lower wholesale inflation keeps Bitcoin at $25,000

Following the PPI numbers, Bitcoin maintained a resistance level of $25,000 after recording its best four-day stretch that ended on March 14 since February 2021. In the last four days, Bitcoin peaked at $26,500, but has since fallen below $24,800.

The US Bureau of Labor Statistics releases the PPI figure during the second week of each month.

Unlike the Consumer Price Index, which measures changes in consumer prices, the PPI measures what producers pay to make finished goods. PPI is also known as wholesale inflation.

So-called core PPI, excluding food, energy and trade services, rose 0.2% in February 2023, down 0.3% from January 2023.

Retail spending fell 0.4% in February 2023, with the biggest declines at 4% in department stores, 2.5% in furniture stores, 2.2% in food services and 1.8% in auto and parts retailers.

Credit Suisse fell 29% to below $1.60 price levels in Swiss trading after investor Saudi National Bank said it would not provide more money. The stock has since recovered, rising to $1.72 at press time.

The bank took down several other bank stocks, including JPMorgan, Wells Fargo and First Republic Bank.

Shares of First Republic fell 19% in premarket trading after Moody’s downgraded the firm for relying on funding from uninsured deposits and holding deposits from a narrow pool of industries.

Yesterday, the US Department of Labor announced that the CPI for February 2023 increased 0.4% month-on-month and 6% annually, in line with Dow Jones estimates.

The Federal Reserve is likely to stick to its 25 basis point hike

Last week, CME’s Fedwatch tool increased the Fed’s likelihood of raising interest rates by 0.5% at its next Open Markets Committee meeting.

The increase came after Federal Reserve Chairman Jerome Powell said the Federal Reserve could escalate the size and pace of future rate hikes needed to bring inflation back to 2%. Powell attributed the continued hawkish stance to a strong labor market with only 3.6% unemployment in January 2023.

He added that the Fed would use February’s PPI and CPI numbers and the health of the US labor market to determine the size of the next rate hike.

“Investors believe that the Fed has taken a 50 basis point hike off the table for next week, and at worst it will be a 25 basis point hike, and maybe no more hikes at all. Bitcoin … was able to capitalize on this sentiment and move to risk before all other assets,” noted James Lavish of the Bitcoin Opportunity Fund.

The Federal Reserve uses monetary policy to restore imbalances in supply and demand. Lower retail sales indicate that the Fed’s policy tightening has reduced demand. It raised interest rates by 4.5% in the past year to combat loose monetary policy and snarls in the Covid-19 supply chain that were driving demand.

The Personal Consumption Expenditure Index, the Fed’s preferred inflation gauge, will be released on March 31, 2023. The PCE index captures changes in consumer behavior due to rising prices. A key area of focus with the PCE index is the cost of medical treatment.

The interest rate hikes plagued Signature Bank and Silicon Valley Bank, which sold securities at heavy losses to raise liquidity. The Federal Deposit Insurance Corporation has taken over both.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.