Bitcoin, Ethereum, XRP On-Chain Analysis: Top Cryptos Still at Risk

The crypto market is showing strong signs of further decline. Bitcoin price is battling the lower $19,000 barrier, while Ethereum fell below the $1,300 mark. XRP, despite bullish news from the Ripple vs SEC battle, has not been able to sustain prices above $0.50.

In a sign of another downward trend across the crypto market, top coins such as Bitcoin, Ethereum and XRP are losing ground. BTC, ETH and XRP falling below their short-term support levels could trigger another round of selling.

Will the Bitcoin price go lower?

The $19,100 mark has served as a solid support level for the Bitcoin price for most of the past two months. At press time, the BTC price was sitting at $19,053, recording only a 0.59% daily loss and a 3.5% weekly loss.

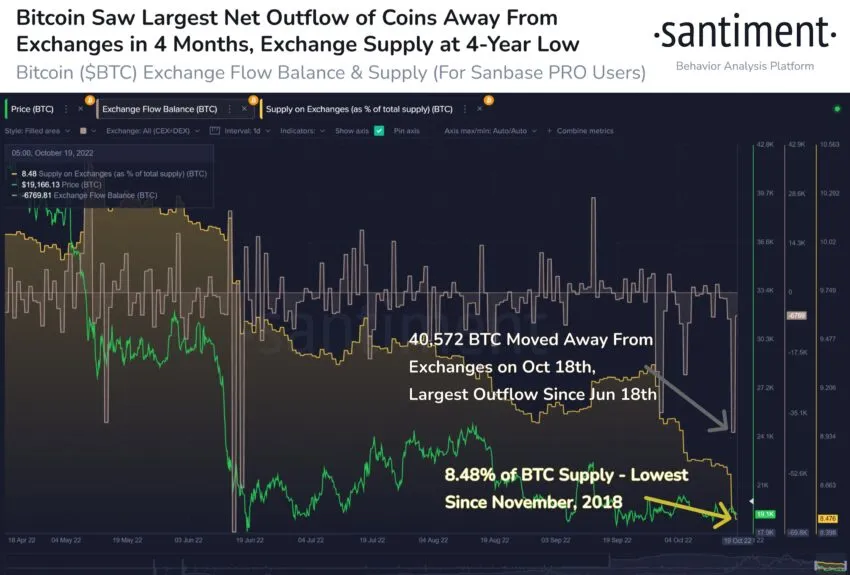

Bitcoin recently saw a massive wave of coins moving off exchanges and recorded the largest daily amount (40,572 BTC) in four months. With the supply of coins on exchanges down to 8.48%, the same chances of future sales decreased.

Bitcoin price falling below the $19,000 mark could cause a cascading effect as there is a significant supply barrier around this level. However, a CryptoQuant analyst believes that there is currently no indication of a 2018-like dump event.

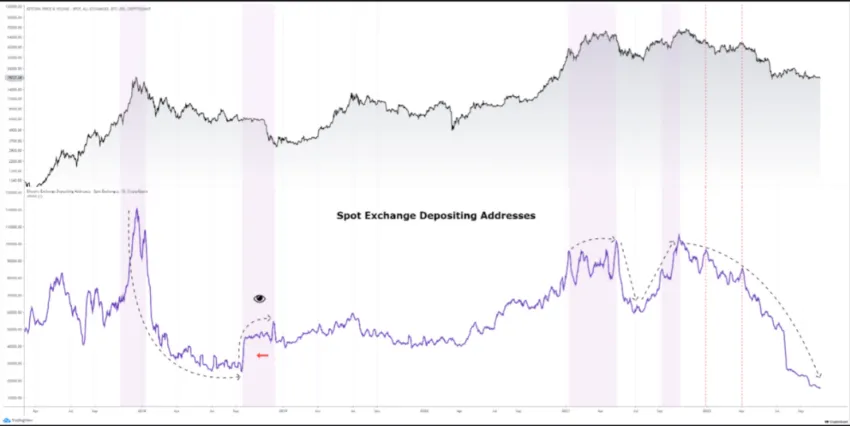

Especially at the end of Q3/2018, when the BTC price started to decrease in volatility and move sideways, there was a sudden increase in the number of addresses sent to spot exchanges. On the contrary, this cycle has seen coins move away from exchanges despite a larger bearish sentiment.

Compared to the current period, except for the peaks on this data system that have shown sharp price drops, the number of addresses that deposited BTC to spot exchanges is at the lowest level in many years.

The Ethereum exchange rate is unstable

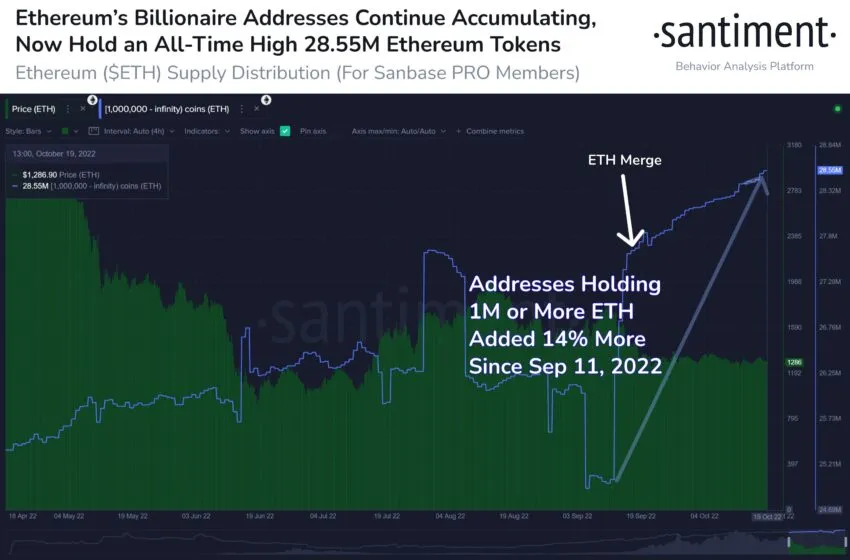

Ethereum price fell below the crucial $1,300 mark, recording a 0.50% drop in the last 24 hours. However, the ETH whales continued to accumulate according to Santiment data. In particular, since September 11th, Ethereum billionaire whale addresses with 1 million or more ETH have collectively added 3.5 million more coins.

The recent accumulation has increased the Ethereum billionaire’s whale addresses’ cumulative bags by over 14%, with 132 such addresses currently.

However, a worrying trend was that Ethereum’s active addresses fell to a 4-month low as weak hands continued to fall after the merger. This also resulted in a higher degree of disinterest from participants as price measures remain stagnant. October 17 was the first day there were less than 400,000 active addresses on the network since June 26.

The ETH price faced rejection at the psychological $1,300 level on October 20. Although ETH has been trying to stay above the $1,300 level, it was trading at $1,288 at press time. A drop below $1,280 could potentially see the decline accelerate.

The relative strength index on the daily chart appears to be flat and is in the oversold territory. RSI’s moving average double rejects the indicator. Further sell-side pressure could pull the ETH price back to the lower $1,200 zone.

However, in the event of a bearish invalidation, ETH could move to the $1,380 mark if bulls continue to buy over the weekend.

XRP price drops as trial draws to a close

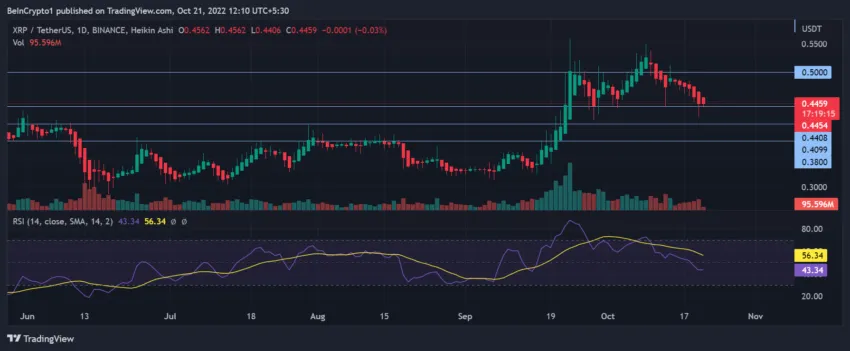

At press time, XRP price was trading at the $0.4468 mark, down 2.63% on the daily and 10.17% on the weekly charts. XRP has been in a prolonged downtrend since October 10, despite Ripple nearing the end of its regulatory battle with the SEC.

On-chain accumulation metrics provided a healthy outlook for XRP as Ripple Whales accumulated close to 300 million XRP over the past few months. However, technical indicators may steer XRP’s short-term price momentum, with retail volumes still trending lower.

The next liquidity levels for XRP, as price action trends lower, could be around $0.40 and potentially $0.38. A break below $0.38 could spell trouble for the coin and extend the bearish price action to the lower $0.32 level.

If the bearish prediction fails and bulls take over the weekend’s price action, XRP could rise to the next resistance mark at $0.48.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.