Bitcoin, Ethereum, Ripple (XRP) Price Analysis

by James · November 29, 2022

Bitcoin Analysis

Bitcoin’s price printed a fifth straight daily candle in negative numbers on Monday, and by the end of the day’s session, BTC’s price was -$217.

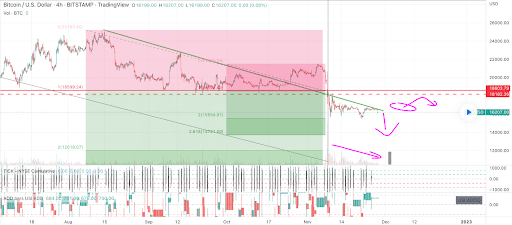

The BTC/USD 4HR Chart below from carnivorous food is where we begin Tuesday’s price analyses. BTC’s price trades between the 2 fibonacci level [$15,554.91] and 1 fib level [$18,522.40]at the time of writing.

Bullish BTC market participants really needs a shot of life right now in the short term and the 4 hour time scale suggested that a breakout and retest of the $18k level was potentially unfolding. However, we haven’t seen that rally yet and bulls will have to retest the 1 fib soon or risk a trip down to test the bottom of the 4HR channel at the 2,618 fib level [$13,721.00].

The overhead targets for bullish BTC traders are the 1 fib and the 0 fibonacci level [$21,489.88].

Bearish traders the opposite aims for the 2 fib level and then the 2.618 fibonacci level.

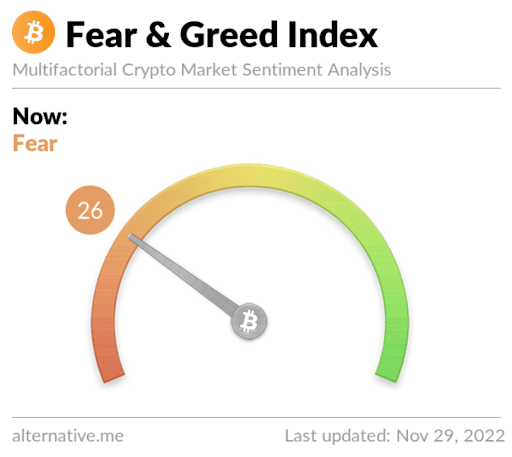

The fear and greed index is 26 Fear and is -2 from Monday’s reading of 28 Fear.

Bitcoin’s Moving Average: 5-day [$16,368.75]20 days [$17,616.77]50 days [$18,722.78]100 days [$20,251.68]200 days [$27,159.84]Year to date [$29,296.39].

BTC’s 24-hour price range is $16,002-$16,487 and its 7-day price range is $15,700.60-$16,753.63. Bitcoin’s 52-week price range is $15,501-$59,174.

The price of Bitcoin on this date last year was $57,845.

The average price of BTC for the last 30 days is $18,099.2.

Bitcoin’s price [-1.32%] closed its daily candle worth $16,215 on Monday.

Ethereum analysis

Ether price also traded lower at the close of the session on Monday than at the opening of the day, and when Monday’s candlestick was printed, ETH’s price was -$25.64.

The ETH/USD 1HR Chart of @BalanceOt is the second chart on today’s docket. At the time of writing, ETH’s price is trading between 23.60% fib level [$1,170.00] and 38.20% [$1,182.11].

Targets to the upside on Ether’s 1HR chart are 38.20%, 50.00% [$1,191.90]61.80% [$1,201.69]and 100.00% [$1,233.38].

Conversely, those still shorting ETH’s price have a main target of the 23.60% fibonacci level followed by a full retrace of 0.00% [$1,150.42].

ETH/USD 1HR chart: price is trading between 23.60% fib level [$1,170.00] and 38.20% [$1,182.11]

Ether’s moving average: 5 days [$1,172.77]20 days [$1,296.70]50 days [$1,333.05]100 days [$1,468.76]200 days [$1,890.95]Year to date [$2,060.34].

ETH’s 24-hour price range is $1,151.02-$1,199.25 and its 7-day price range is $1,082.89-$1,222.44. Ether’s 52-week price range is $883.62-$4778.

The price of ETH on this date in 2021 was $4,442.82.

The average price of ETH for the last 30 days is $1,336.16.

Ether price [-2.15%] ended its daily session on Monday valued at $1,167.71.

XRP analysis

XRP’s price has closed in the green for 6 of the last 8 days, but on Monday, XRP’s price ended in negative numbers at -0.00685 USD.

The XRP/USD 1D Chart from ObiWianKenobi is the final chart for analysis this Tuesday. With recent news from Russia that Vladimir Putin is interested in blockchain technology and a settlement system outside the control of states and banks, many are closely watching XRP’s price action.

XRP’s price is currently trading on the daily time scale within a Rising Wedge pattern. Bullish XRP market participants needs to eclipse the $0.47 level to break out to the upside of the chart.

Bearish XRP traders looking to reject bullish traders at the heart of the current pattern and secure another break to the downside at the $0.34 level.

Ripple’s 24-hour price range is $0.372-$0.399 and its 7-day price range is $0.355-$0.418. XRP’s 52-week price range is $0.287-$1.02.

Ripple’s price on this date last year was $0.989.

The average price of XRP in the last 30 days is $0.411 and its -15.69% over the same duration.

Ripple’s price [-1.73%] closed its daily candle on Monday worth $0.389.