Bitcoin Holders Selling at Big Losses, Final Capitulation Here?

On-chain data shows that Bitcoin holders have been selling at large losses at the level of previous lows, suggesting that the final capitulation for the cycle may be here.

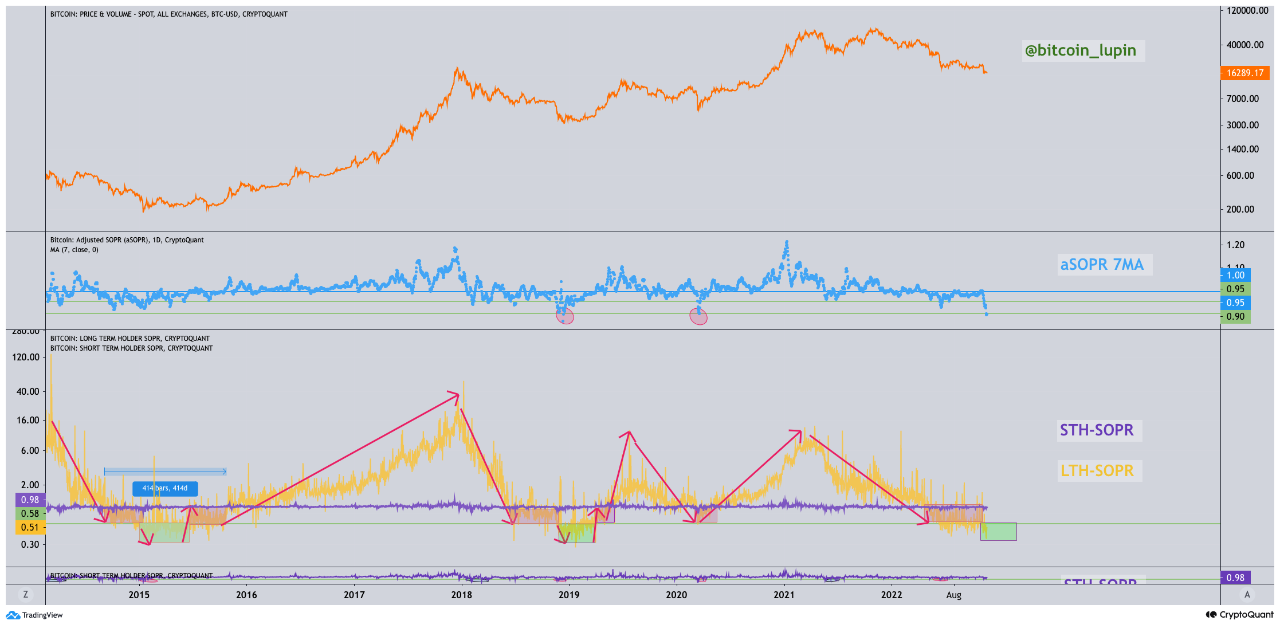

Bitcoin 7-Day MA aSOPR has fallen sharply recently

As pointed out by an analyst in a CryptoQuant post, BTC market participants may be close to surrendering.

The relevant indicator here is the “Spent Output Profit Ratio” (SOPR), which tells us whether Bitcoin investors are selling their coins at a profit or a loss right now.

When the value of this metric is greater than 1, it means that the average holder is moving their coins at a profit at the moment.

On the other hand, the indicator that has values less than the threshold suggests that the market as a whole is realizing some loss at the moment.

Naturally, SOPR with values exactly equal to 1 means that investors only break even when they sell.

“Adjusted SOPR” (aSOPR) is a modified version of this calculation that does not take into account the movement of all the coins that were sold within an hour of their purchase. This helps to remove noise from the data that will not have a significant impact on the market.

Now, here is a chart showing the trend of the 7-day moving average Bitcoin aSOPR over the past few years:

Looks like the 7-day MA value of the metric has declined in recent days | Source: CryptoQuant

As you can see in the graph above, the 7-day MA Bitcoin aSOPR has taken a deep dive below the 1 mark recently. This means that the investors are now selling at sometimes large losses.

The current levels of the indicator are the same as those observed during the bottom of the bear market in 2018-19, as well as during the COVID crash.

The reason such deep capitulations have usually coincided with major bottoms in the price of the crypto is that they signify the exhaustion of selling pressure as the weak holders give up and dump their holdings at a loss.

Stronger hands then buy these coins and accumulate at cheap prices, leading to a more positive long-term result.

If the current capitulation is indeed the final one, a bottom could be in sight for Bitcoin. However, the bullish trend would not immediately follow the coin; the short-term outcome is likely to remain bearish.

BTC price

At the time of writing, Bitcoin’s price is hovering around $16.1k, down 5% in the last week.

The value of the crypto seems to have gone down during the past day | Source: BTCUSD on TradingView

Featured image from 愚木混株 cdd20 on Unsplash.com, charts from TradingView.com, CryptoQuant.com