Bitcoin Falls as Hot Job Numbers Fuel Hawkish Fed Policy

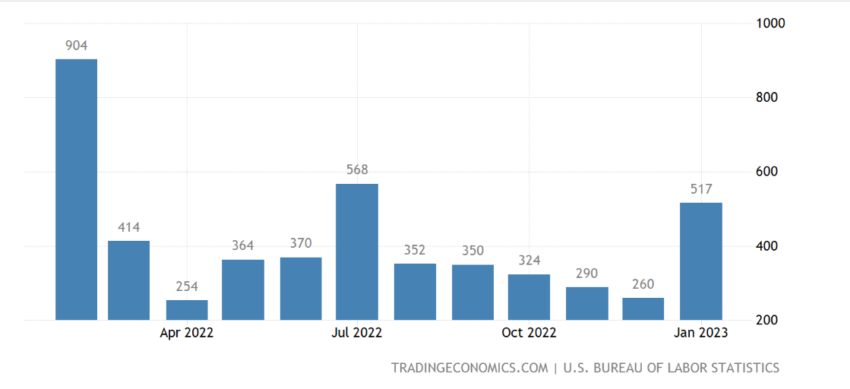

US ADP Nonfarm Employment Change for February beat expectations, coming in above estimates of 200,000 at 242,000, indicating that wage growth is likely to contribute to continued aggressive Fed tightening.

The ADP Nonfarm Employment Change, which analyzes the payrolls of about 400,000 US business clients ahead of the monthly US jobs report, recorded an increase of 242,000 new jobs in February 2023.

The Federal Reserve will consider the ADP Jobs Report at its next meeting

The report is jointly released monthly by the ADP Research Institute and the Stanford Digital Economy Lab two days before the Labor Department releases job numbers for the previous month.

According to Investopedia, higher unemployment forces employers to pay higher wages to attract workers. Companies pass on these rising input costs to the consumers of their goods and services.

In a House Financial Services Committee hearing today, Federal Reserve (Fed) Chairman Jerome Powell said the Open Markets Committee would consider the ADP report, the jobs report due on February 10, 2023, and the US consumer price index, and personal consumption figures when you determines the next interest rate increase.

Following the ADP news, Bitcoin was largely flat, falling briefly to $21,990.68 from $22,016 before rising to $22,217 at press time. ETH fell slightly to $1,550 before rising to $1,558 at press time.

Cryptocurrencies likely absorbed most of the shock after Powell’s speech yesterday, in which he indicated that a strong labor market could mean the central bank could continue to increase the pace of rate hikes. He added that the terminal rate, the rate at which US inflation falls to 2%, could be higher than the bank’s original estimate.

In January, jobs increased by 517,000, higher than the Dow Jones estimate of 187,000.

The unemployment rate came in at a decade low of 3.4%, beating forecasts of 3.6%.

Fed’s Powell challenged on unemployment statement

Members of both the Senate and Housing Congressional Committees before which Powell has appeared over the past two days severely criticized the Federal Reserve’s correlation of inflation with increased unemployment and its claim that lower levels of unemployment would correlate with lower inflation.

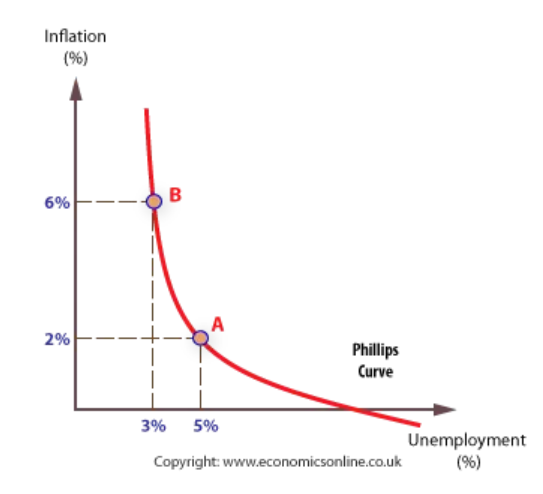

Before the pandemic, monetary policymakers such as the Federal Reserve used the Phillips curve, developed by New Zealand economist William Phillips, to find the optimal unemployment rate for a given inflation target. According to the graph, the Fed’s 2% inflation target equates to 5% unemployment.

Yesterday, Senator Elizabeth Warren of the US Senate Banking, Housing and Urban Affairs Committee chastised Powell for suggesting the effects of unemployment on US households.

“Chairman Powell, if you could speak directly to the two million hard-working people who have decent jobs today and whom you plan to fire over the next year, what would you say to them? How would you explain your view that they need to lose their jobs?” Warren challenged Powell.

Powell rejected the comment, claiming that more than two million are affected by ongoing inflation.

Today, House Financial Services Committee Chairman Patrick McHenry, who created a subcommittee on digital assets in January of this year, advised Powell to resist Democrats prioritizing their agenda over the prosperity of Americans.

“And now when we look at the Fed, President Biden’s lurch to the far left is what got us into this inflationary mess. I urge you to reject the ideologues who put their social agenda ahead of economic prosperity, McHenry said.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.