Bitcoin: Highway To The Danger Zone (BTC-USD)

Photofex/iStock Editorial via Getty Images

Summary of the assignment

Bitcoin (BTC-USD) has made a compelling case in recent months that a cycle low may be in store. However, history shows that we can have a very aggressive pullback before the halving takes place place.

This view is also reinforced by both technical analysis and macroeconomic analysis of liquidity and the business cycle.

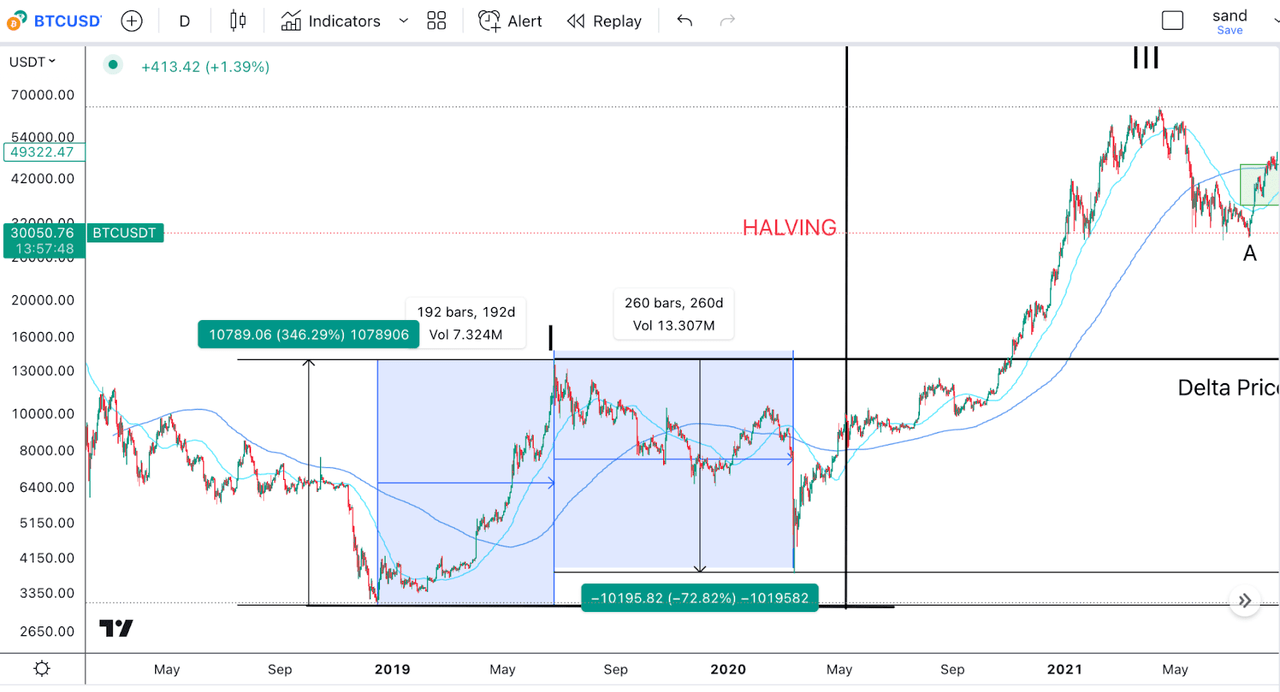

A mirror image of 2019?

Let’s start with a trip down memory lane. This is how Bitcoin behaved until the last halving, which took place on May 11, 2020.

BTC Previous Cycle Price Action (Author’s work)

As we can see, Bitcoin bottomed out at around $3,500 just before the start of 2019. The world’s first cryptocurrency then surged 346% over the next 192 days. After this, we can characterize the next 260 days as a market correction, with Bitcoin losing 72.83% of its value. This movement was accelerated of the Covid crisis, but from an Elliott Wave perspective it fits perfectly as an I-II setup, which was then followed by an aggressive wave III to the upside.

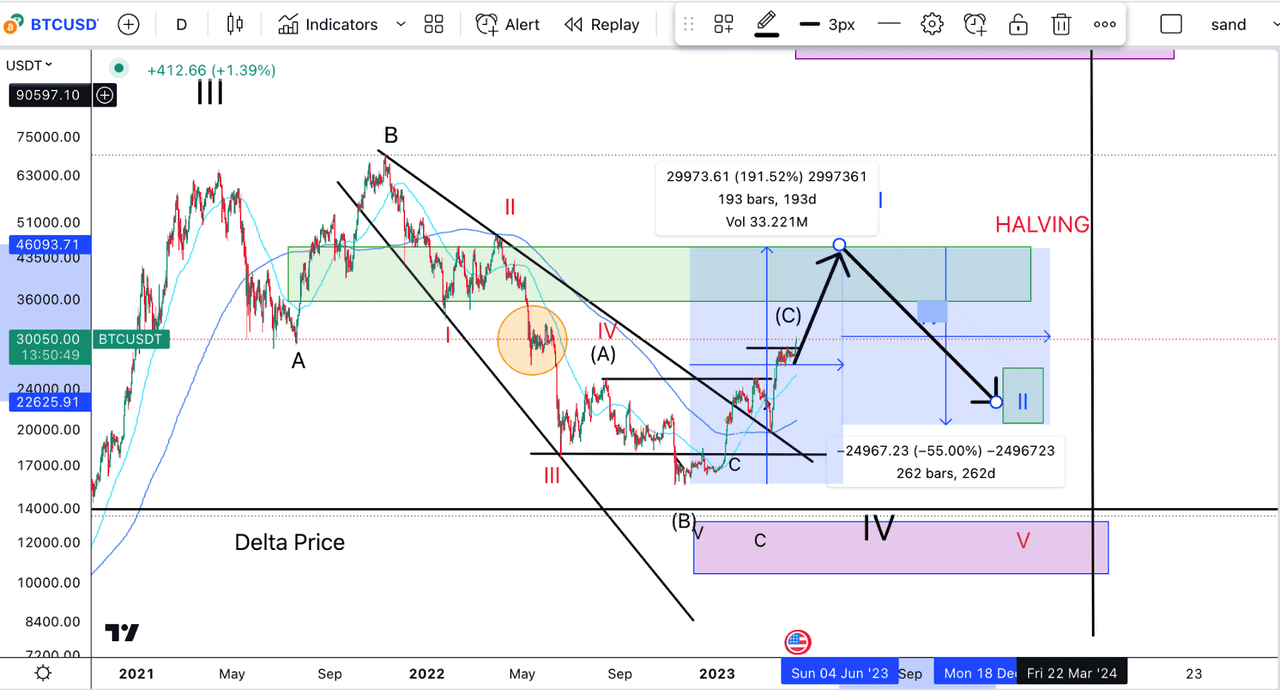

Here is the Bitcoin chart now and what the next few months might look like if we assumed a similar behavior:

Bitcoin Price Forecast (Author’s work)

The next halving should happen around April/May 2024. BTC has already almost doubled since bottoming out over 140 days ago. Therefore, BTC may continue to rally over the next nearly two months, likely targeting somewhere around the $40K-$50K range. This goal was achieved using Fibonacci extensions which I have discussed in more depth with my subscribers.

History would tell us that BTC could peak by the end of May and then begin a correction which again, using Fibonacci ratios, I believe could take us back to the $22K area by January 2024.

This will follow a similar time frame to the previous cycle, but the price swings are slightly less aggressive, which makes sense if we consider how Bitcoin’s volatility has decreased with each cycle.

Once again, this move would fit nicely into my EW count, which would see us complete a wave 1 and 2 in what would be the larger wave V to the upside.

In itself, this is just a nice little comparison, but I think this can be strongly supported by macroeconomic fundamentals.

The liquidity seems to be right

Liquidity is a crucial factor in market movements, and this is especially true of Bitcoin, which is perhaps one of the best liquidity proxies out there.

US liquidity can be calculated by taking the balance at the Fed, subtracting the use of the Reverse Repo facility, the Treasury General Account and, as recently, adding up Fed remittances, which are interest the Fed pays to the Treasury.

From an American perspective, there are a couple of factors that can drain liquidity. First, as we enter tax season, the TGA will replenish, which equates to liquidity being sucked out of the market.

This was very eloquently explained by fellow SA contributor Pragmatic Value Investing in this recent article. He estimated that $398 billion in liquidity could be trapped over the next few months.

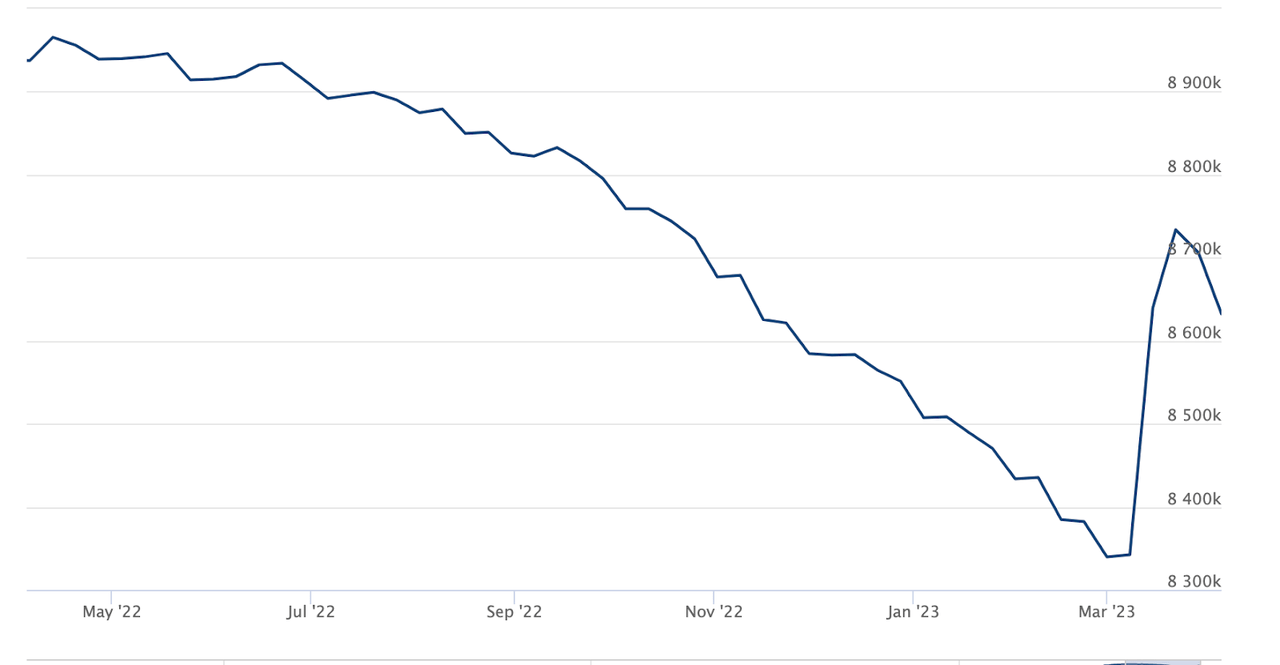

Another false need for liquidity could be the unwinding of the recent loans that the Fed made to distressed banks. Below we can see Fed assets in recent months.

Fed Assets (St. Louis Fed)

A lot of noise was made, myself included, about how the Fed loans had undone months worth of QT, but we can see how this has quickly reversed in recent weeks. The fact is that QT is still in effect and the economy is still digesting interest rate hikes from the past few months.

As far as global liquidity is concerned, things may improve a little, but it is currently quite uncertain how some of the major central banks will behave in the coming months. The Bank of Japan has just changed governors, and the policy of yield curve control, which has been instrumental in injecting liquidity in recent years, is being called into question.

China has been quite accommodative in its monetary policy, and with low inflation figures this may continue, but it also has to worry about the value of the Yuan, especially as more countries begin to use it in trade.

All in all, the expectation is that liquidity may fall during the summer months, and the markets may be dragged down with it.

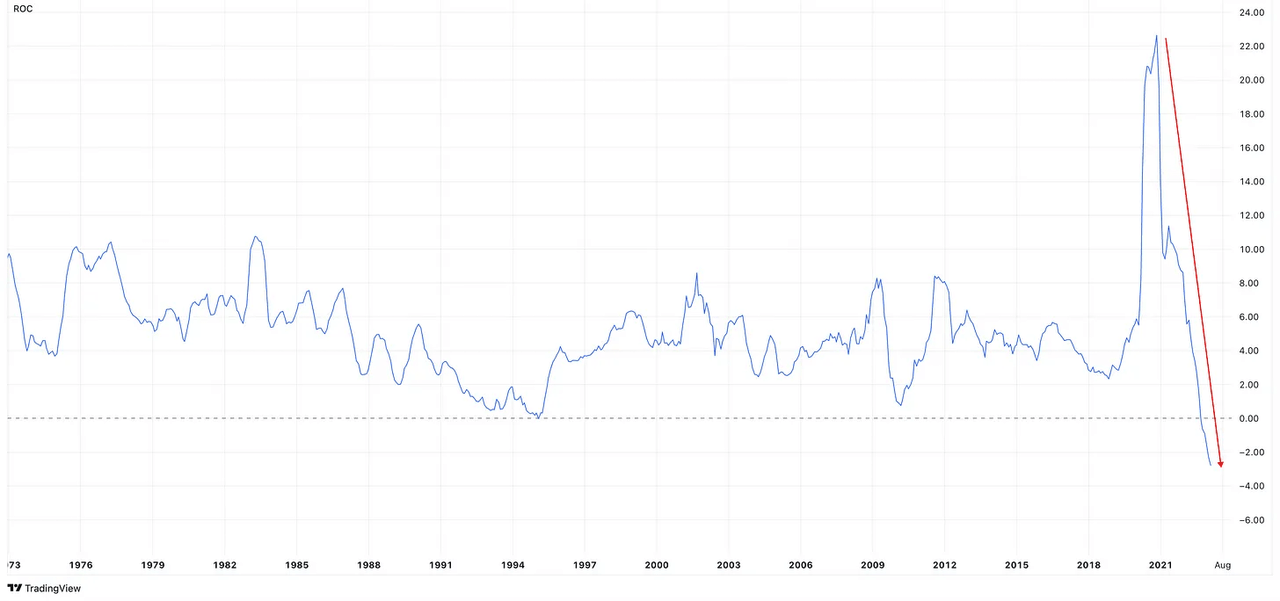

Recession is coming

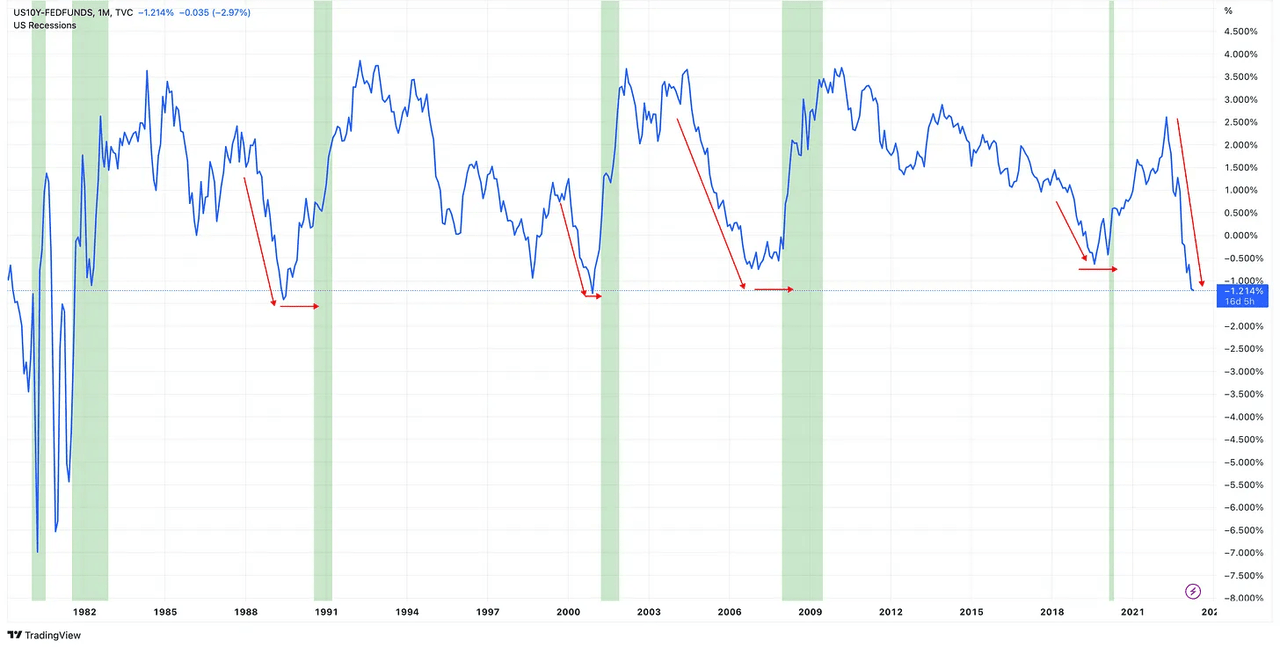

And the other big problem we face is, of course, the impending recession, which could come as soon as the year ends. This is clear if we look at leading indicators. Below we can see the rate of change of M2, and the difference between the US10Y note and the Fed Funds rate.

M2 Rate of Change (Swissblock Insights)

Yield curve (Swissblock Insights)

The collapse in M2 and the inversion of the yield curve are warning signs that a recession is on the way.

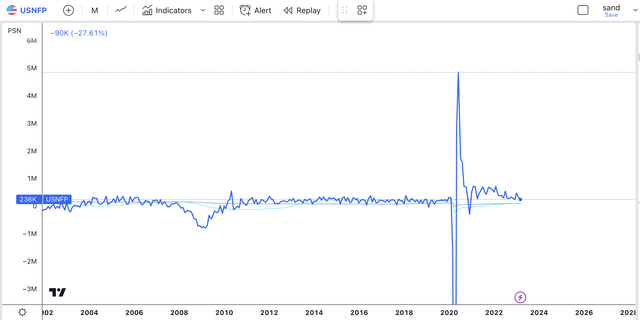

In recent weeks, we have received more concrete evidence of a recession. with coincident indicators such as non-farm payrolls taking a turn for the worse:

Non-Farm Wages (TradingView)

It looks like a deflationary recession could be coming soon and this is sure to drag down the markets. Bitcoin may actually hold up a bit better, but I still expect it to underperform.

Remove

It’s pretty simple, really. With the latest inflation data, the stage is set for a Fed break. A break in interest rates is bullish for assets, and it is these expectations that are fueling the current rally. However, a recession will drag the markets with it, and based on history, it won’t be until after the Fed starts cutting that a solid bottom forms.

The question is, how far can the markets rally before the recession hits? My guess is that we can go a little higher, but we are entering the danger zone. I think the next few weeks might be a good time to take some profits.