Bitcoin hash bands point to miner capitulation as ownership increases

The biggest news in the cryptoverse for November 23 includes the Bitcoin hash band metric’s indication of an upcoming miner capitulation, on-chain data revealing investors taking advantage of the low prices, and Bitcoin and Ethereum making up 91% of Bitfinex’s total reserves .

CryptoSlate Top Stories

BTC hash band upcoming convergence signals miner capitulation

Bitcoin (BTC) miners have sold at the most aggressive rate in the last two years, indicating that the upcoming hash rate adjustment will be negative in the next epoch.

The Bitcoin hash bands are often used to identify price bottoms. When the hash band signals an upcoming miner capitulation, the Bitcoin price falls.

Currently, the hash band convergence signals that the end of this capitalization period is almost over and the market is likely to turn upwards.

Bitcoin on-chain data shows a ray of light in a dark market

After the FTX collapse, Bitcoin has struggled to recover from its bear market price of around $20,000. Especially during the weekend of November 19-20, Bitcoin stayed below $16,000.

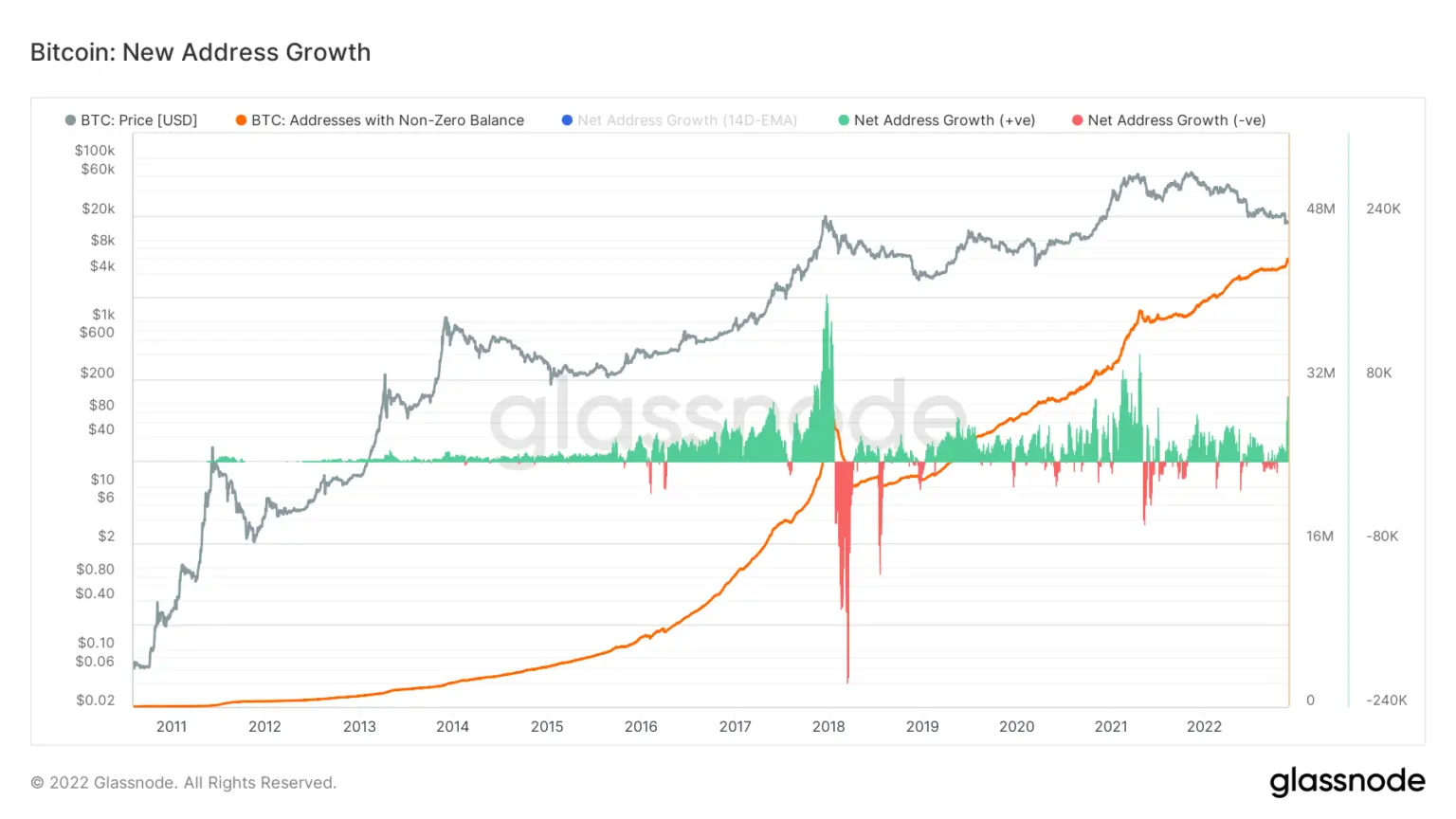

While this may be a bearish price, it was seen as a great buying opportunity for many. On-chain data shows that the number of wallets holding Bitcoin has increased while the number of addresses with non-zero balances is decreasing.

Bitfinex’s reserves are 91% Bitcoin, Ethereum

Crypto exchange Bitfinex’s reserves of Bitcoin and Ethereum (ETH) account for 91% of its total holdings. This percentage is 63% for Coinbase, 15% for Binance and 52% for Crypto.com.

According to the exchange’s proof of reserves, Bitfinex’s 91% large Bitcoin and Ethereum reserves correspond to 207,356,67967717 Bitcoins and 1,225,600 Ethereums.

US senators want Justice Department to hold FTX executives accountable for collapse

US Senators Elizabeth Watten and Sheldon Whitehouse wrote a letter to the US Department of Justice (DOJ). They asked the DOJ to hold FTX executives “accountable to the fullest extent of the law” for the FTX collapse.

US congressman defends decentralization, blames SBF, Gensler, CeFi for FTX collapse

US Congressman Tom Emmer argued that the FTX collapse was a failure of centralized finance (CeFi), not a failure of crypto.

Emmer also said that FTX founder Sam Bankman-Fried (SBF) and US Securities and Exchange Commission (SEC) Chairman Gary Gensler also share the blame.

Referring to the relationship between the SEC and the SBF, Emmer said the SEC worked with the SBF and gave him special treatment that other exchanges did not receive.

Record amounts of Bitcoin leave stock exchanges in readiness for contagion

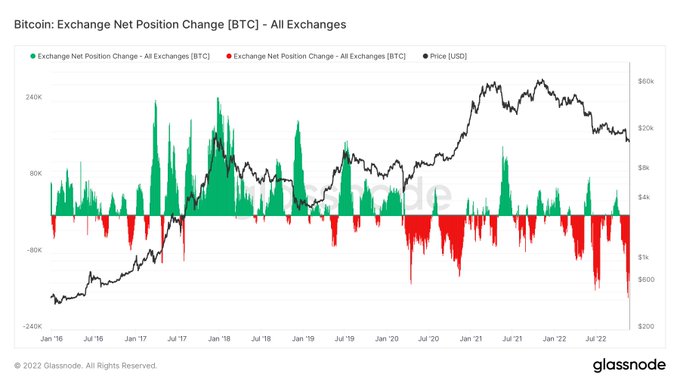

In the last 30 days, 136,882 Bitcoins were withdrawn from the exchanges, which is equivalent to 0.7% of the total circulating supply.

the chart above also shows massive Bitcoin outflows since 2016 and marks the current outflow levels as the highest. Even at the height of the Terra (LUNA) crash contagion, around 120,000 Bitcoins had left exchanges.

Mango Market hacker’s attempt to exploit Aave fails

Mango Markets leverages Avraham Eisenberg transferred USD Coin (USDC) worth $40 million to Aave (AAVE) for the purpose of borrowing Curve DAO Token (CRV) to short. This strategy is known as Eisenberg’s “highly profitable trading strategy”, with which he previously exploited the Mango market.

First he came for Mango and I didn’t speak out because I’m not an investor

Then he came for USDT, and I didn’t say anything, because he didn’t pose a risk

Now he is trying to hunt down the loan of one of the godfathers of DeFi, and that’s when the foot is put down to defend pic.twitter.com/feV78YPtq0

— Andrew Kang (@Rewkang) 22 November 2022

As for the CRV token, Eisenberg’s plan did not go according to plan, as the community rallied behind the CRV token, causing it to increase by 46% in the last 24 hours.

Hackers steal $42 million from Fenbushi Capital founder’s wallet

Fenbushi Capital’s general partner Bo Shen was attacked by malicious actors, who stole $42 million from his personal wallet on November 10.

Shen disclosed the attack on November 23 via his personal Twitter account. According to blockchain security firm Beosin, the hack was the result of a private key compromise.

The latest mining rigs increase the difficulty of zoning out the competition

Cybersecurity analyst Matt C drew attention to the increasing pressure from the latest mining rigs on previous generations of miners.

#Bitcoin mining profitability at @LuxorTechTeam says it all..

Antminer S19 XP is 3+ times better than previous generations 💰

2022 Miners put difficulties through the roof as they try to send competition out of business. pic.twitter.com/g5akp0RXjf— Matt C⚡️ (@mithcoons) 23 November 2022

Considering that hashing costs $0.07/kWh, the Antminer S19XP emerges as the most profitable mining rig.

News from the entire Cryptoverse

Genesis meets investors to get lending back on its feet

The Genesis CEO published a letter informing Genesis customers that the management team is meeting with potential investors to come up with a solution to fix the illiquidity problem of the lending services. The letter said Genesis expects to decide on a course of action in the coming days.

Apple buys rights to book at SBF

Well-known author Michael Lewis had spent six months with SBF before the stock exchange collapsed and is to write a book that sheds light on SBF’s crypto-empire. The book is expected to become a feature film, and Apple is close to a book rights deal with Lewis, according to MacRumors.

Onomy Raises $10 Million to Unite DeFi, Forex

The Onomy protocol raised $10 million from investors such as Bitfinex and Ava Labs during its private funding round. The protocol aims to converge the DeFi and Forex markets.

Crypto market

Over the past 24 hours, Bitcoin (BTC) gained 2.73% to trade at $16,566, while Ethereum (ETH) gained 3.97% to trade at $1,172.