Bitcoin, Ethereum, Cardano were sent higher on Tuesday

by James · December 14, 2022

Bitcoin Analysis

Bitcoin’s price had its best performance in December on Tuesday, and at the time of writing, BTC’s price was +$557.

The BTC/USD 1D Chart below from Alan Santana This is where we begin our price analyzes for this Wednesday.

After weeks of relatively calm trading sessions bullish BTC market participants tried to send the asset’s price up to test the 0.382 fibonacci level [$18,267.1] on Tuesday. If they can regain 0.382 with daily candle confirmation this week, the bullish target shifts to the 0.5 fib level [$19,132.2] followed by 0.618 [$19,997.4]and 0.786 [$21,229.1].

Reverse, bearish BTC traders has a target to retest the $16,640 level. If they can push BTC’s price below that level, the next target for bearish traders of Bitcoin’s market is the asset’s multi-year low of $15,501.

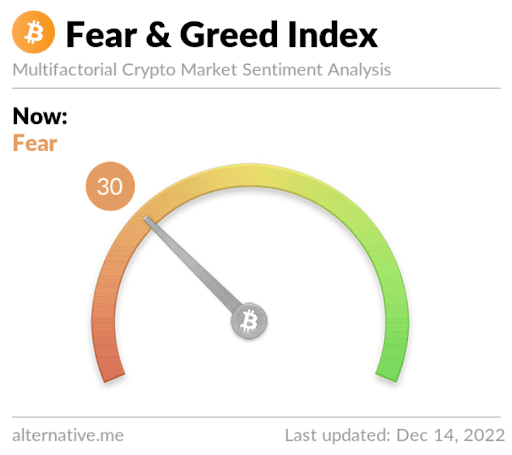

The fear and greed index is 30 Fear and is +3 from Tuesday’s reading of 27 Fear.

Bitcoin’s Moving Average: 5-day [$17,144.61]20 days [$16,727.40]50 days [$18,264.49]100 days [$19,747.23]200 days [$25,894.85]Year to date [$28,749.66].

BTC’s 24-hour price range is $17,102-$18,000 and its 7-day price range is $16,781.78-$18,000. Bitcoin’s 52-week price range is $15,501-$52,027.

The price of Bitcoin on this date last year was $48,408.

The average price of BTC for the last 30 days is $16,759.4 and +2% over the same interval.

Bitcoin’s price [+3.23%] closed its daily candle worth $17,785 and in the green for the second day in a row on Tuesday.

Ethereum analysis

Ether price performed similarly to BTC on Tuesday and ended its daily candle +$45.75.

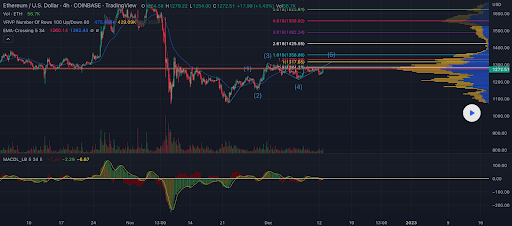

The other resource we are looking at today is Ether and more specifically we are looking at ETH/USD 4HR Chart below of fknbadbeats. ETH’s price trades between the 1 fibonacci level [$1,317.65] and the 1.2 fib level [$1,330.99].

Targets to the upside on Ether is the 1.2 fib level, 1.618 [$1,358.86]2,618 [$1,425.55]3,618 [$1,492.24]4,618 [$1,558.92]and the 5,618 fib level [$1,625.61].

Contrary to those longing for the Ether market bearish traders which targets the downside of the 4HR chart for the 1 fibonacci level and the 0.5 fib level [$1,284.31].

Ether’s Moving Average: 5-day [$1,266.65]20 days [$1,225.65]50 days [$1,318.99]100 days [$1,456.70]200 days [$1,811.74]Year to date [$2,025.00].

ETH’s 24-hour price range is $1,255.1-$1,349 and its 7-day price range is $1,225.02-$1,349. Ether’s 52-week price range is $883.62-$4148.85.

The price of ETH on this date in 2021 was $3,860.41.

The average price of ETH for the last 30 days is $1,230.17 and +0.62% in the same period.

Ether price [+3.59%] ended its daily session on Tuesday worth $1,320.73 and in the green for the third time in four days.

Cardano analysis

Cardano’s price also rose more than 2% on Tuesday and ended its daily session at +$0.0068.

The final chart to conclude Tuesday’s price analyzes is ADA/USD 1D Chart below of HerWill. ADA’s price trades between the 0.5 fib level [$0.2497] and 0.382 fib level [$0.4525]at the time of writing.

Traders of Cardano’s market are stuck in the middle of these two fibs and have accumulated just above the $0.30 level for more than a month.

If bullish ADA traders can clearly establish price action on the asset above the heart line, then their next target is the 0.382 fib level.

Bearish traders however, hoping to retest the bottom of a long-term descending channel and break the 0.5 fibonacci level [$0.2497] before testing 0.618 [$0.1378].

Cardano’s 24-hour price range is $0.313-$0.315 and its 7-day price range is $0.301-$0.319. ADA’s 52-week price range is $0.296-$1.63.

Cardano’s price on this date last year was $1.26.

The average price of ADA in the last 30 days is $0.318 and its -11.72% over the same stretch.

Cardano’s price [+2.20%] closed its daily candle on Tuesday worth $0.313 and in positive numbers for the first time in three days.