Bitcoin, Ethereum and Dogecoin price analysis

Bitcoin Analysis

Bitcoin’s price failed to post a green daily session over the weekend, and when traders settled on Sunday, BTC’s price was -$122.2.

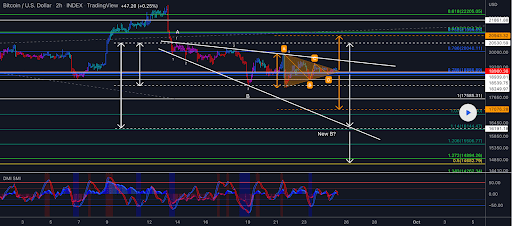

We lead the new free week with BTC/USD 2HR Chart below from andre_007 to start our price analyses. BTC’s price trades between the 1 fibonacci level [$17,585.31] and 0.786 [$20,040.11]at the time of writing.

Bullish traders hope they can break out of the current descending wedge pattern that BTC’s price is trading within and bulls have targets to the upside at 0.786, 0.702 [$21,154.7]and 0.618 [$22,205.05].

Reverse, bearish traders looking to follow up on a successful bearish backtest of BTC’s 2017 ATH [$19,891] with a test of the 2022 low at $17,611. The targets for bearish traders are the 1 fib level followed by 1.07 [$16,879.5]1.14 [$16,144.47]1,206 [$15,506.77]1,272 [$14,894.26 and 1.343 [$14,262.34].

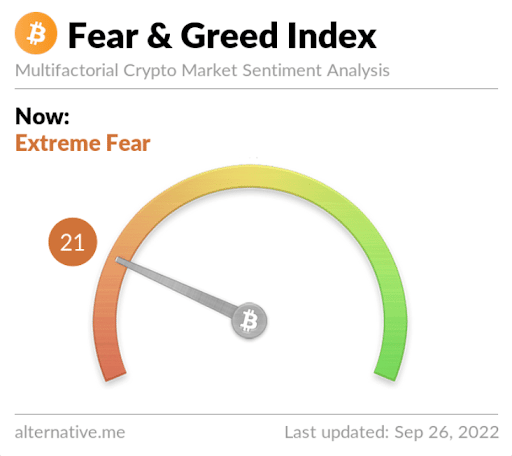

The fear and greed index is 21 Extreme fear and is -3 from Sunday’s reading of 24 Extreme Fear.

Bitcoin’s Moving Average: 5-day [$19,106.06]20 days [$19,845.37]50 days [$21,636.72]100 days [$23,467.92]200 days [$32,687.96]Year to date [$31,849.04].

BTC’s 24-hour price range is $18,629.2-$19,180.2 and its 7-day price range is $18,424.7-$19,721.93. Bitcoin’s 52-week price range is $17,611-$69,044.

The price of Bitcoin on this date last year was $43,180.

The average price of BTC for the last 30 days is $20,005.5 and its -12.5% in the same period.

Bitcoin’s price [-0.65%] closed its daily candle worth $18,802 and in the red for the third day in a row on Sunday.

Ethereum analysis

Ether price closed Sunday’s daily candle at -$22.79 as bullish ETH market participants continue to search for solid footing and look to end the sea of red that has crossed ETH charts since the beginning of The merger.

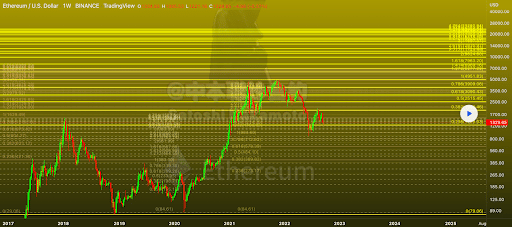

The next chart we look at this Monday is ETH/USD 1W Chart below of ZhongBenCong001. ETH’s price is trading between the 0.236 fib level [$1,229.03] and 0.236 [$1,940.46]at the time of writing.

The goals of the upside on Ether for bullish traders are 0.236, 0.382 [$1,940.46]0.5 [$2,515.45]0.618 [$3,090.43]0.786 [$3,909.86]and 1 [$4,951.83].

Contrary to bullish traders are bearish traders and their target is .236 and a full tracking of 0 [$79.06].

Ether’s Moving Average: 5-day [$1,328.00]20 days [$1,526.70]50 days [$1,618.66]100 days [$1,579.52]200 days [$2,320.12]Year to date [$2,236.16].

ETH’s 24-hour price range is $1,269.27-$1,337 and its 7-day price range is $1,238.84-$1,388.23. Ether’s 52-week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $3,063.32.

The average price of ETH for the last 30 days is $1,522.53 and its -23.05% over the same duration.

Ether price [-1.73%] closed its daily candle on Sunday worth $1,294.21 and in the red for a second daily session in a row.

Dogecoin Analysis

Dogecoin price was the worst result of the day’s price analyses, and by the close of daylight, DOGE was $0.00192.

The last chart we look at for Monday is DOGE/USD 1D Chart from davedesigns. Dogecoin price trades between the 100.00% fib level $0.049 and the 78.60% fib level [$0.197]at the time of writing.

Those who are long the DOGE market has a main target of 78.60% followed by 61.80% [$0.313]50,005 [$0.394]38.20% [$0.763]23.60% [$0.570]and 0.00% [$0.740].

Bearish traders which short DOGE has an initial target at 100.00% fib level with a target to make a new 12 month low if successful at 100.00% fib level.

Dogecoin Moving Averages: 5-day [$0.059]20 days [$0.060]50 days [$0.066]100 days [$0.070]200 days [$0.107]Year to date [$0.103].

Dogecoin’s 24-hour price range is $0.060-$0.063 and its 7-day price range is $0.056-$0.067. DOGE’s 52-week price range is $0.049-$0.339.

Dogecoin’s price on this date last year was $0.204.

The average price of DOGE in the last 30 days is $0.061 and its -11.26% over the same period.

Dogecoin price [-3.04%] ended its daily session on Sunday worth $0.061 and finished in the red for two days in a row.