Bitcoin: FTX’s Implosion and Its Impact on Profitability, Blockspace Demand, and More

- Bitcoin’s realized losses reached an all-time high when FTX collapsed.

- New demand for block space is entering the market again.

- The market is dominated by small transactions.

In the wake of FTX’s unexpected collapse, Bitcoin [BTC] changed hands for $15,000, trading at a two-year low.

As the royal coin bounced from a low of $16,065 to a high of $17,197 to begin mining, analytics platform Glassnode got on the chain. considered the impact of FTX’s implosion on market participants, miners and BTC network activity.

Read Bitcoins [BTC] Price prediction 2023-2024

How big were the losses?

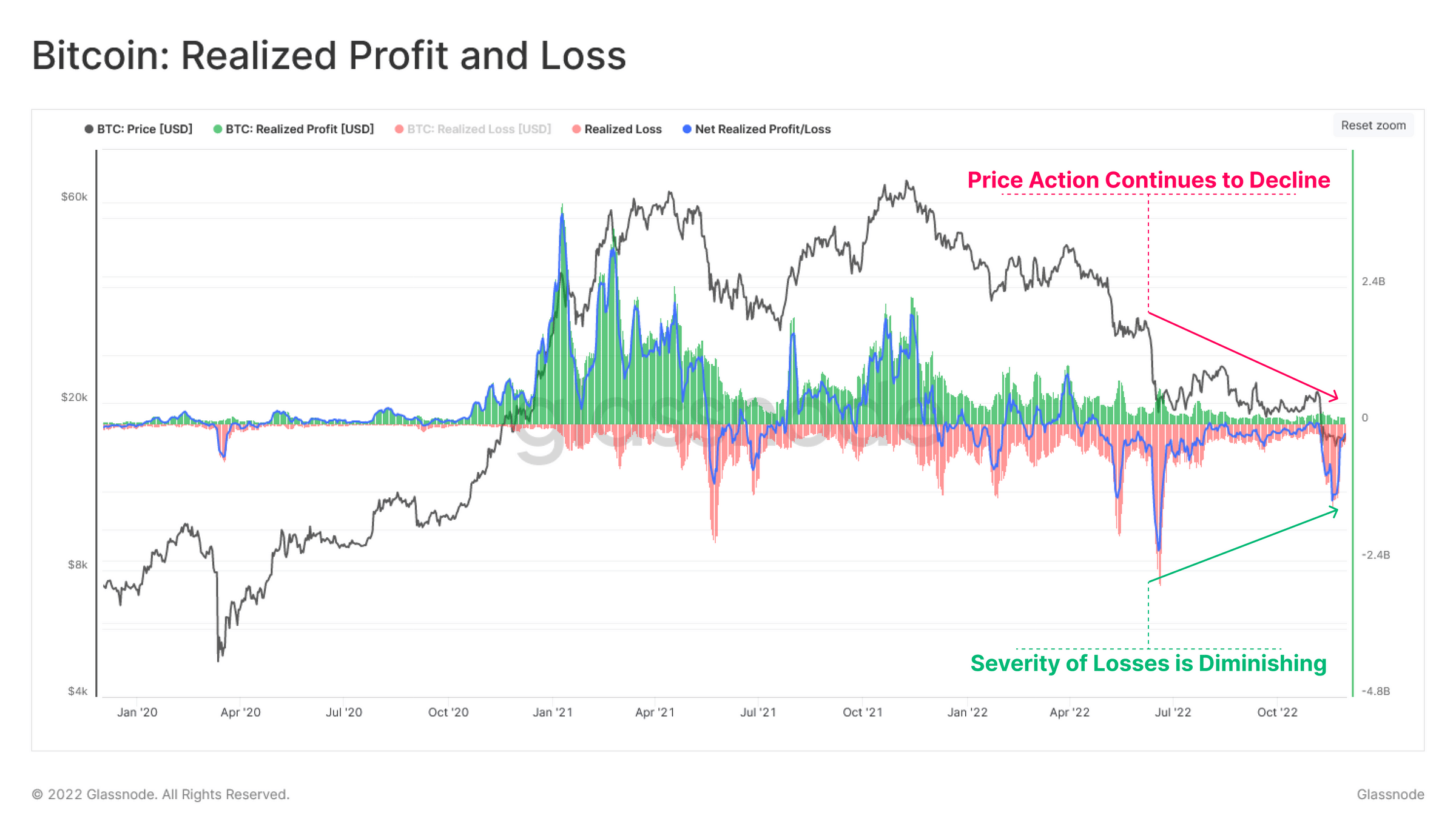

Glassnode first assessed the quantum of losses incurred by the various cohorts of holders that make up the BTC market. An assessment of BTC’s realized profit and loss metrics revealed that the FTX debacle led BTC to record a one-day loss of $4.435 billion, an all-time high.

As BTC’s price regained the $17,000 price mark, a reassessment of the calculations on a weekly moving average showed that the losses have started to diminish, Glassnode found.

Source: Glassnode

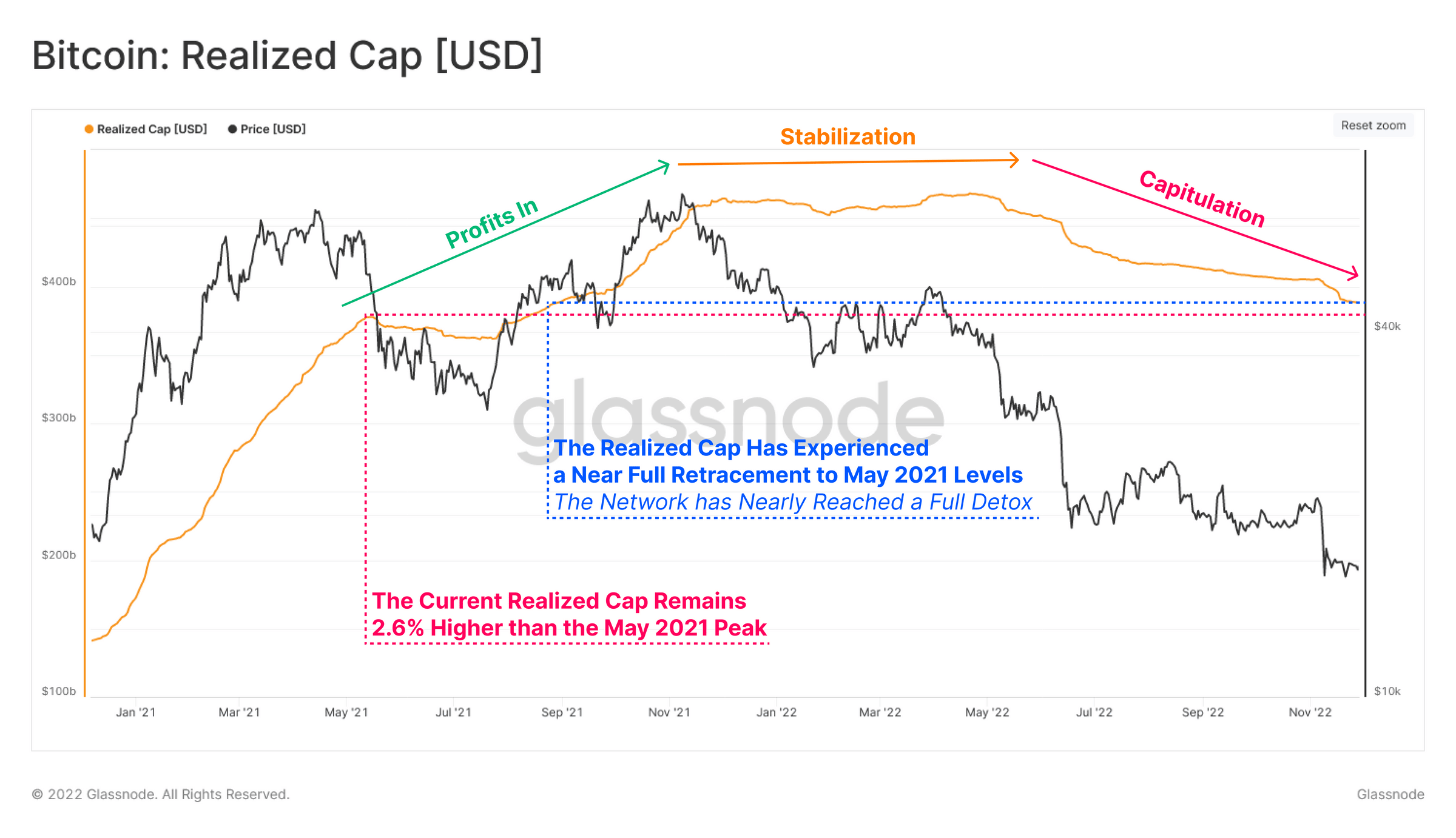

To further understand the severity of losses incurred by market participants, Glassnode assessed realized capitalization. This calculation shows the net sum of capital inflows and outflows to the network since its inception. It is used to determine the severity of capital outflows from the network after the market cycle peak.

Following FTX’s fallout, BTC’s realized capitalization fell to May 2021 levels, bringing “the exuberance experienced during the H2 2022 rally to ATH” nearing the point of full retracement. This, according to Glassnode, suggested “an almost complete detox of this excess liquidity.”

Source: Glassnode

Glassnode noted that

“The realized loss experienced by Bitcoin investors over the past 6 months has been historic in scale. The profitability stress is starting to ease after the event, but has resulted in a complete flush of all excess liquidity attracted over the past 18 months. This suggests that a complete deportation of (the) speculative prize in 2021 has now taken place.”

Blockspace demand sees growth

Historically, prolonged bear markets have been marked by a slowdown in network activity, culminating in small fee income for miners on the BTC network.

As the bear market continued, the continued decline in BTC’s price would usually entice new demand for block space. As sellers were displaced by buyers, demand for block space would also grow, thus increasing miners’ fee income.

As BTC recovered from its two-year low, Glassnode found that BTC’s “monthly mining revenue fees are starting to pick up.” However, it added a caveat

“The most interesting thing is whether this upswing is fleeting or whether it can be sustained, meaning a potential regime change is underway.

Source: Glassnode

As the market attempts to recover from FTX’s collapse, Glassnode found that smaller transactions (up to $100k) have dominated the market while the dominance of larger institutional-sized transfers has declined.

A look at BTC’s Total Transfer Volume calculation confirmed this. While the number of transactions is growing, the transfer volume is decreasing, and according to Glassnode, that is “probably a reflection of more small transfers.”

Source: Glassnode