Bitcoin, Ether rise; ADA is today’s biggest winner; investors await the European Central Bank’s interest rate decision

Bitcoin and Ether rose in Thursday afternoon trading in Asia, along with all other top 10 non-stablecoin cryptocurrencies by market capitalization. Cardano’s ADA token saw the biggest gains of the day. Most Asian shares strengthened, while European stock markets fell in anticipation of the European Central Bank’s interest rate decision. US stock futures also fell, as markets priced in the Federal Reserve’s 25 basis point interest rate hike.

See related article: Crypto markets ahead of US Fed decision

Crypto

Bitcoin, the world’s largest cryptocurrency, rose 1.19% in the 24 hours to 16:30 in Hong Kong to $29,080. Ether rose 1.71% to $1,902, recapturing an important psychological price level alongside the world’s number one cryptocurrency.

Cardano’s ADA token saw the biggest gains in the top 10 cryptos, rising 2% to $0.39, followed by Solana’s SOL token which rose 1.89% to $22.15.

Global crypto market capitalization increased by 1.45% to $1.2 trillion, while total crypto market volume rose 24.39% to $42.84 billion.

NFT

In the non-fungible token (NFT) market, the Forkast 500 NFT Index fell 1.01% to 3,650.47 points in the 24 hours to 16:30 in Hong Kong, falling 1.82% for the week .

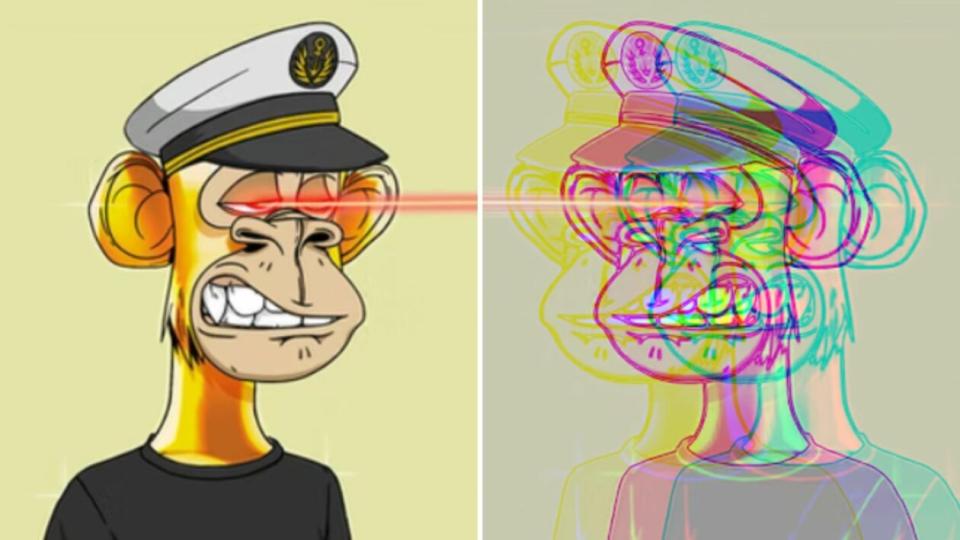

24-hour NFT sales on the Ethereum network fell for the second day in a row, down 25.55% to $17.3 million, according to CryptoSlam data. The decline was due to a 27.33% drop in 24-hour sales for Bored Ape Yacht Club and a 67.85% drop for the Azuki Collection.

In other NFT developments, South Korea’s leading blockchain game maker Wemade launched the Bored Ape Golf Club NFT collection on its platform on Wednesday.

The golf-themed variation of the popular Bored Ape Yacht Club collection had 40,000 concurrent users during the pre-sale period last year, according to Wemade’s press release. Wemade, established in 2000, serves several games to serve video games globally, including MIR4, and recorded over $83 million in sales in the fourth quarter of 2022.

Stock

Most Asian shares gained on Thursday, with the Shenzhen Component Index falling 0.57%. The Shanghai Composite rose 0.82%, Japan’s Nikkei 225 rose 0.12% and Hong Kong’s Hang Seng Index rose 1.27%.

Retail sales in Hong Kong grew by a record 39.4% year-on-year in March 2023, up from growth of 29.7% in February, driven mainly by rising sales of jewellery, watches, value gifts, clothing and footwear.

Most US stock futures fell at 16:30 in Hong Kong, except for Nasdaq 100 futures which rose 0.24%. Dow Jones Industrial Average futures fell 0.8% and S&P 500 index futures fell 0.018%. Markets have priced in the Federal Reserve’s latest rate hike of 25 basis points and comments signaling it could be the last rate hike for now.

Investors await the European Central Bank’s monetary policy decision, which will come later on Thursday. The bank is also expected to raise the key interest rate by 25 basis points. Ahead of the decision, major European stock markets were trading in the red on Thursday, with the benchmark STOXX 600 falling 0.51% and Germany’s DAX 40 losing 0.38%

See related article: US reaction to crypto is like ‘deer caught in headlights,’ says ex-CFTC chief