Bitcoin edges below $28K as investors weigh Deutsche Bank contagion fears

Join the most important conversation in crypto and web3! Secure your place today

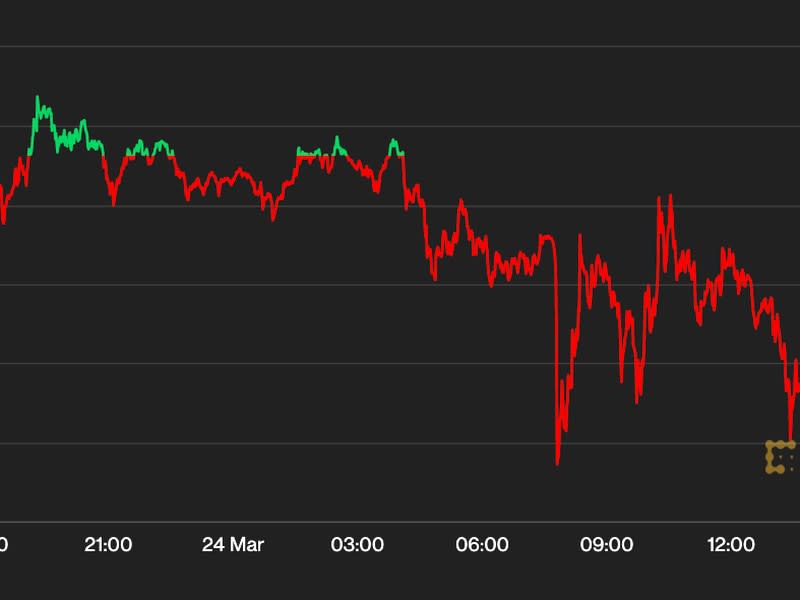

Cryptocurrency prices fell on Friday as investors grappled with a new threat to the global banking system as well as continued concerns about US monetary policy.

Bitcoin (BTC), the largest cryptocurrency by market capitalization, recently changed hands at around $27,450, down more than 2% in the past 24 hours, according to CoinDesk data. BTC rose as high as around $28,300 earlier in the day and is up more than 16% in March.

But most risk markets fell for much of the day after the cost of insuring the debt of financial giant Deutsche Bank rose to its highest point in four years, reigniting concerns about the strength of the banking sector.

Shares of Deutsche Bank ( DB ) plunged 14% one point on Friday before closing down 3%. Deutsche Bank’s troubles come just days after UBS agreed to buy its troubled rival, Credit Suisse, for $3.2 billion, and less than three weeks after the failures of US-based Silvergate, Silicon Valley and Signature banks.

In a newsletter on Friday, analysts for bitcoin mining equipment and hosting provider Blockware Solutions said BTC’s resistance had formed at $28,800, roughly where it stood during a summer 2021 correction.

“This would be a logical place to see BTC make another leg lower, but a continued consolidation here would be welcome,” the analysts wrote. “This is a pretty key spot for bulls to defend to maintain this current bullish structure.”

“A break above this level would obviously be the most ideal scenario for bulls, but if we’re going to pull back, we’d like to see BTC hold ~$25,200,” they added.

Ether (ETH), the second largest cryptocurrency, recently changed hands at $1,745, down 3% from Thursday at the same time. Layer 2 blockchain Optimism’s OP token price fell by over 9% to $2.23 from over $2.47 the previous day.

The CoinDesk Market Index, which measures the overall performance of the crypto market, was down about 2.7%.

Stock markets edged lower at Friday’s open before closing in the green as investors recovered from at least some of the banking shock. The S&P 500, Dow Jones Industrial Average (DJIA) and tech-heavy Nasdaq ended up 0.5%, 0.4% and 0.3% respectively.

“Large banks tend to be interconnected, with shared exposures on syndicated loans, and via a web of repo and other counterparty transactions,” Steve Sosnick, chief strategist at brokerage Interactive Brokers, wrote in a note Friday about bank contagion.

“It’s logical, but unhelpful, for investors who were burned by one bank to get serious jitters about those most similar to it,” Sosnick wrote.

He also noted that credit default swaps can be “catastrophic” for bondholders because “it weakens the income stream on which the holders depend,” adding, “As a result, the market value of the bond can decline significantly and rapidly.”

Meanwhile, crypto investors continued to consider recent regulatory enforcement issues, including a Securities and Exchange Commission (SEC) warning to Coinbase that the agency is pursuing an enforcement action against the exchange for possible securities violations.

“Nobody knows how regulators are going to decide if all tokens are securities,” Edward Moya, senior market analyst for currency market maker Oanda, wrote in a Friday note, adding that Coinbase’s success is “important for long-term crypto growth.”

“In the US, Coinbase is a critical option for how people get started with crypto,” he wrote.