Bitcoin Heading To End Week 9% Higher After Inflation Data, Ether Set For 13% Weekly Gain

peshkov

Bitcoin (BTC-USD) is on track to post a weekly gain of ~9%, during a week that saw the top cryptocurrency cross $30,000 after economic data showed inflation slowing. Ether (ETH-USD) is set to exit the week ~13% higher after the successful software upgrade in Shanghai.

Markets widely expect the Federal Reserve to pause its rate hike campaign in June, after another 25 basis point increase in May, as wholesale inflation unexpectedly fell and retail inflation showed signs of moderating.

Meanwhile, Ether (ETH-USD) climbed to its highest level since last August. The software update, completed on Wednesday night, allows users to withdraw their stake ETH for the first time ever. Shanghai, or Shapella, marks the end of the network’s multi-year transition to a Proof-of-Stake protocol from Proof-of-Work – the same one used by bitcoin (BTC-USD).

“Bitcoin and Ethereum are breaking out here,” said Edward Moya, senior market analyst, OANDA. “Bitcoin has recaptured $30K, a key level that was an entry level for many institutional investors in 2021. ETH is over $2.1K after a successful Shanghai upgrade and Ethereum is now fully Proof-of-Stake.”

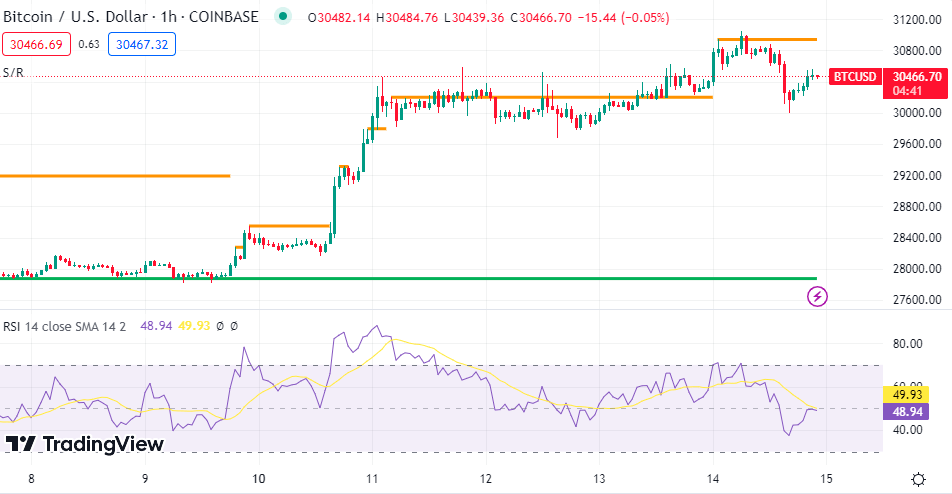

Bitcoin (BTC-USD), which rose to a 10-month high of $31K on Friday, traded in the $27.8K-$30.5K range during the week. The total crypto market cap is now $1.28T, up 1.5% over Thursday, according to CoinMarketCap.

Galaxy Digital CEO Michael Novogratz attributed the current rally to longtime enthusiasts who have moved back into the market after last year’s selloff. “This rally is built on the back of the crypto community,” he said. “It’s not new money… It was really retail driven.”

In regulatory news, the SEC reopened a proposal from last year that would now require registration of all crypto exchanges and decentralized finance (DeFi) platforms. “Make no mistake: many crypto trading platforms already fall under the current definition of an exchange and thus have a pre-existing duty to comply with securities laws,” said SEC Chairman Gary Gensler.

Remarkable news

- FTT Token (FTT-USD) more than doubled in value after lawyers representing bankrupt FTX reportedly told a court that the exchange is considering relaunching in the second quarter.

- The European arm of FTX received approval from a Swiss court to explore a potential sale.

- ETF issuer VanEck plans to exit a crypto-mining ETF it launched just over a year ago, hurt by losses from falling mining stocks.

Bitcoin price

- Bitcoin (BTC-USD) inched 0.4% higher to $30.47K at 19:01 ET and ether (ETH-USD) rose 4.8% to $2.11K.

- The Digital Trend, head of the Investing Group ‘Technically Crypto’, believes the next few weeks could be a good time to take some profits in bitcoin (BTC-USD). “A break in interest rates is bullish for assets, and it is these expectations that are fueling the current rally,” they noted. But with a recession looming, likely when the Fed starts cutting interest rates, BTC seems to be entering the “danger zone”.

More about Crypto

Ethereum: Sell Reputation, Buy Shanghai

Bitcoin Rises 81% YTD: Is The Rally For Real Or Just FOMO?

Bitcoin vs. Gold: Which is the best buy?