Bitcoin, Ethereum, Elrond Price Analysis

by James · August 17, 2022

Bitcoin Analysis

Bitcoin’s price ended in the red for the third day in a row on Tuesday, ending its daily trading session at -$247.3.

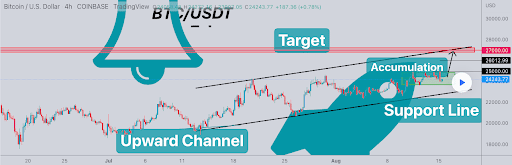

The first chart we look at for Wednesday is the BTC/USD 4HR chart below YMG group. BTC’s price is trading just below the $24k level, at the time of writing.

On the chart below, we can see that BTC’s price could potentially be in an accumulation zone before the next move. If this is an accumulation zone and BTC’s price has another move up, then the target for bullish BTC traders is the top of the current channel at $27k.

Bitcoin bulls have support at the $22k level if bearish traders continue to press down.

The Fear and Greed Index is 41 Fear and is -3 from Tuesday’s reading of 44 Fear.

Bitcoin’s moving average: 5-day [$24,049.44]20 days [$23,264.77]50 days [$22,314.61]100 days [$29,253.28]200 days [$37,565.3]Year to date [$33,824.5].

BTC’s 24-hour price range is $23,671.2-$24,247.5 and its 7-day price range is $22,826.07-$24,995.08. Bitcoin’s 52-week price range is $17,611-$69,044.

The price of bitcoin on this date last year was $44,698.

The average price of BTC for the last 30 days is $23,090.3 and its +14% over the same duration.

Bitcoin’s price [-1.03%] closed its daily candle worth $23,855.6 on Tuesday.

Ethereum analysis

Ether’s price also traded lower during Tuesday’s daily candle, and when traders settled at 12:00 UTC, ETH was at -$23.57.

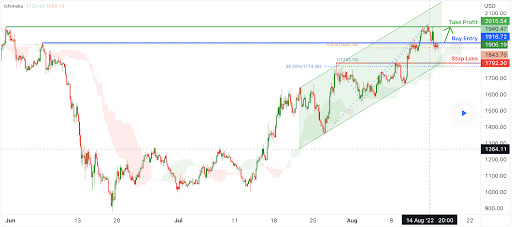

We also look at Ether on the same timeframe and the ETH/USD 4HR chart below at desmondlzw for Tuesday. Ether’s price trades between the 1 fibonacci level [$1,793.16] and 0.618 [$1,885.38]at the time of writing.

Targets overhead on ETH for bullish traders is 0.618 and then backing up to test the recent high of $2,024.5.

Bearish traders shorting the Ether market are looking to again push ETH’s price below the 1 fib level with a second target on the downside of the chart at 38.20% [$1,773.36]. The 38.20% Fibonacci level is a key level for short-term control of the Ethereum market. A break below that level would confirm ETH’s current weakness – which would suggest it is stuck below the heart line of the current ascending channel on the 4-hour time frame and testing the trend line.

Ether’s moving average: 5-day [$1,891.43]20 days [$1,688.52]50 days [$1,414.07]100 days [$1,993.99]200 days [$2,698.72]Year to date [$2,350.24].

ETH’s 24-hour price range is $1,853-$1,915 and its 7-day price range is $1,671.64-$2,024.5. Ether’s 52-week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $3,012.34.

The average price of ETH for the last 30 days is $1,669.7 and +52.30% for the same time frame.

Ether price [-1.24%] closed its daily candle on Tuesday worth $1,876.68 and in the red for a third consecutive day.

Elrond Analysis

EGLD was the best performer of the project’s coverage today, but also traded lower at the close than at its open session and EGLD closed Tuesday at -$0.27.

The last chart we look at for Wednesday is the EGLD/USD 1D chart below from Mussad Abdulaziz. EGLD’s price is bumping up against overhead resistance at $65.28, at the time of writing.

This price level on EGLD is an important historical level with Elrond’s price holding above this level after initially breaching it for almost all of 2021 and the first half of 2022.

EGLD’s price is -56.55% against the US dollar, -15.76% against BTC and -25.47% against ETH, over the same duration.

Elrond’s moving average: 5-day [$64.10]20 days [$58.84]50 days [$56.41]100 days [$90.93]200 days [$N/A]Year to date [$94.86].

EGLD’s 24-hour price range is $59.56-$61.96 and 7-day price range is $59.56-$68.77. Elrond’s 52-week price range is $38.07-$542.7.

Elrond‘The price on this date last year was $140.15.

The average price of EGLD in the last 30 days is $59.31 and its +2.23% over the same time frame.

Elrond’s prize [-0.44%] ended its daily session on Tuesday worth $60.41 and in the red for the fourth day in a row.

![Want Bitcoin [BTC] along with Ethereum [ETH] 5x this month Want Bitcoin [BTC] along with Ethereum [ETH] 5x this month](https://www.cryptoproductivity.org/wp-content/uploads/2022/08/regularguy-eth-AI6fP9IBOYk-unsplash-1-1000x600.jpg)