Bitcoin heading for 6% weekly loss as investors avoid risky bets after hot inflation data

designer491

Bitcoin (BTC-USD) is on track to end the week ~6% lower, in line with broader equity markets, as investors steered clear of risky bets amid continued macroeconomic uncertainty fueled by warmer-than-expected inflation data.

The data cemented fears that the Federal Reserve will have to tighten policy longer than expected. Markets are pricing in a ~75% chance that interest rates will top 5.25% by the end of the Fed’s June meeting.

“In our view, the US is experiencing a series of rolling recessions, including downturns in housing, cryptocurrency, several areas of Big Tech, industrial activity and capital spending,” said Wolfe Research analyst Chris Senyek, maintaining his medium-term bearish call on equity markets.

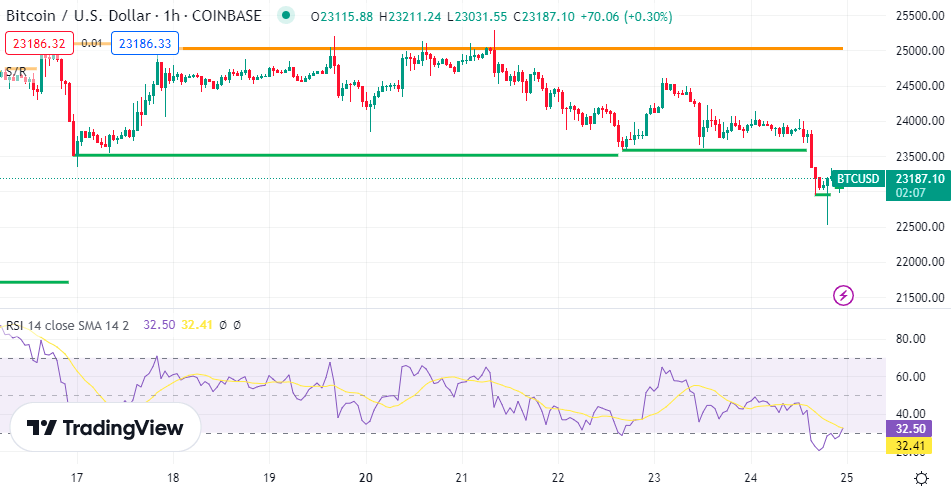

As for bitcoin (BTC-USD), risk aversion appears to have stalled last week’s brief rally, triggered by higher-than-usual shorter liquidations. Bitcoin failed to stay above the $25K level, trading in the $23.04K-$25.13K range this week.

“Bitcoin (BTC-USD) seems to be stuck in a range right now and that can only change if we see risk aversion run amok on Wall Street,” said Edward Moya, Senior Market Analyst, OANDA.

The global crypto market cap is currently $1.06T, down 3% over Thursday, according to CoinMarketCap.

Regulatory breakdown

- The SEC and New York’s Financial Conduct Authority objected to Binance.US’ deal to acquire bankrupt Voyager Digital’s (OTCPK:VYGVQ) assets for ~$1B due to violations of certain laws.

- The FTC is investigating Voyager (OTCPK:VYGVQ) for allegedly “misleading and unfair” marketing of crypto to the public.

- Sam Bankman-Fried, disgraced co-founder of failed crypto exchange FTX (FTT-USD), has been slapped with additional criminal charges from federal prosecutors.

- The SEC is said to be investigating whether stablecoins have been issued in violation of investor protection laws.

- NYDFS strengthened its ability to identify illegal activity among crypto entities with new risk monitoring tools.

- US financial regulators warned banks about liquidity risks associated with certain funding sources from crypto-related entities.

Land’s move to crypto

- Hong Kong will make crypto trading on licensed exchanges legal for all its residents, starting June 1.

- The Bank of Israel released a series of proposed rules for stablecoin activity, in a move motivated by the demise of terraUSD (UST-USD).

More layoffs

- Polygon Labs reduced its workforce by 20% as it consolidates a number of its units.

- Dapper Labs is laying off 20% of its workforce in its second round of layoffs in less than four months.

- Crypto intelligence startup Messari reduced headcount by 15% due to market headwinds.

- But bucking the trend is crypto startup Circle Internet, which plans to increase its headcount by up to 25% by 2023.

Remarkable news

- Coinbase (COIN) debuted a testnet of its own ethereum-powered blockchain network to make it easier for developers to build decentralized applications.

- FTX Japan has become the first subsidiary of Bankman-Fried’s crypto empire to resume customer withdrawals.

Bitcoin price

- Bitcoin (BTC-USD) fell 3.1% to $23.19K at 6:59 PM ET and Ether (ETH-USD) fell 2.6% to $1.61K.

- SA contributor The Digital Trend expects a near-term selloff in bitcoin (BTC-USD), providing what could potentially be the last chance to buy the dip. However, there is no guarantee that it has bottomed out.

Crypto-related stocks that fell on Friday include: Hut 8 Mining (HUT) -8.4%Marathon Digital (MARA) -8.4%Riot Platforms (RIOT) -7.9%CleanSpark (CLSK) -6.8%Coinbase (COIN) -6.3%.