Bitcoin hits nine-month high as traders move away from banks

Bitcoin hit a nine-month high on Friday as crypto traders moved funds away from banks and warmed to rapidly changing interest rate expectations.

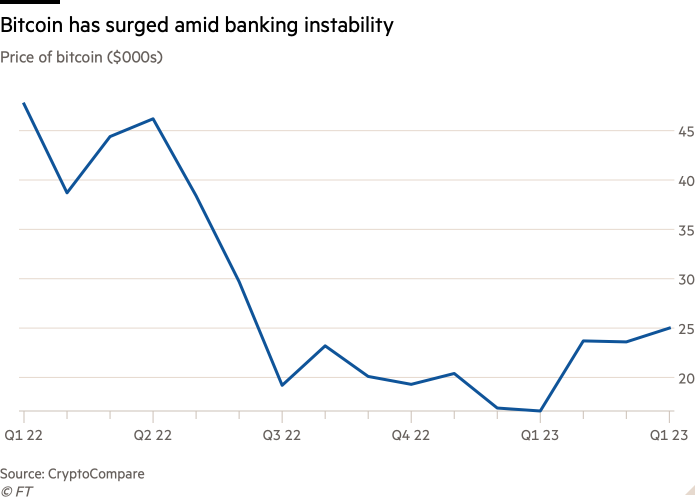

The dollar-denominated price of the original and largest cryptocurrency has surged more than 30 percent this week to more than $27,000, the highest point since the beginning of the crisis of confidence that engulfed the market last summer. The second largest token, ether, has risen by a fifth in the same period.

Buyers have emerged after a week of acute turbulence for the world’s banking industry on both sides of the Atlantic as investors worry about the valuation of smaller banks’ bond portfolios and business models.

The US government and major banks stepped in to stabilize the system while the Swiss central bank provided an emergency bailout of $54 billion for lender Credit Suisse. The uncertainty has led to speculation that the Federal Reserve and the European Central Bank will put their plans to aggressively raise interest rates on hold to curb persistent inflation.

Over the past 18 months, the price of bitcoin, once touted as a hedge against inflation, has often been correlated with traditional stock indexes such as the S&P 500 and Nasdaq Composite, and sensitive to trading expectations of interest rates.

Traders point out that when investors fear crypto prices, they move funds to bank deposits and stablecoins. When there are worries over banks, they quickly move to buy tokens.

“Fears about the stability of the banking system, along with falling real interest rates, create a good environment for bitcoin to rebound because it is seen by some investors as a hedge against systemic risk,” said Ilan Solot, co-head of digital assets at the London-based broker Marex.

The market rally has also been boosted by assurances from US authorities that deposits in the failed Silicon Valley Bank would be protected.

Circle, operator of the crypto market’s second-largest stablecoin USDC, admitted it had $3.3 billion trapped at SVB, triggering a temporary drop in the value of the stablecoin to 88 cents.

Stablecoins act as a channel between crypto and sovereign money and must at all times maintain their value one-to-one against the dollar.

Despite a short-term recovery for digital assets, turbulence in the banking sector casts doubt on the crypto industry’s long-term footprint in the US.

Along with Silvergate and Signature, SVB was one of a trio of crypto-friendly banks that met their demise in recent days. Their failure has sparked fears among industry supporters that the US is defunding the crypto industry.

Republican Congressman Tom Emmer wrote a letter to the Federal Deposit Insurance Corporation on Wednesday, arguing that the regulator was intentionally trying to limit the banking industry’s exposure to crypto markets.

“A lot of people already understand that the industry is rotating away from the US, so in many ways the US crypto downturn has been priced in by the market,” Solot said.