Bitcoin Hashrate Continues Sharp Sting as Miners Give Up

Data shows that the Bitcoin mining hashrate has continued its sharp decline over the past week, as miners quit due to low earnings.

Bitcoin 7-day average mining hashrate has been rapidly decreasing recently

According to the latest weekly report from Arcane Research, a miner capitulation may not have a major impact on the price this time around.

“Mining hashrate” is an indicator that measures the total amount of computing power connected to the Bitcoin network.

When the value of this metric goes up, it means that miners are bringing more machines online right now. Such a trend shows that miners are positive on crypto in the long term.

On the other hand, a decrease in the indicator’s value suggests that miners are disconnecting some of their rigs at the moment. This kind of trend suggests that miners do not find the blockchain attractive for mining at the moment.

Now, here is a chart showing the Bitcoin mining hashrate trend over the past six months:

The value of the metric seems to have been rapidly trending down in recent days | Source: Arcane Research's Ahead of the Curve - November 29

As you can see in the graph above, the Bitcoin mining hash rate hit a new all-time high not too long ago. But since then, the metric has declined.

The reason behind the downtrend is that the ATH levels of the metric caused the network difficulties to reach a new high, which meant that the income for the individual miners shrank.

As the block rewards are fixed and shared between the miners, more miners means a smaller piece of the pie for everyone involved.

The decrease in the hash rate has been particularly rapid in the last week, as the indicator has lost around 10% of its value in the period.

When miners come under heavy stress like they are right now, they have no choice but to sell their Bitcoin reserves.

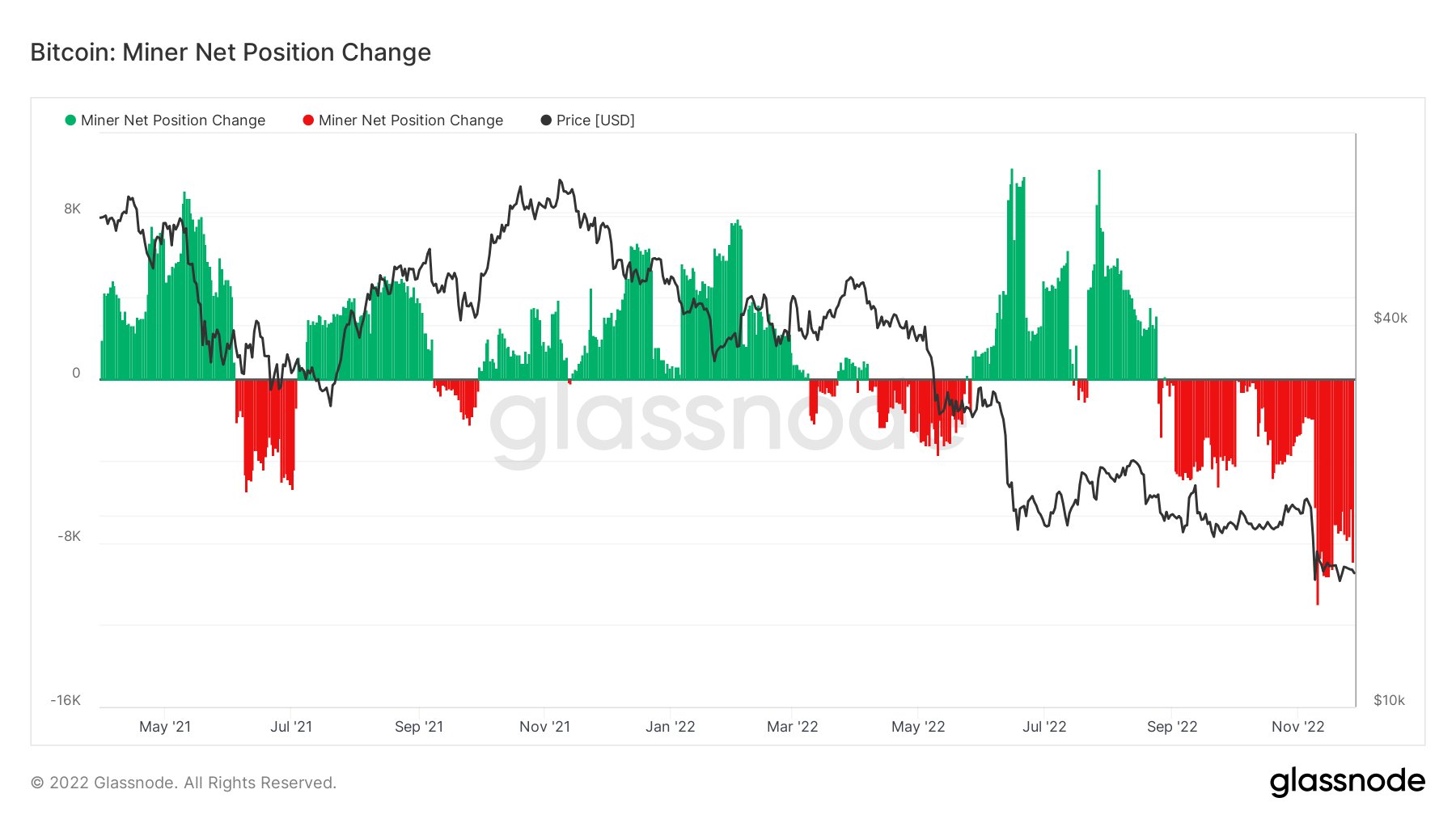

As the chart below shows, miners have actually sold a lot lately since they transferred a large number of coins from their wallet.

Looks like miners have been selling aggressively in the last couple of weeks | Source: Will Clemente on Twitter

Such miner capitulations have historically resulted in major crashes in the price of Bitcoin. A previous case of such an incident was during the cliff in November 2018.

However, the report believes that the market environment is different today, and therefore it is unlikely that the miners giving up will have any significant impact on the price this time around.

BTC price

At the time of writing, Bitcoin’s price is hovering around $16.8k, up 2% in the last week.

BTC has surged up | Source: BTCUSD on TradingView

Featured image from Dmitry Demidko on Unsplash.com, charts from TradingView.com, Arcane Research