Bitcoin: Fall of Silicon Valley Bank Could Be a Silver Line for BTC, Here’s Why

- USDC has seen increased swaps as more Bitcoin leaves exchanges.

- BTC volume hits near three-month high as transactions increase.

Fear, uncertainty and doubt (FUD) about Bitcoin stemming from the collapse of a single bank contributed to the downward trend earlier this week.

Yet the failure of yet another bank may have turned public opinion and brought back support for the royal coin. However, Bitcoin may have been affected differently by the Silicon Valley bank run that triggered a fall in USDC.

Read Bitcoin (BTC) Price Prediction 2023-24

The Silicon Valley Bank Race

The California Financial Institutions Control Board shut down Silicon Valley Bank, a major venture capital-backed startup bank. It was the first bank insured by the FDIC to fail in 2023.

The California regulator has designated the FDIC as a receiver to secure insured savings, although the reason for the shutdown is unknown. SVB, one of the 20 largest banks in the US measured by assets, financed several startups with a focus on cryptocurrency.

People’s reactions to the SVB failure indicate that uncertainty is the prevailing mood today. The process of extracting assets for clients with $250,000 or more has sparked discussions based on a thread by Mark Cuban (an American businessman) and the following comments.

In addition, Circle announced in a statement that over $3 billion of the $40 billion was held by SVB. Another negative reaction has been the flight of USDC holders who have exchanged their holdings for other stablecoins and Bitcoin.

Bitcoin Sharks and Whales Increase Accumulation

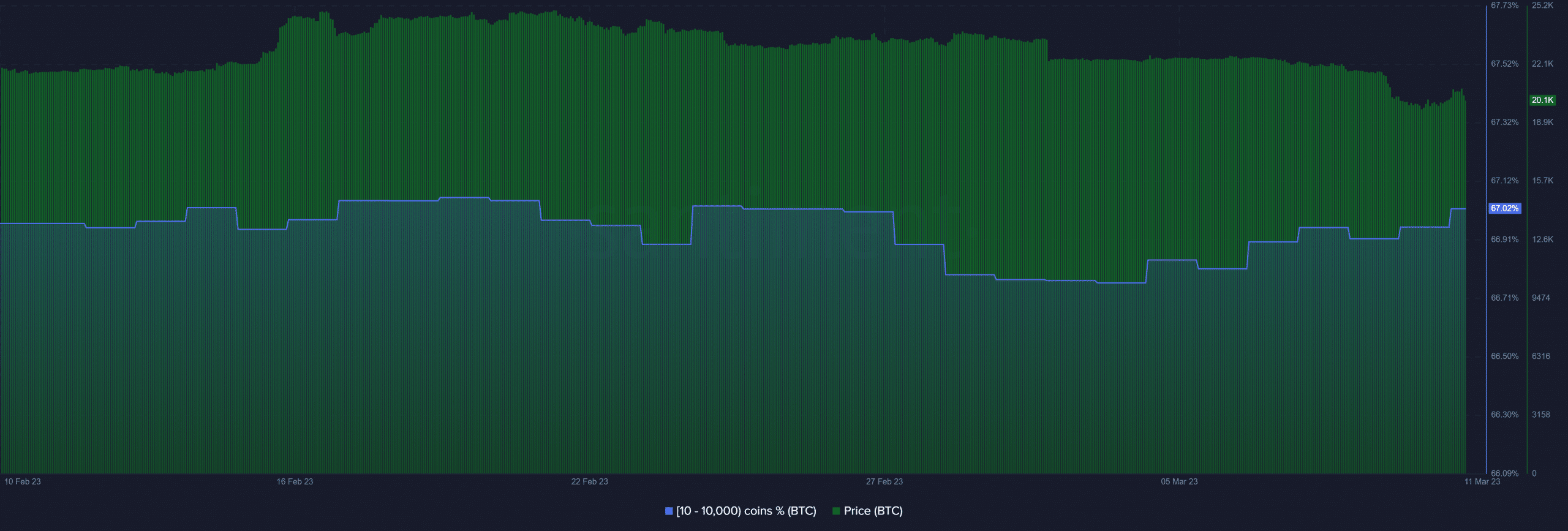

In accordance Sentiment statistics, the accumulation of whales and sharks continued despite the FUD caused by the Silvergate crash.

At the time of writing, addresses with 10-10,000 BTC had risen to over 67%. Looking at the data, it is clear that on March 11th there was a surge in whale and shark accumulation, coinciding with the time when the USDC experienced a capital flight.

Source: Sentiment

BTC volume goes up a notch

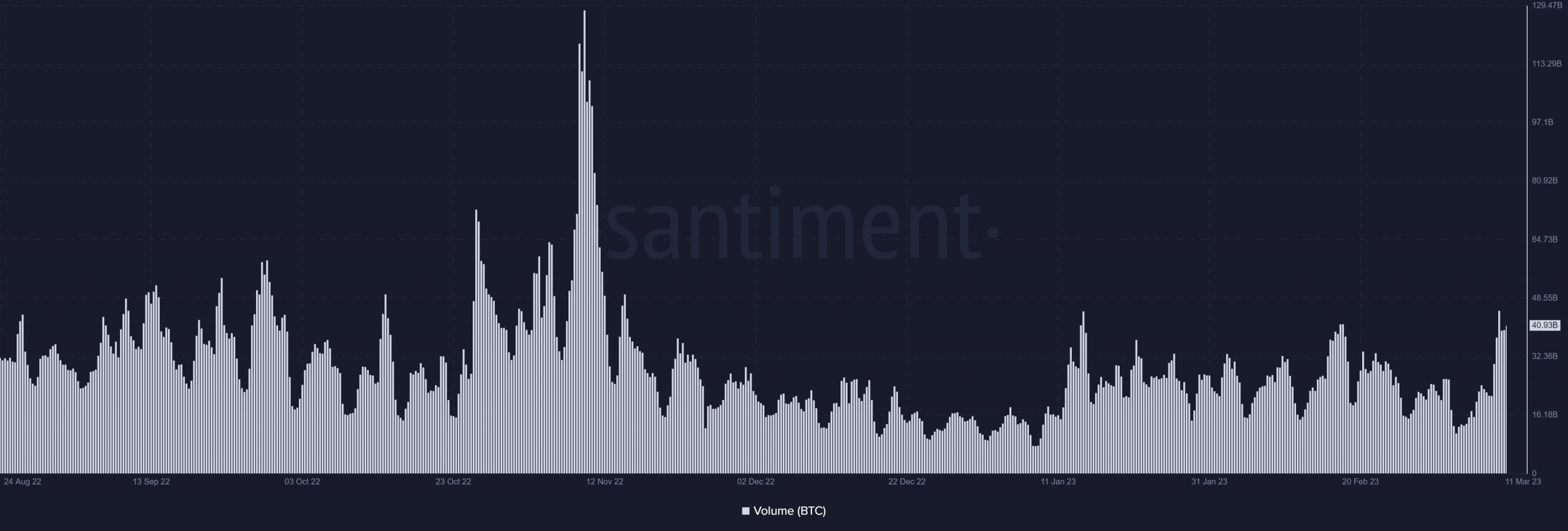

In addition, the volume measurement at Santiment revealed some exciting acts. By 09:00 UTC on March 11, BTC volume had already reached 45 billion, and by 17:00 UTC it had reached 35 billion.

This volume is notable because it is the highest Bitcoin has seen since December. There is little doubt that this is a sign of an increase in business activity. It was more than 39 billion when this was written.

Source: Sentiment

Bitcoin Outflow becomes dominant

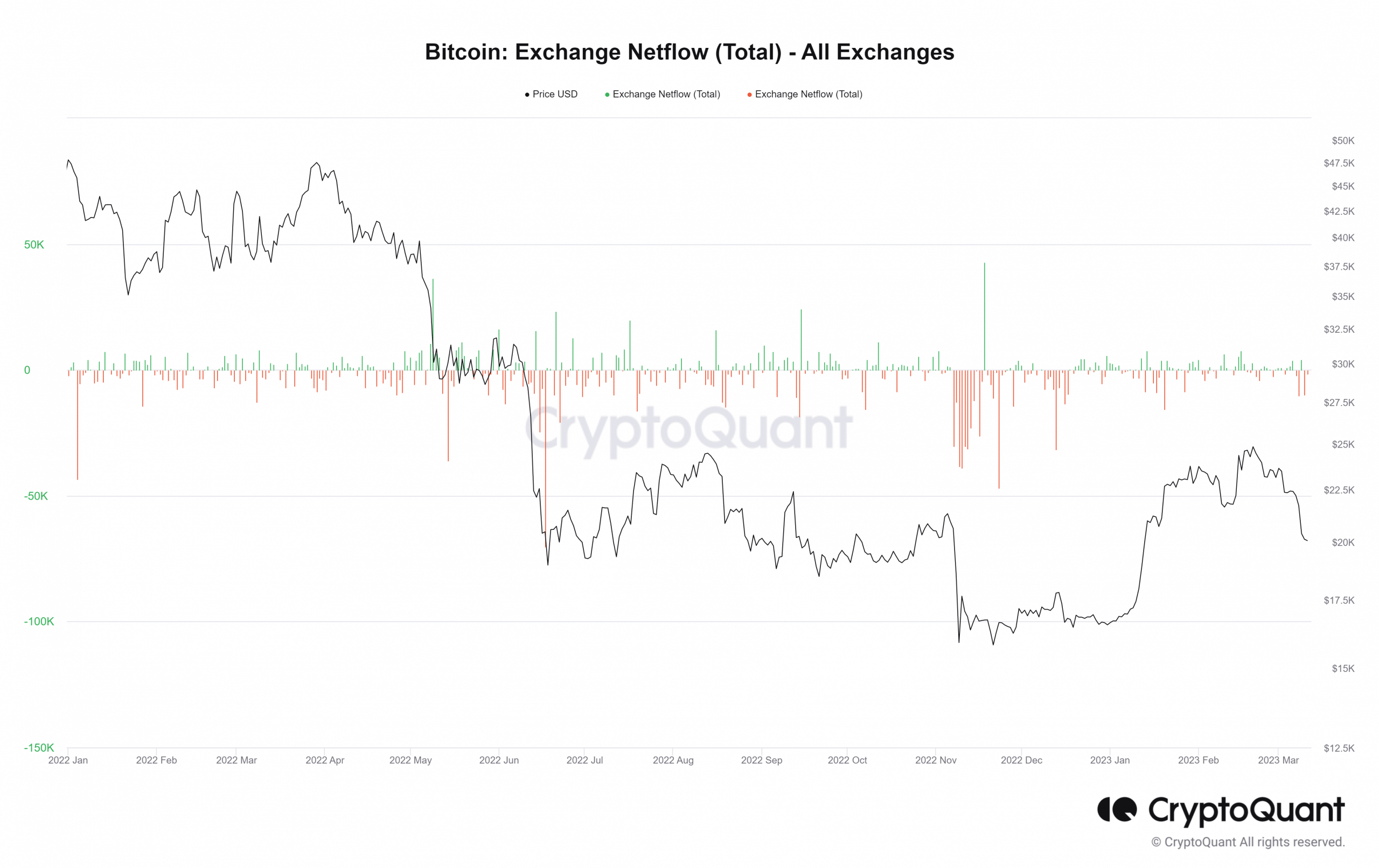

Although the number of trades has increased, most tokens have left exchanges. More and more Bitcoin (BTC) holders are moving their coins from exchanges due to the continued exchange with USDC.

CryptoQuant’s Netflow measure shows that on March 10, more BTC left the system than entered; this trend persisted at the time of writing.

Source: CryptoQuant

A tale of two prizes

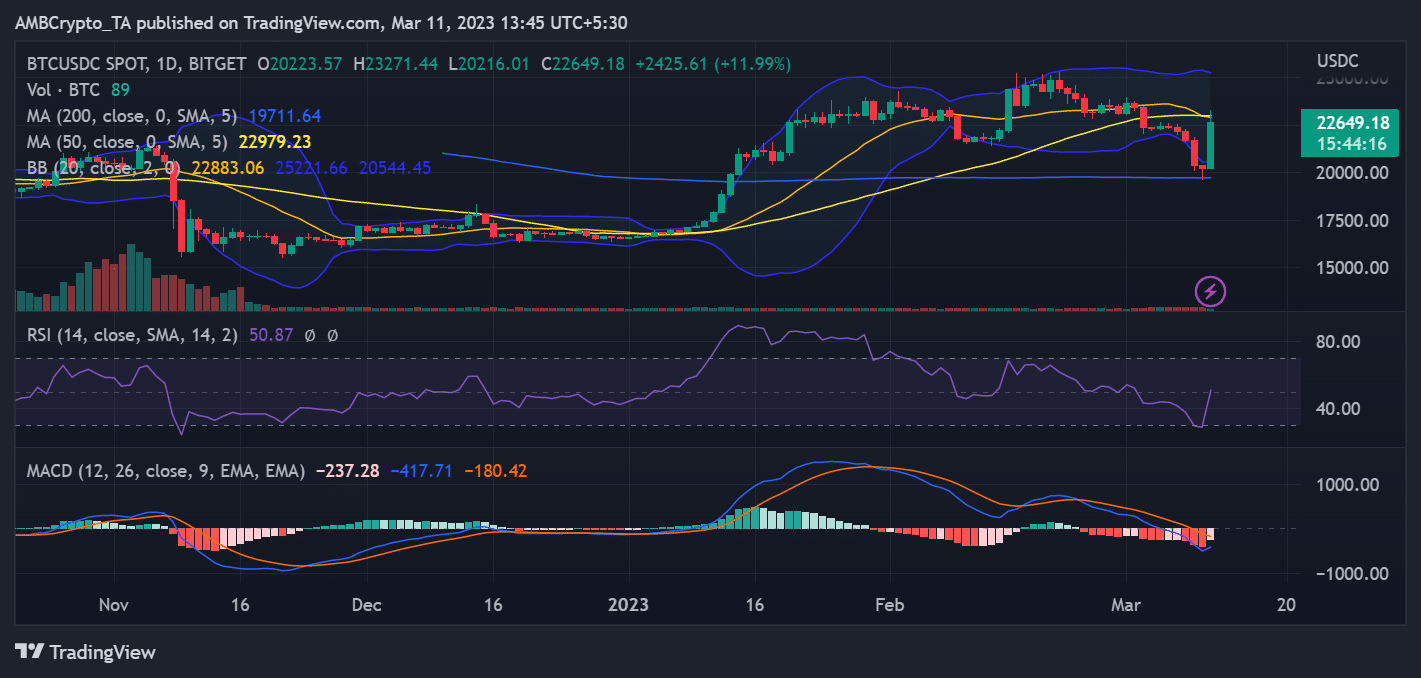

Looking at the spot price of BTC/USDC at the time of writing, we can see that BTC has increased in value by more than 11% on a daily time frame. At the time of writing, one Bitcoin was worth approximately $22,600 at the current USDC exchange rate.

Source: TradingView

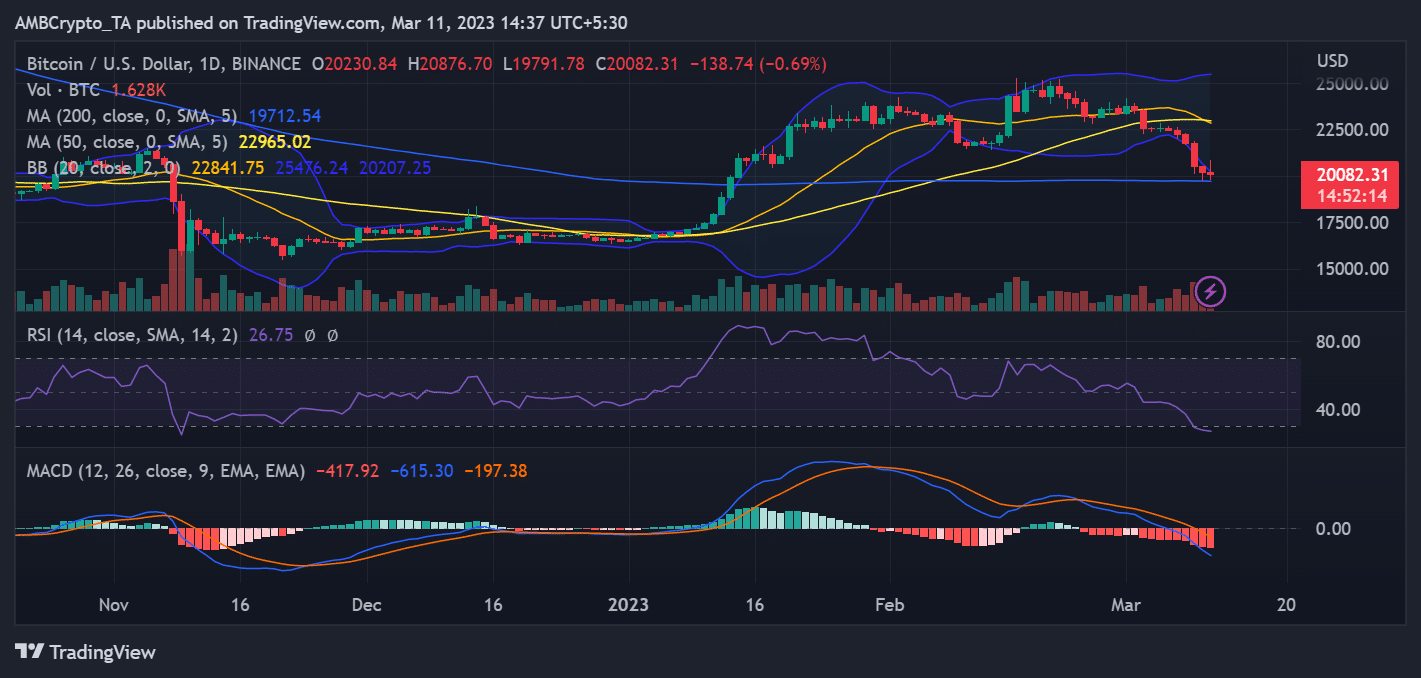

Still, on a daily time frame, the BTC/USD spot price showed that it had lost almost 1% of its value, trading at around $19,900 and $20,000.

Source: TradingView

Is your portfolio green? Check out the Bitcoin Profit Calculator

A possible indicator of the degree of interdependence between conventional finance and cryptocurrency is the public reaction to the SVB failure, which was focused on Bitcoin and stablecoins.

Still, Bitcoin showed that despite its volatility, it can be a viable alternative store of wealth.