Bitcoin, FTX and the impact of the stock market collapse on conviction of BTC HODLs

- Bitcoin’s price was severely affected by the failure of FTX.

- On-chain calculations suggested a shift in HODLer’s behavior.

The sudden collapse of Sam Bankman-Fried’s crypto-empire saw the overall cryptocurrency experience significant losses. The effects of the events between November 6 and 14, 2022 can be compared to the collapse of Mt Gox in 2012.

Read Bitcoins [BTC] Price prediction 2022-2023

For the first time in two years, leading coin Bitcoins [BTC] the price fell below the $17,500 price tag. Per data from CoinGeckoThe sweeping impact of the FTX collapse caused the global cryptocurrency market cap to fall below $900 billion for the first time since January 2021.

While BTC HODLers have been resilient despite the market downturn, FTX’s collapse tested their faith. This was because many long-term owners sought security for their investments in the last week.

On-chain analytics company Glassnode, in a new report, considered a few metrics to assess whether “there has been a noticeable loss of conviction” among BTC holders as the FTX debacle unfolded.

Let’s take a closer look at some of these calculations.

To call it in or not?

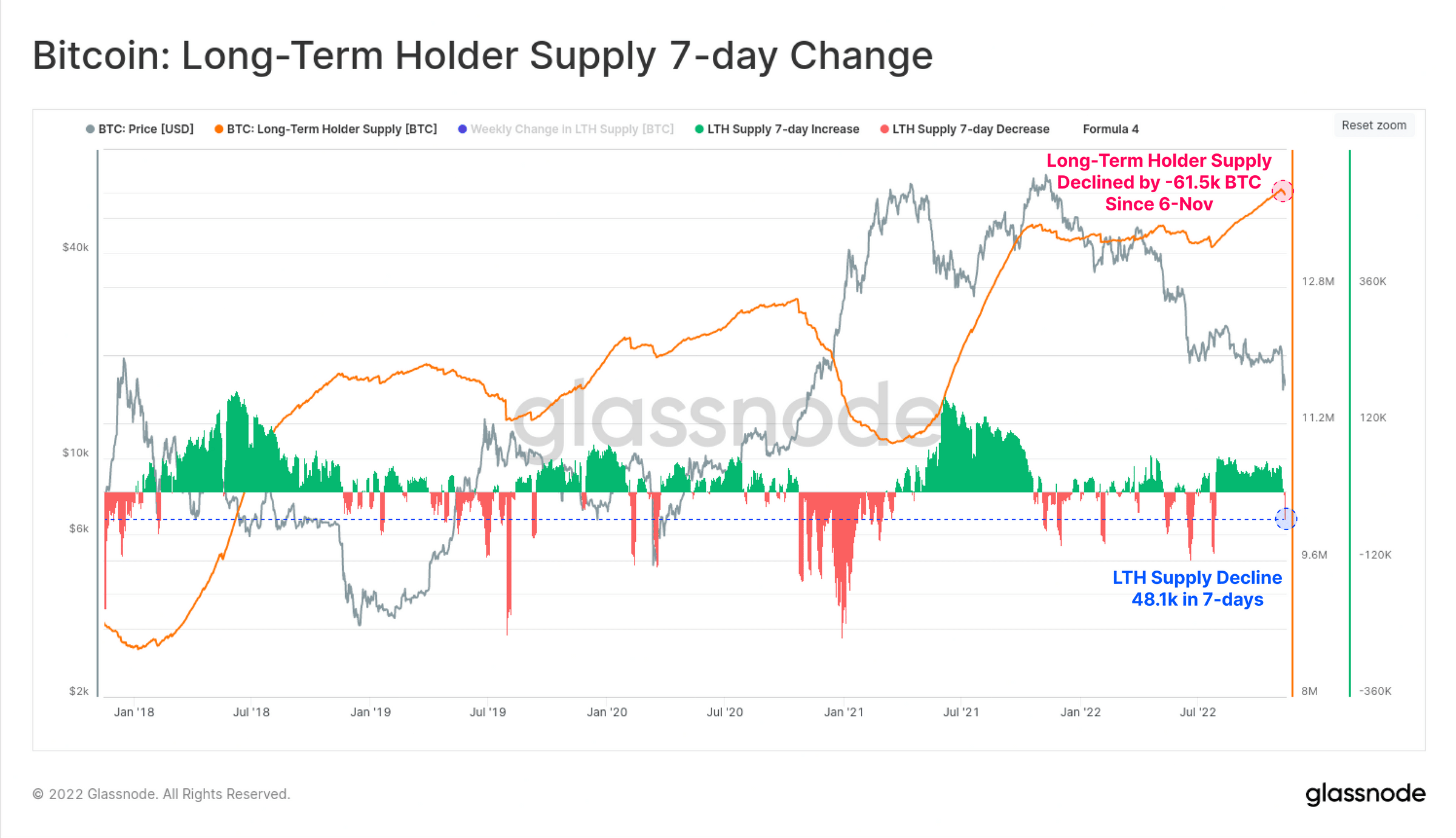

Glassnode assessed BTC’s long-term holder supply metric and found that the category of BTC least likely to be used declined since November 6. Glassnode found that in the last seven days around 48,100 BTC were spent. While this was a notable decline, Glassnode believed it was not enough “to infer widespread loss of conviction.” However, it added a caveat that a continued decline in the calculation “could suggest otherwise.”

Source: Glassnode

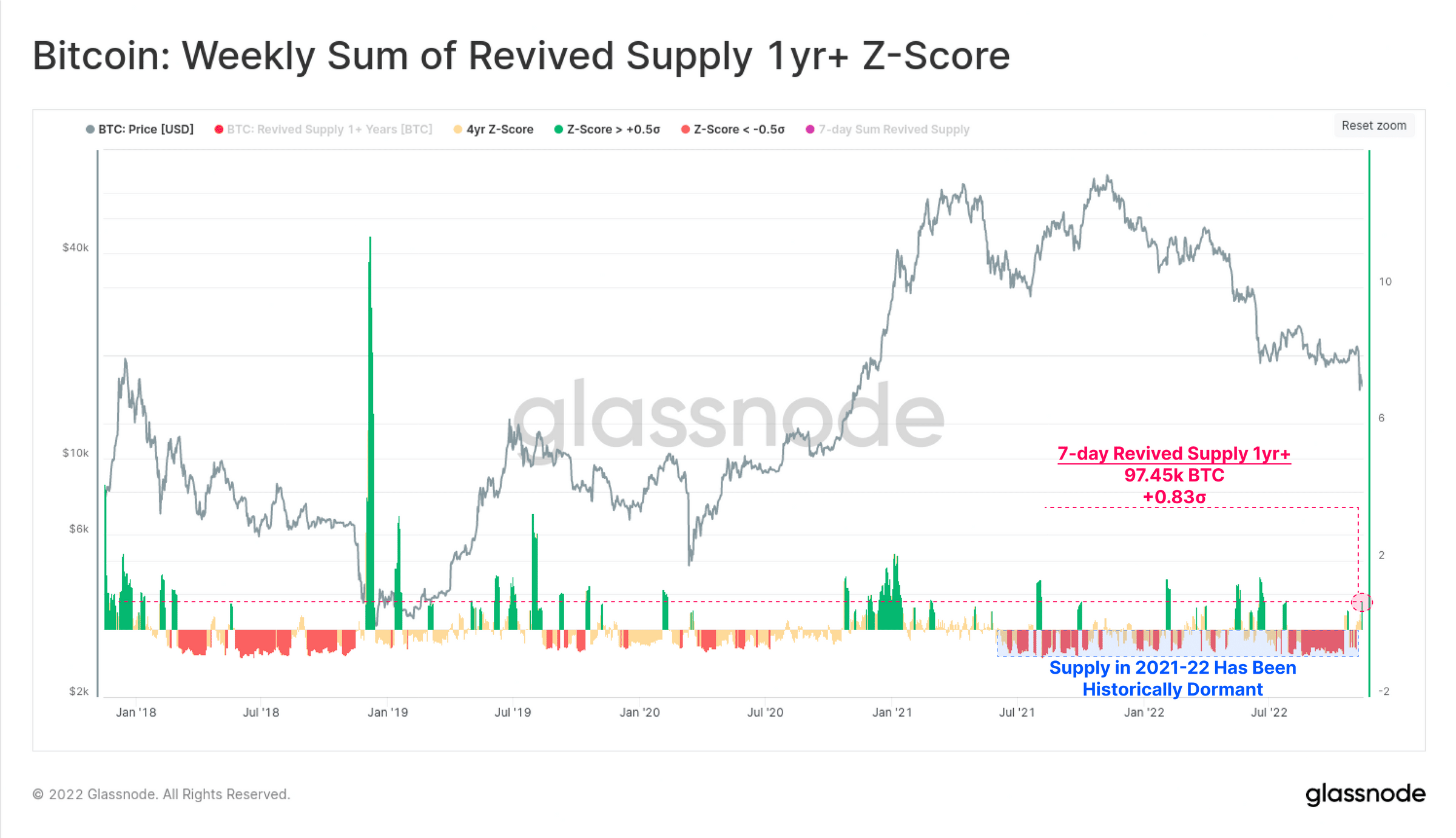

Another metric that showed a decline this past week was BTC’s Revived Supply. Per Glassnode, 97,450 BTC older than a year were spent “and potentially returned to liquid circulation” in the past week.

While this was an unusual move as it represented a +0.83 sigma move on a four-year basis, Glassnode noted that it was “not yet of historical magnitude.” It was, however, to keep an eye on as a consistent increase. This was because an increase in the number of BTC holders using BTC older than one year would mean a loss of conviction.

Source: Glassnode

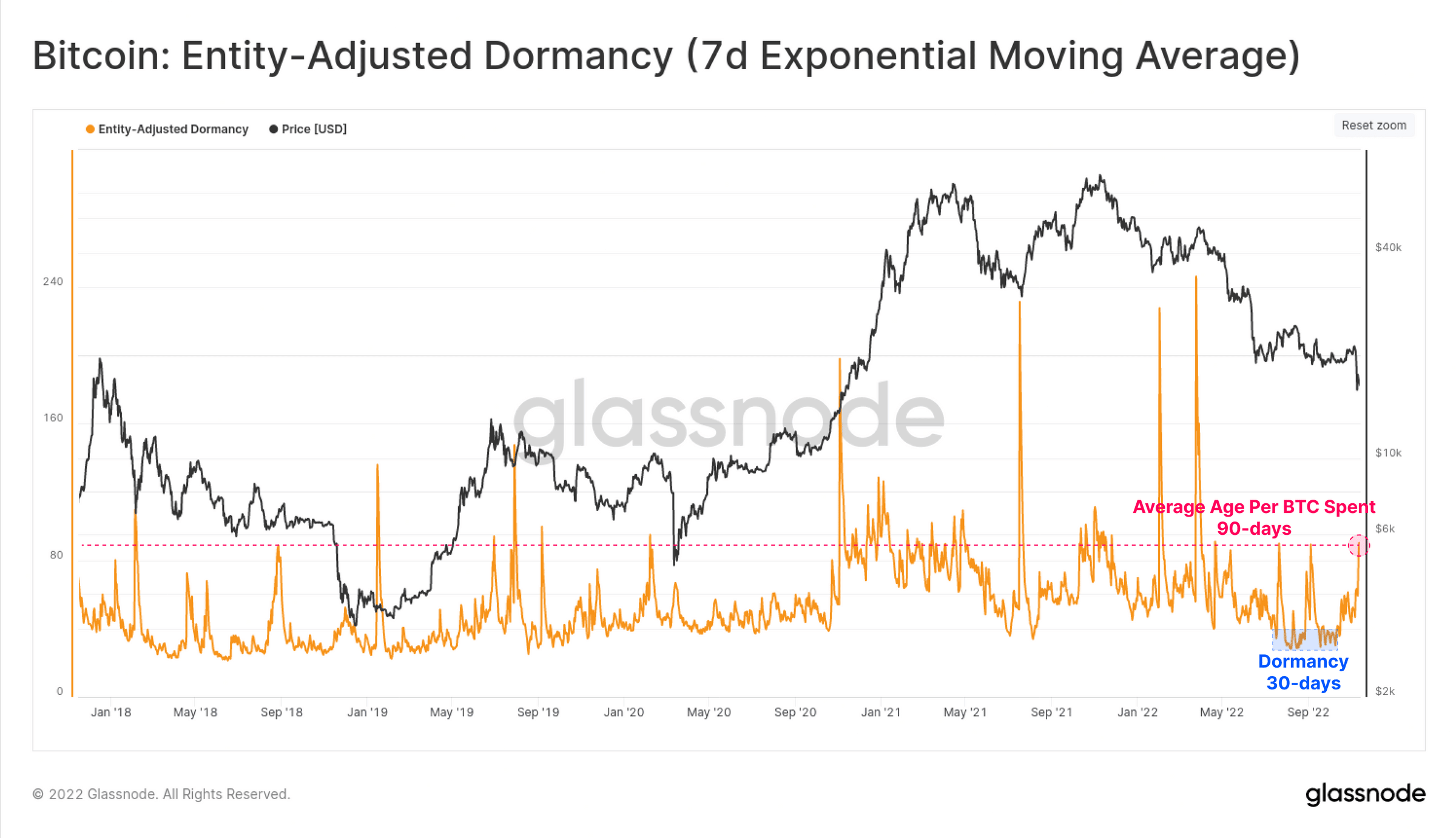

Furthermore, Glassnode found that the average age per used BTC also rose to over 90 days in the last week. According to the report, this index was triple that used during September and October.

According to Glassnode,

“The uptick in older coins being used is notable and is in line with peaks seen during previous capitulation selling and even profit-taking from the 2021 bull market. A sustained uptrend or elevated dormancy level could indicate that a more widespread panic has taken root among the HODLer cohort. “

Source: Glassnode

Finally, Glassnode stated,

“Overall, there has certainly been a degree of immediate panic in the HODLer cohort. But given the scale of the circumstances, this is arguably an expected outcome. What’s probably more interesting is whether these peaks soften over the coming weeks, something suggesting that this shake-out is more of an ‘event’, rather than a ‘trend’.