Bitcoin Falls From Key Levels With Whales On The Move; Ethereum continues to gain ground with Bellatrix fork

The biggest news in the cryptoverse for September 6 includes liquidations crossing $100 million as Bitcoin falls below the $19k support, CryptoVinco accuses Saylor of sending 200K BTC to Coinbase, and Ethereum’s Bellatrix fork goes live.

CryptoSlate Top Stories

Crypto whale purported to be Saylor sent over 200K BTC to exchanges in July; society in doubt

Twitter user CryptoVinco convincingly claimed that Bitcoin maximalist Michael Saylor is the whale behind the movement of over 200,000 BTC to Coinbase back in July. He claimed that Michael Saylor planned to sell all the transferred tokens.

One of the biggest #Bitcoin whales with over 200K+ $BTC sent ALL their coins to exchanges.

I’m 99% sure this is Michael Saylor’s Bitcoin address and they plan to sell everything.

When he sells soon, expect a carnage the likes of which we’ve never seen before. pic.twitter.com/vx643TPAyg

— CryptoVinco (@CryptoVinco) 5 September 2022

Despite this, the crypto community did not fully buy his claims on the grounds that the said wallet address contains more BTC than Saylor’s MicroStrategy.

Bitcoin loses $19k as $100M is liquidated in less than 4 hours

The sharp drop in BTC price below $19,000 on September 6 saw over $100 million in Bitcoin liquidation within four hours, according to Coinglass data.

The ripple effect on the market was that around 100,000 traders reportedly lost over $407 million in total daily liquidations.

Circle CEO says Binance decision to stop USDC support is good as it increases utility

Circe CEO Jeremy Allaire emphasized supporting Binance’s move to convert users’ USDC holdings to BUSD. He said the decision was consistent with the converged dollar ledger model available in leading exchanges such as FTX and Coinbase.

Wintermute’s Gaevoy added that using a converged will make the market more liquid and easier for users to deposit and withdraw USDC from the platform.

Bellatrix upgrade goes live, sets stage for Ethereum’s merger

Bellatrix, the first step towards the merger was successfully activated today. The upgrade was triggered on the consensus layer by 73% of Ethereum nodes.

With the successful completion of the Bellatrix upgrade, the community is preparing for the Paris upgrade, which will mark the end of proof-of-work mining on Ethereum and usher in the merger.

Ethereum presses year to date high vs Bitcoin after Bellatrix hard fork ahead of The Merge

News of the successful completion of the Bellatrix upgrade helped Ethereum gain up to 6% as its price reached $1,680.

Since the beginning of September, Ethereum is up 15.6% when snapped against Bitcoin. Looking at the ETH-BTC charts, it revealed that Ethereum traded at a high of 0.84 BTC since falling to 0.49 BTC in June.

Charles Hoskinson Calls Ethereum Classic ‘Dead Project Without Purpose’

Cardano co-founder Charles Hoskinson was accused of trying to milk Ethereum Classic after he proposed a 20% mining tax.

In response to the claim, Hoskinson said Ethereum Classic is “a dead project with no purpose.” However, he advised users keen on using proof-of-work networks to turn to the Ergo blockchain, which most Ethereum miners said they would adopt after the merger.

Sports NFT market to double to $2.6 billion by 2022

A Market Decipher report shows that the gradual shift from physical to digital collectibles has helped see the Sports NFT market double from $1.3 billion to $2.6 billion by 2022.

Annual growth projections in the study show that the Sports NFT market is likely to reach $41.6 billion by 2032.

Research highlight

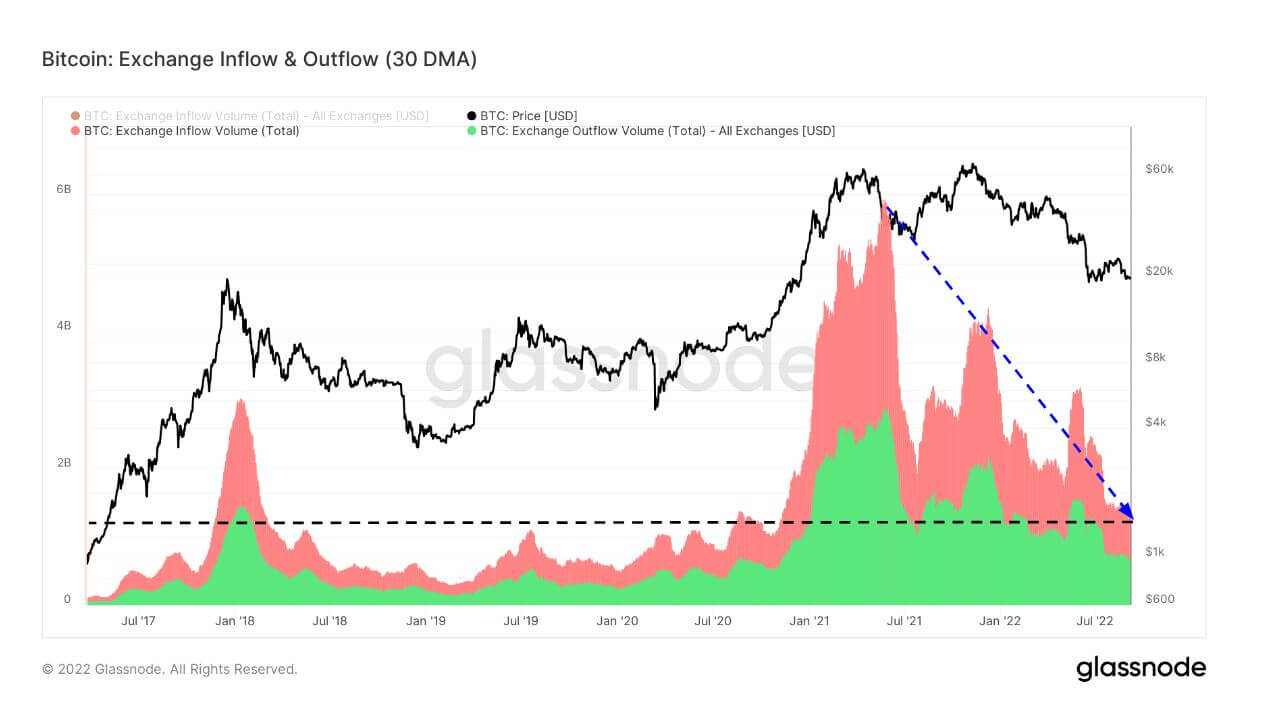

Bitcoin exchange inflows drop to multi-year lows

Bitcoin’s exchange flow metrics analyzed by CryptoSlate reveal that there is a general decrease in both inflows and outflows, although inflows are increasing higher, indicating more investors are withdrawing money.

CryptoSlate also assessed the exchange heatmaps, which track total transfer volumes deposited and withdrawn from exchanges.

The exchange inflow heat map shows high inflow volume during the peak market in December 2020, March 2021 and November 2021. Similarly, exchange exits peaked during the same period.

The analysis reveals that during peaks in the bull market, short-term owners bought Bitcoin while long-term owners cashed out.

News from the entire Cryptoverse

Singapore’s largest bank DBS offering crypto services to 300,000 investors

DBS CEO Piyush Gupta said the leading bank is working to expand its cryptocurrency services to over 300,000 investors across Asia, according to Financial Times.

Only accredited institutional investors will be able to access the crypto offering as Singapore’s current regulatory measures restrict retail investors.

Crypto market

Bitcoin was down -04.49% on the day, trading at $18,891, while Ethereum traded at $1,573, reflecting a -1.8% decline