Bitcoin falls 1.4% after US payroll data, FTX Japan works to offer liquidity

The biggest news in the cryptoverse for December 2nd includes Bitcoin’s negative 1.4% reaction to US payroll data, FTX Japan’s attempt to bring liquidity back, and Binance’s $3 million freeze as a precaution after the Ankr protocol was exploited.

CryptoSlate Top Stories

Bitcoin falls 1.4% on better-than-expected US wages data

The US Bureau of Labor Statistics latest payroll data revealed that 263,000 jobs were added during the month of November. Bitcoin (BTC) reacted to this news by falling 1.4% to trade at $16,780.

FTX Japan will release withdrawals of client funds

FTX’s Japanese subsidiary has been working on a financial plan to allow users to withdraw money.

On December 2, the subsidiary announced that the related authorities approved the plans and that users will soon be able to withdraw.

Binance freezes $3 million from Ankr exploitation.

An attacker exploited a flaw in the Ankr protocol (ANKR) code and minted six quadrillion of aBNBc tokens. The exploiter converted a portion into a 5 million dollar coin (USDC).

Possible hacks on Ankr and Hay. Initial analysis is that the developer’s private key was hacked, and the hacker updated the smart contract to a more malicious one. Binance stopped withdrawals a few hours ago. Also froze about $3 million that hackers move to our CEX.

— CZ

Binance (@cz_binance) 2 December 2022

Binance CEO Changpeng Zhao said the exchange froze about $3 million of its funds in response to the exploit.

Over 8% of the Bitcoin supply was purchased between $15.5K and $17K

According to the UTXO Realized Price Distribution (URDP) calculation, 8% of the total Bitcoin supply was purchased when the price was between $15,000 and $17,000.

While the 8% volume signals that further redistribution is likely, Bitcoin consolidation remains high, suggesting that long-term owners are in control.

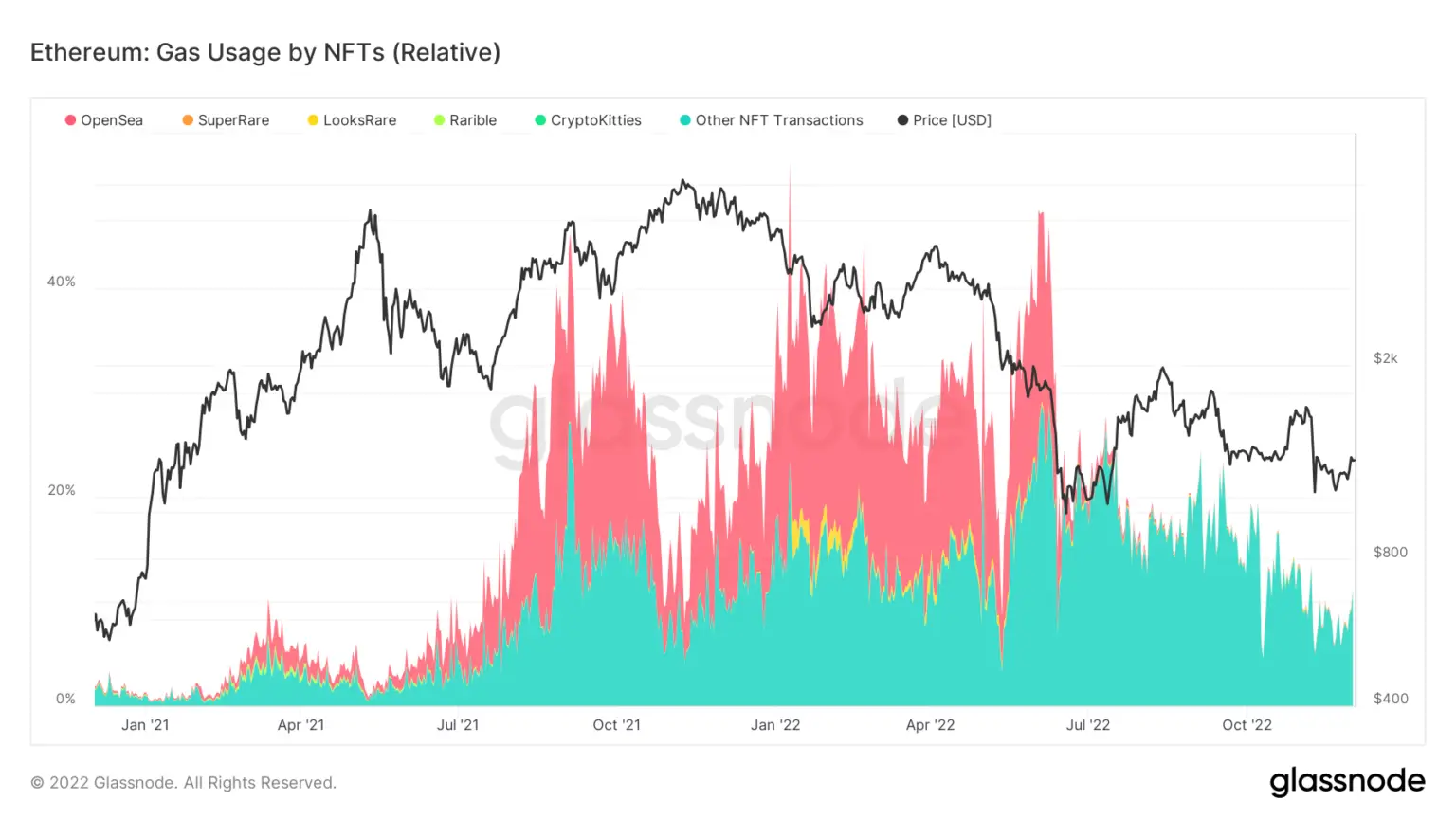

OpenSea’s Ethereum gas usage has dropped to almost zero

NFT marketplace OpenSea’s Ethereum (ETH) gas usage has declined over the past five months.

According to the data from Dune Analytics, gas fees in the ERCC721 and ERC1155 token standards that took place in major NFT marketplaces increased between October 2021 and January 2022, and OpenSea accounted for around 20% of this volume.

Over the past five months, however, OpenSea’s percentage has shrunk, allowing Optimism and Arbitrum to grow.

Galaxy Digital wins bid for GK8 in Celsius bankruptcy auction

Galaxy Digital announced the purchase of GK8 without disclosing the amount. GK8 is a self-storage program and was acquired by Celsius in November 2021, which went bankrupt after the Terra collapse.

Galaxy’s CEO said the acquisition of the self-storage platform is a “crucial cornerstone” in the creation of a full-service financial platform.

US lawmakers are questioning the role of private firms in the development of a CBDC

In response to allegations that private firms are involved in the design of the “hypothetical” US central bank digital currency (CBDC), US lawmakers wrote a joint letter to send to the Federal Reserve Bank of Boston.

The lawmakers argued that some private firms involved in the CBDC project could help exploit the project as research and develop and scale other CBDC products to sell to commercial banks in the future.

CBDCs: India’s digital rupee falls flat as low-volume back-end trials run

Despite their negative attitude towards the crypto market, Indian lawmakers have always found CBDCs useful.

India’s digital Rupee has been running as a pilot program since early November. It eventually went live on December 1, but the news media reported that it failed to catch on.

Research highlight

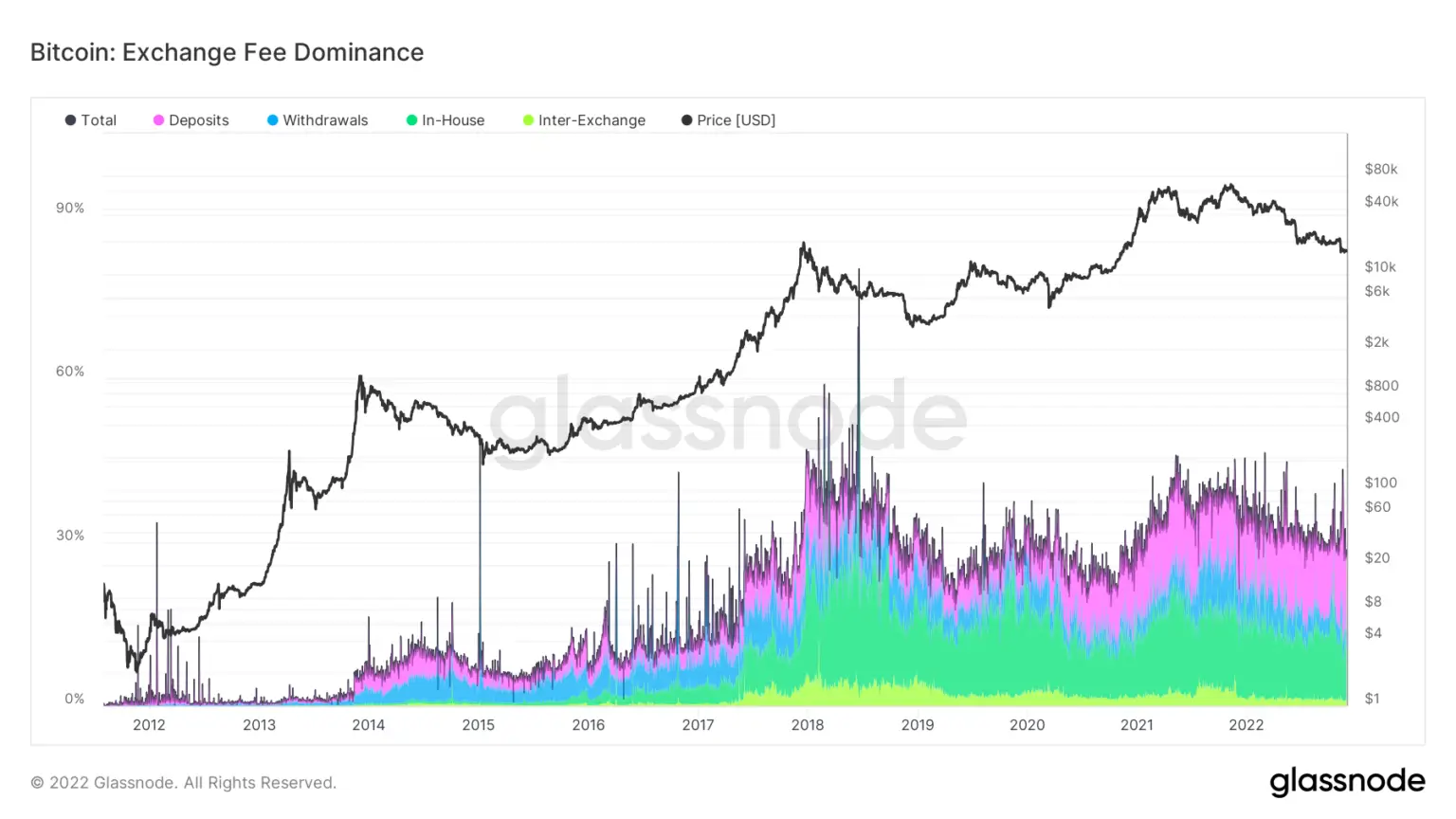

Research: Analysis of Crypto Transaction Fees Suggests Exchanges Prefer to Move to Bitcoin.

CryptoSlate analysts looked at the on-chain data about the crypto exchange’s internal transactions to reveal that they prefer to use Bitcoin to transfer funds internally.

The exchange fee dominance metric is a percentage of total transaction fees paid for on-chain exchange activity. The type of transaction that costs a fee is divided into deposits, withdrawals, internal and interexchange.

The chart above shows Bitcoin transaction fees comprised 36% of all sources of exchange revenue related to Bitcoin. It also shows that deposits and internal transfers have grown exponentially over the past five years.

Exclusive to CryptoSlate

Mythbusting Solana – Downtime, Competition and Technology with Matt Sorg of the Solana Foundation – SlateCast #38

Solana Labs’ Head of Product and Technology, Matt Sorg, gave an exclusive interview to CryptoSlate talking about Solana (SOL) and its future in the cryptosphere.

Sorg said he was drawn to Solana because it was a “differentiated technology” in terms of scalability, speed and future potential. He said:

“Solana is differentiated technology, there’s a lot of noise in the room about how things will scale in the future, but Solana is ready today and has a very clear path to scale very arbitrarily in the future in a very user-friendly way.”

Sorg also mentioned that he expected the crypto space to evolve into a multi-chain future where “different chains and different protocols will take some learning from other protocols.” He argued that Solana would be more configurable over time to fit into this multi-chain environment.

News from the entire Cryptoverse

Alameda invested in Genesis before its collapse.

In accordance BloombergAlameda Research invested $1.15 billion in total in Genesis Digital before the market imploded and the mining industry began to suffer.

Galaxy CEO expects Bitcoin to see $500,000

According to a Bloomberg article published on December 1, Galaxy Digital CEO Michael Novogratz expects Bitcoin to rise to $500,000 based on Federal Reserve interest rate hikes.

The House Committee on Financial Services thanks SBF for being honest

Chair of the US House Committee on Financial Services, Maxine Waters Tweeted to thank FTX founder Sam Bankman-Fried for being honest about the FTX fallout and invited him to join their hearing on December 13.

Binance Labs invests $4.5 million in Ambit Finance

Binance Labs announced that it committed to invest up to $4.5 million in Ambit Finance to boost trustless DeFi development on the BNB Chain.

Crypto market

In the last 24 hours, Bitcoin (BTC) gained +0.33% to trade at $17,001, while Ethereum (ETH) gained +1.11% to trade at $1,288.