Bitcoin, Ethereum, Solana Price Analysis

Bitcoin Analysis

Bitcoin’s price closed during a historically important inflection point [$19,891] on Tuesday, and as traders settled on the world’s number one cryptocurrency, BTC’s price was -$496.

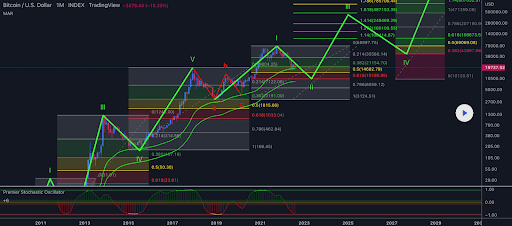

Today’s first chart for analysis is BTC/USD 1M Chart below of andre_007. BTC’s price trades between the 0.5 fibonacci level [$14,682.79] and 0.382 [$21,154.70]at the time of writing.

If BTC does not go back to 0.618 as this chart’s next wave implies. Then oxen hoping to reverse the course at $19,891 and aim again at 0.382. Above the 0.382 fib level, targets for bullish BTC market participants are 0.214 [$35,580.14]and a full trace on this chart of 0 [$68,997.75].

Reverse, BTC bears trying to keep BTC’s price below the 2017 ATH [$19,891] and again proving that the level is no longer a strong support for bullish traders. Below that level, the targets are 0.5 [$14,682.79]0.618 [$10,190.85].

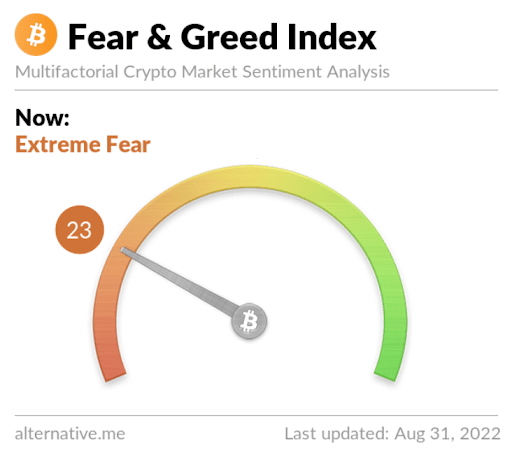

The fear and greed index is 23 Extreme fear and is -4 from Tuesday’s reading of 27 Fear.

Bitcoin’s Moving Average: 5-day [$20,780.3]20 days [$22,552.23]50 days [$21,828.62]100 days [$26,991.02]200 days [$35,602.09]Year to date [$33,106.51].

BTC’s 24-hour price range is $19,574-$20,589, and its 7-day price range is $19,574-$21,753. Bitcoin’s 52-week price range is $17,611-$69,044.

The the price of Bitcoin on this date last year was $47,157.

The average price of BTC for the last 30 days is $22,534.3 and its -16.5% over the same time frame.

Bitcoin’s price [-2.44%] closed its daily candle worth $19,812 on Tuesday and in the red for the fourth time in the last five days.

Ethereum analysis

Ether price couldn’t resist the bigger decline in the macro again on Tuesday and sold off almost 2%. By the end of the day, Ether was -$29.3.

The ETH/USD 4HR Chart below of CryptoAnalytics is the second chart we analyze today. Despite the upcoming consolidation for Ethereum, ETH’s price continues to trade in tandem with bitcoin’s price and the larger macro trend that we have also seen from stocks.

Ether’s price trades between 0.382 [$1,475.81] and 0.236 [$1,667.55]at the time of writing.

The targets above for those still holding on to the merger and ETH’s price in the short term on the 4HR chart are 0.236 and 0 [$2,031.56].

Bearish traders is out to destroy Ethereum’s merge from PoW to PoS next week and has more or less destroyed this market for 6 of the last 9 months. Their target on ETH to the downside is 0.382, 0.5 [$1,337.08]0.618 [$1,211.38]and 0.786 fib level [$1,052.54].

Ether’s Moving Average: 5-day [$1,603.61]20 days [$1,726.58]50 days [$1,481.05]100 days [$1,832.54]200 days [$2,563.15]Year to date [$2,310.50].

ETH’s 24-hour price range is $1,473.61-$1,606.13 and its 7-day price range is $1,433.57-$1,713.59. Ether’s 52-week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $3,429.35.

The average price of ETH for the last 30 days is $1,703.67 and its -11.04% over the same duration.

Ether price [-1.89%] ended its daily session on Tuesday worth $1,523.22 and in the red for four of the last five daily sessions as well.

Solana Analysis

Solana’s price finished just $0.28 above an important inflection level on Tuesday and SOL ended its daily candle -$0.97.

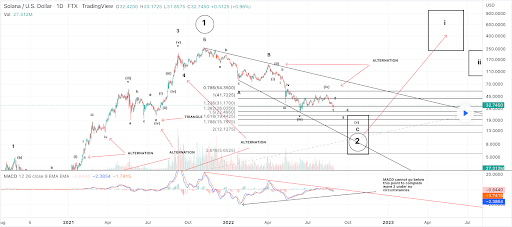

The last chart we look at today is SOL/USD 1D Chart below from maikish. Solana’s price trades between the 1.236 Fibonacci level [$31.17] and the 1 fib level [$41.72]at the time of writing.

If bullish Solana traders can SOL’s price from 1,236, they can start targeting their primary target of 1 [$41.72]. The secondary measure for Solana bulls is 0.786 [$54.35] which was the last high during the peak of the crypto market’s recent relief rally.

Bearish Solana traders has been in control of this market for most of 2022 and has really sent SOL’s price lower in 7 of the last 9 months. To continue the damage, the short SOLs must first push the price below 1.236. Below that level, the targets are 1,382 [$26.02]1.5 [$22.49]1,618 [$19.44]1,786 [$15.79]and 2 [$12.12].

Solana’s moving average: 5 days [$33.55]20 days [$38.75]50 days [$38.34]100 days [$50.68]200 days [$91.00]Year to date [$75.04].

Solana’s 24-hour price range is $30.64-$33.16 and its 7-day price range is $30.21-$36.27. SOL’s 52-week price range is $25.97-$259.8.

Solana’s price on this date last year was $108.38.

The average price of SOL in the last 30 days is $38.95 and its -27.29% over the same period.

Solana’s price [-2.99%] closed its daily candle on Tuesday worth $31.45 and in the red as well for the fourth time over the last five daily candles.