Bitcoin, Ethereum Derivatives Discontinued

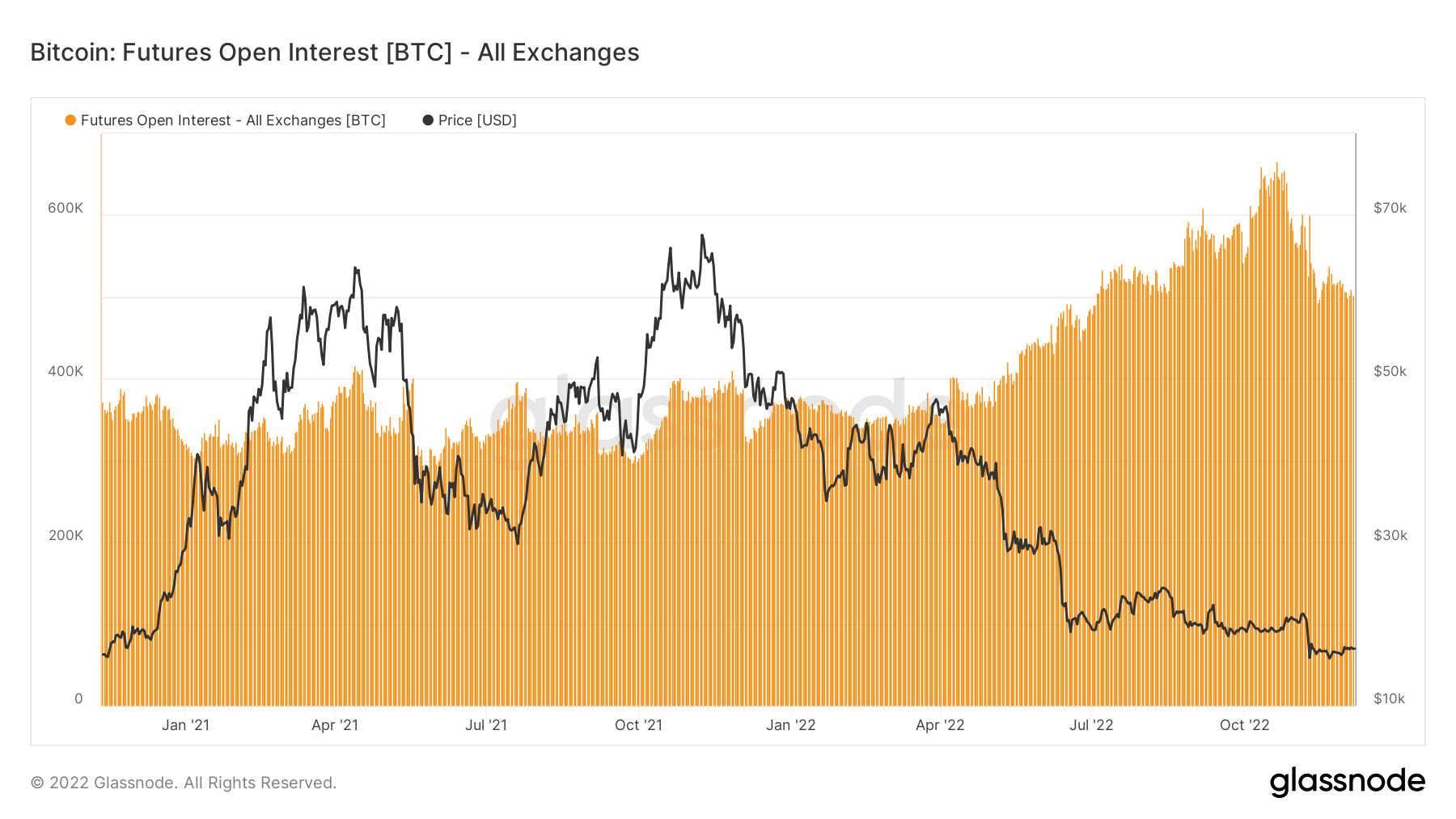

Looking at Bitcoin and Ethereum derivatives shows that they have been affected by the FTX fallout, with data analyzed by CryptoSlate showing that over 160,000 BTC have been liquidated since the beginning of October.

This data indicates that approximately $3 billion worth of futures contracts have been closed in two months.

Cryptocurrency derivatives are an important indicator of the overall health of the market. They also act as a pointer to where prices can go next, as they show how much leverage the market has.

The open interest rate on Bitcoin futures shows a sharp decline in the amount of funds allocated to open futures contracts, which is now back to the levels recorded in July 2022.

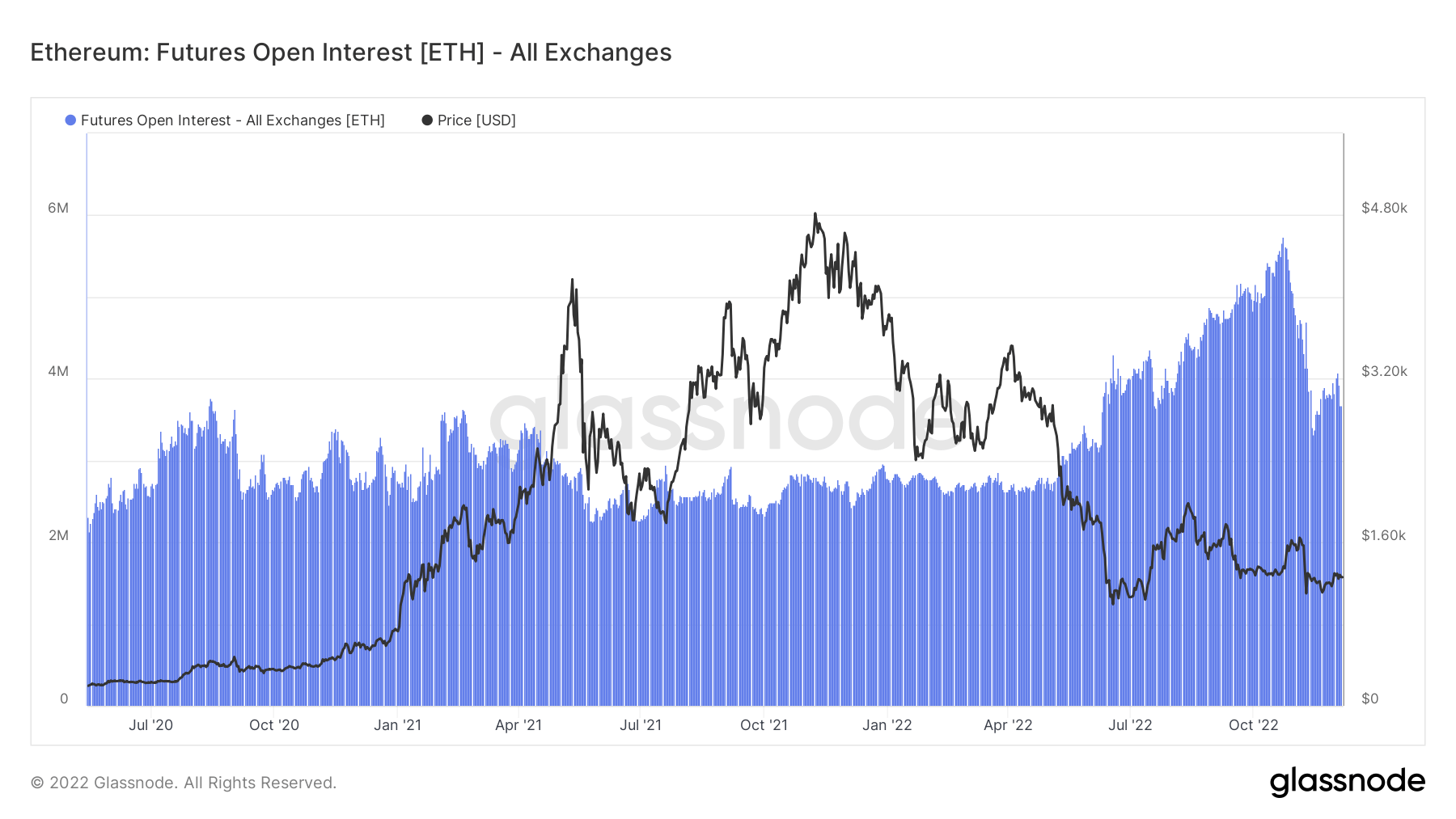

A similar trend is also present in Ethereum derivatives. Around 2 million ETH have been liquidated since October, with the open interest on Ethereum futures now back to early 2022 levels.

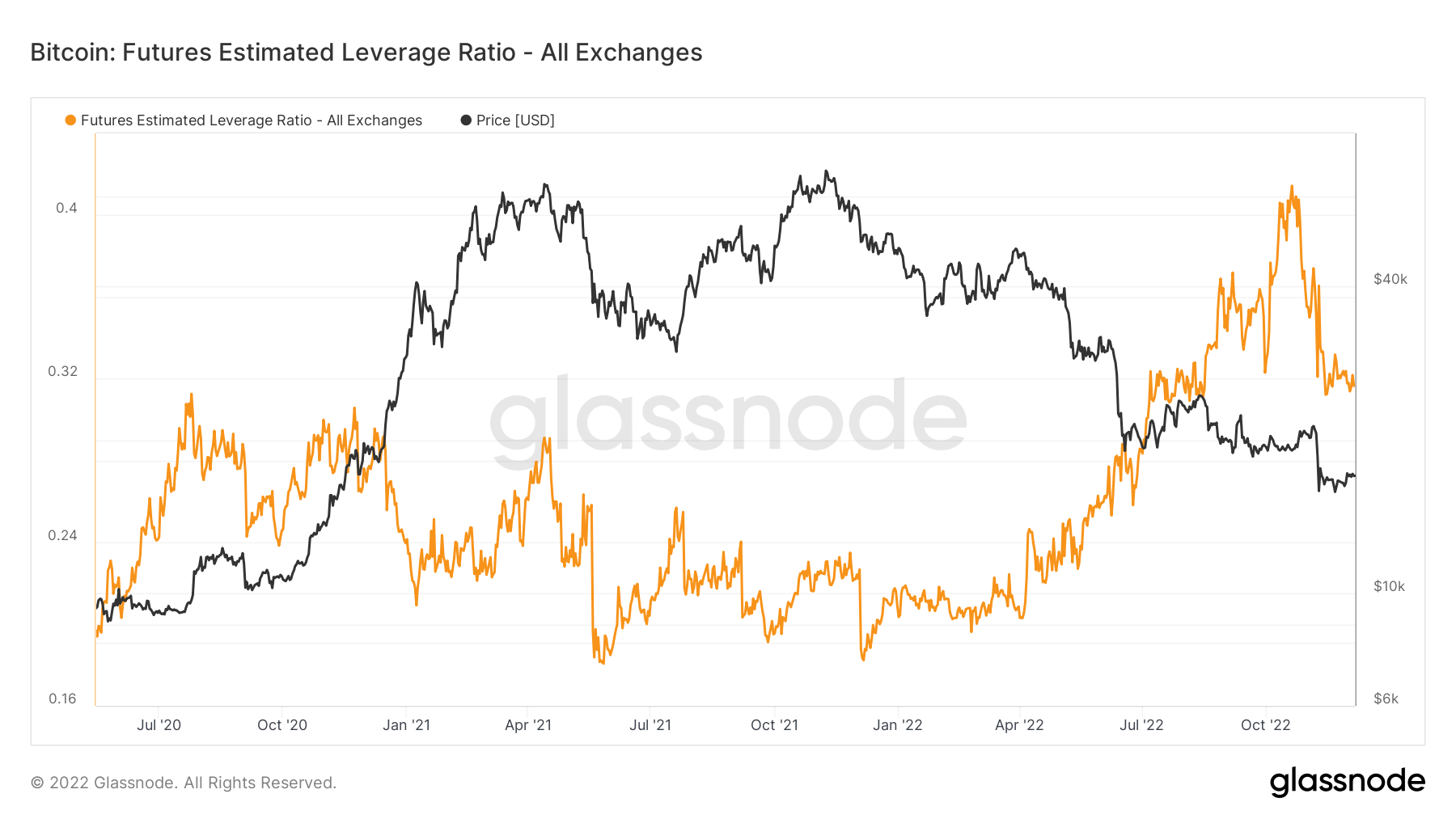

Aside from open interest in futures contracts, another way to estimate the amount of leverage in the market is by looking at the Estimated Leverage Ratio (ELR). Estimated Leverage Ratio is the ratio between open interest in futures contracts divided by the reserves of corresponding exchanges. It shows how much influence there is on exchanges and can be used to gauge traders’ sentiment. A high ELR indicates an oversold market and incoming volatility. A low ELR, on the other hand, shows a deleveraged market and indicates stability.

When ELR starts to decrease, it shows that more investors are starting to de-leverage and close their positions. And while an increasing ELR may show confidence in leveraged positions, it usually indicates that the market is mature with high leverage risk.

In October 2022, ELR peaked at 0.41 when Bitcoin’s price hovered around $19,000. Since then, the ratio has declined significantly and currently stands at 0.32. This decline shows that a significant number of derivative positions have been liquidated in just two months, giving the market some degree of stability.

But ELR is still high compared to last year. If the ratio begins to increase or remains on a sideways trajectory, more leverage will continue to relax.

And while this could threaten Bitcoin’s price, delving deeper into its derivatives shows some hope for stability.

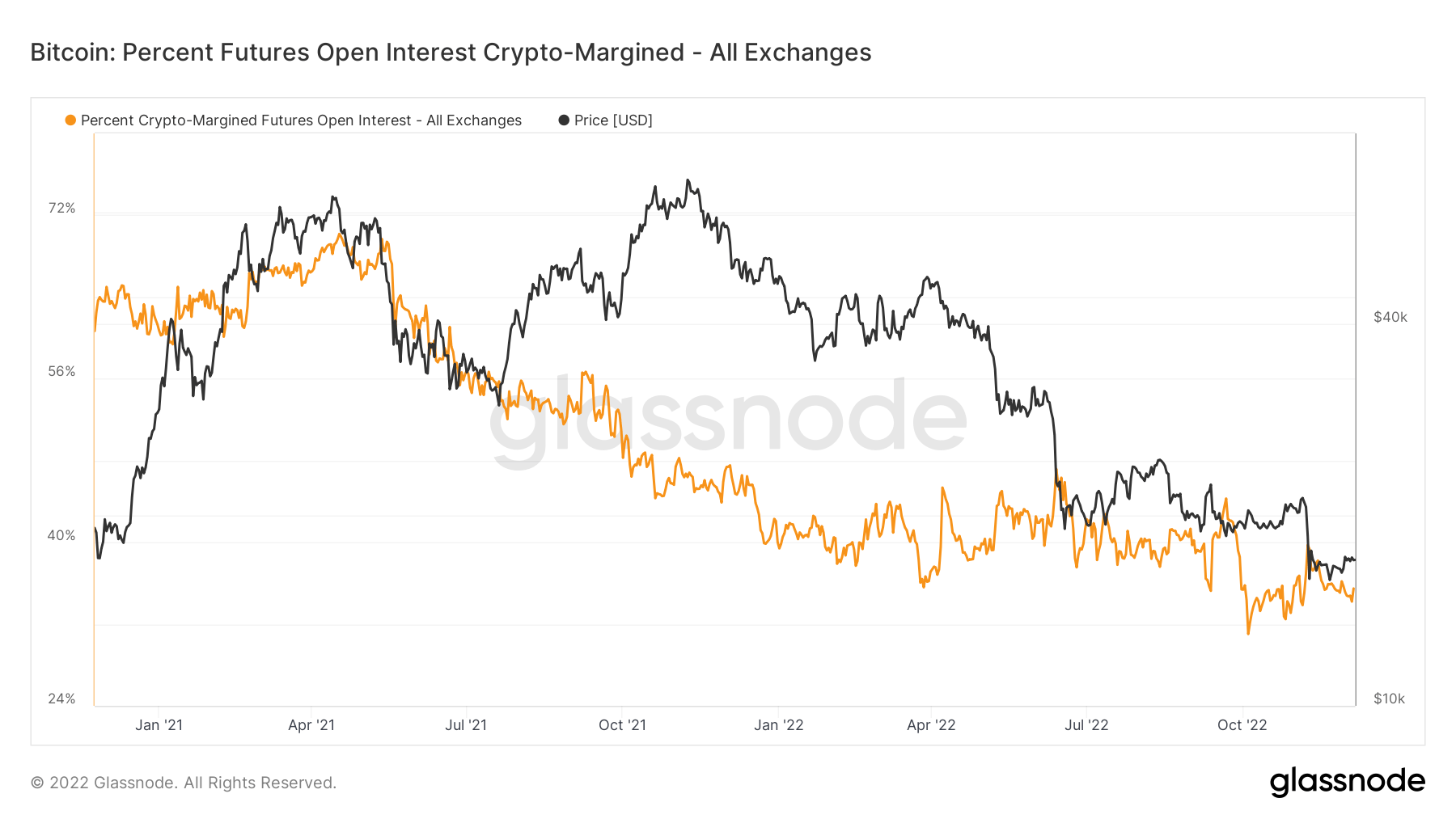

The open interest margin percentage in Bitcoin is much smaller than the open interest margin in USD and USD-pegged stablecoins. Around 35% of open interest is crypto margined, down from around 41% at the start of the year.

A declining percentage of crypto-margined open interest shows that investors are taking less risk with Bitcoin. The liquidation that is now underway will ultimately have a positive effect on the market. Flushing out leveraged positions will cause short-term volatility, but lead to a healthier market in the long term, creating a solid foundation for future accumulation.