Bitcoin Heading For Over 20% Weekly Loss; investors still struggling after FTX implosion

24K Production/iStock Editorial via Getty Images

Bitcoin (BTC-USD) is on track to post a weekly loss on over 20%with cryptocurrency investors still reeling from the implosion of troubled exchange FTX that sent shockwaves through the industry this week.

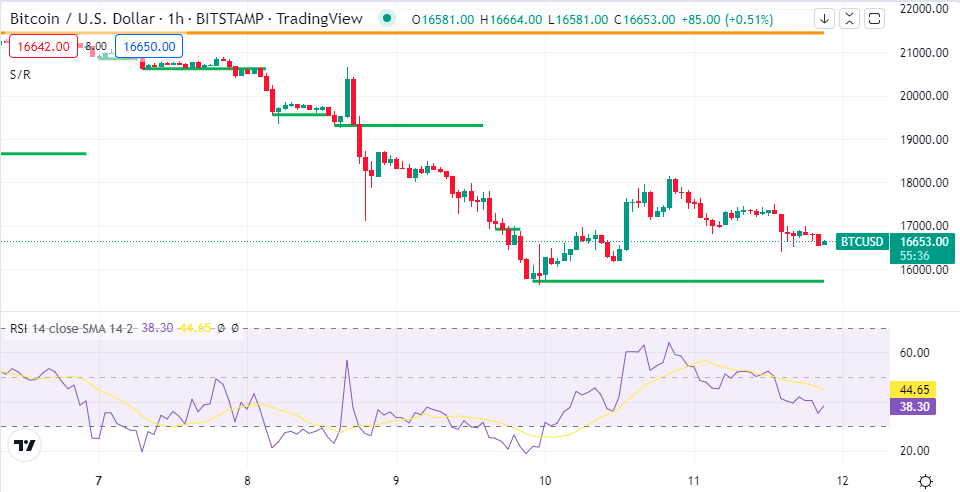

The top crypto, which stuck in range-bound trading over the past few weeks, fell to a two-year low of ~$15.7K on Wednesday.

Sam Bankman-Fried stepped down as FTX CEO and the crypto exchange entered voluntary Chapter 11 bankruptcy proceedings in the U.S. John Ray III has been named Fried’s successor as CEO. Ray is said to have overseen the liquidation of the former energy trader Enron.

FTX Tokens (FTT-USD) market capitalization has shed ~$2.6B this week, and currently stands at ~$350M, according to CoinMarketCap.

The world’s largest crypto exchange Binance initially offered to buy the non-US business of FTX, but pulled out after FTX reportedly came under regulatory scrutiny over potential mishandling of funds. In response to the crypto sale, Binance increased its emergency insurance fund to $1 billion.

Voyager Digital (OTCPK:VYGVQ) said late Friday that it reopened the tender process for the firm after FTX filed for voluntary Chapter 11 bankruptcy.

SEC Chairman Gary Gensler told CNBC that crypto investors need better protections as the sector is “significantly non-compliant,” despite having some clear rules.

Meanwhile, Galaxy Digital ( OTCPK:BRPHF ) CEO Mike Novogratz told CNBC that the FTX implosion is a “body shock” to confidence in the industry. But MicroStrategy (MSTR) co-founder Michael Saylor said it highlights the importance of bitcoin (BTC-USD), adding that now is a good time to accumulate the token.

Now, one exchange-traded fund has taken advantage of the broader selloff — the ProShares Short Bitcoin Strategy ETF (BITI). The ETF climbed over 9% on Friday, with its trading volume of ~1.7 million against its average trading volume of 916.9K.

On Thursday, the inflation print for October came in cooler than expected, after which bitcoin (BTC-USD) and ether (ETH-USD) erased some losses as the data sparked speculation that the Federal Reserve could raise interest rates at a slower pace.

Bitcoin (BTC-USD) fell 7.3% to $16.67K at 4:01 PM ET, while Ethereum (ETH-USD) fell 5.7 percent to $1.25K.

SA contributor Nathan Aisenstadt thinks bitcoin (BTC-USD) will fall to $12.7K-$13.6K, after which there will likely be a multi-month period of accumulation. The FTX implosion, he said, raised the likelihood of a domino effect on other market participants.

The global cryptocurrency market cap is $848.56 billion, down 3.6% over Thursday, data from CoinMarketCap showed.

Crypto-related stocks that finished in the red on Friday include: Galaxy Digital (OTCPK:BRPHF) -10%Marathon Digital (MARA) -2.1%Riot Blockchain (RIOT) -1.5%.

Bucking the trend were crypto exchanges Robinhood Markets (HOOD) +12.9%Coinbase (COIN) +12.8% and Bakkt (BKKT) +10.6%all of whom recovered from losses seen this week following the FTX fallout.