Bitcoin disconnects from older markets amid macro turmoil

September 29, Bitcoin Magazine Analyst Dylan LeClair noted that Bitcoin had begun to “disconnect” from the S&P 500.

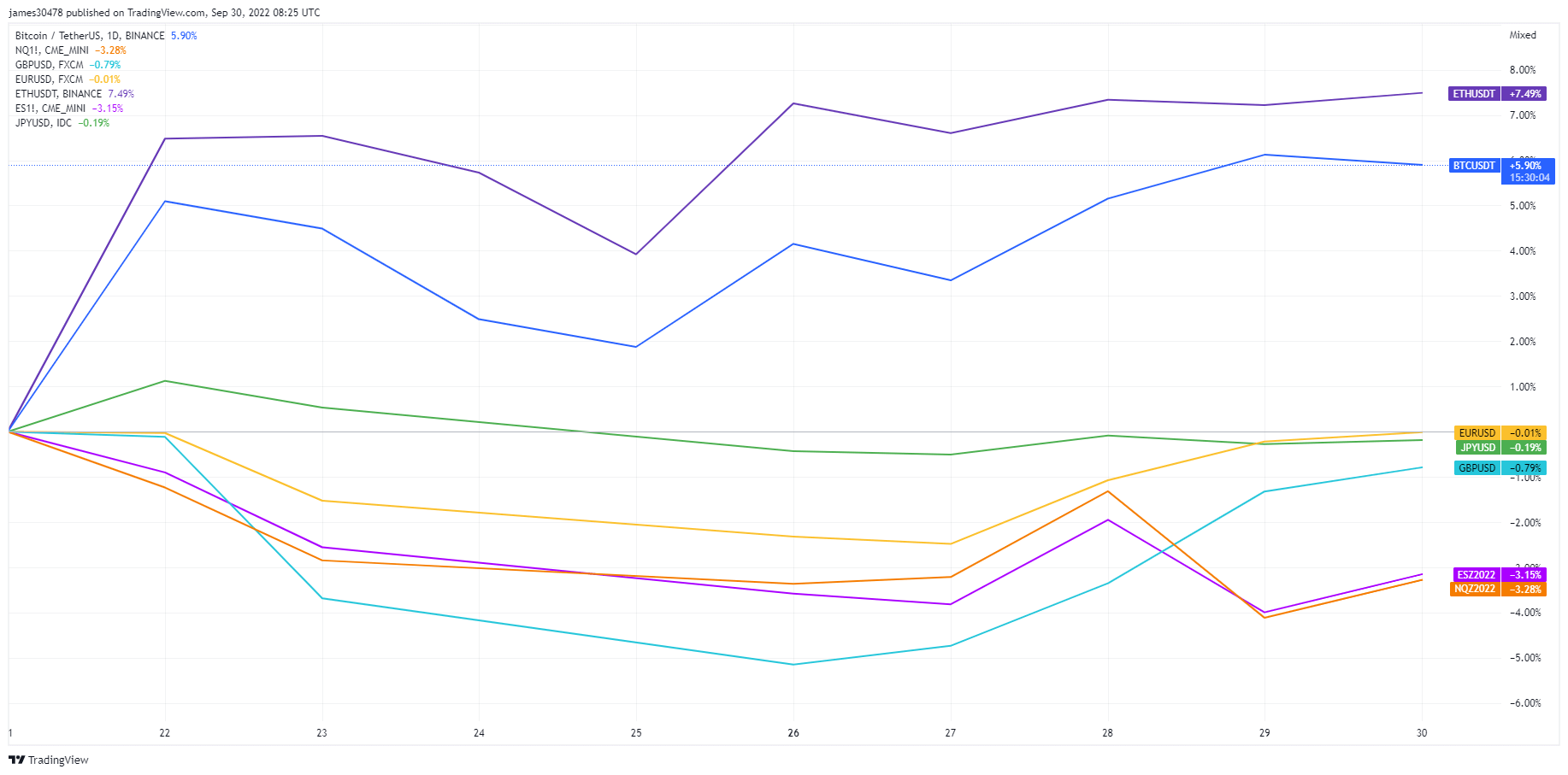

His charts below show a rise in the spread between the two as the S&P 500 continues to slide amid macro weakness shown by the Bank of England’s (BoE) swing to quantitative easing this week.

Because of its fixed supply of 21 million tokens, Bitcoin was always sold as an “anti-fiat” that could not be debased to zero.

As the global economy continues to falter, that narrative unraveled as BTC displayed risk characteristics. However, BTC’s recent performance may suggest otherwise.

Is Bitcoin an old hedge?

In April, Bloomberg published an article showing the correlation between Bitcoin and the S&P 500 at an all-time high. This further derailed talk of BTC being a “safe haven asset”.

Inflation has since worsened, and ordinary people are experiencing firsthand the effects of loose monetary policy in a cost-of-living crisis.

As asset risk continues to decline, Bitcoin has held steady, trading between $18,100 and $22,800 throughout September.

Meanwhile, the S&P500 has charted a clear decline over the same period, falling 10% since September 1 – a significant percentage drop for an older index.

Since the September 21 FOMC meeting, where the Fed implemented a third consecutive rate hike of 75 basis points, BTC and ETH have outperformed non-USD major currencies, providing further evidence of a disconnect.

LeClair doubts the disconnect will continue

The question remains, will this trend persist as the macro landscape continues to deteriorate?

LeClair responded by saying that a continuation of this trend is “highly unlikely.” Still, BTC’s recent outperformance is a “decent start” to restoring its safe-haven narrative.

“Still think a long-term ‘disengagement’ is highly unlikely at this stage, but relative outperformance is a decent start.”“

With that he signed off and said that it is “aI’m looking at currencies, global bonds and stocks” as investors prepare for what’s to come.

In the short term, some analysts expect other central banks to follow the BoE and reverse hawkish policies to intervene in future crises.