Bitcoin: Despite headwinds, the seller solution is clear

alexsl/iStock via Getty Images

When I last covered Bitcoin (BTC-USD) in early July, I made the argument that bearish Bitcoin had become a one-sided trade. While Bitcoin is lower now than it was at the time of that article, bulls got a relief rally which took the coin from $21ki at the time of writing to $25k within a few weeks. Sentiment is again bearish, this time though I don’t see the same opposite possibility. This article will instead focus on the technical downsides of Bitcoin, the Lightning Network and its activity, and the broad macro headwinds currently facing all risk markets.

Network disadvantages

One of the major technical flaws of Bitcoin’s base layer is its lack of scalability. While Visa ( V ) can reportedly process tens of thousands of transactions per second (or TPS), Bitcoin can handle less than 10. This rightly leads many to be highly skeptical of Bitcoin’s theoretical mass adoption as a peer-to-peer payment network. It is also a big reason why there has been a proliferation of other blockchains that aim for better scalability through higher transactions per second figures.

- Solana (SOL-USD) claimed 50,000 TPS on testnet, although others suggest real capacity is far lower than that

- Avalanche (AVAX-USD) claims to be able to process 4500 TPS

The scalability problem for Bitcoin, and Ethereum (ETH-USD) as well, is highlighted through what has been called the “blockchain trilemma”.

Blockchain Trilemma (Ledger.com)

Essentially, the three desirable characteristics needed from public blockchains are security, scalability and decentralization. What we have seen so far is that all of these public blockchains can achieve two of the three characteristics. None of them have achieved all three. For example, Bitcoin is secure and decentralized, but not scalable. Most of the blockchains with high TPS are able to achieve the scalability at the cost of decentralization or security. While Ethereum has tier two options like Polygon (MATIC-USD) and Arbitrum that help with scalability, Bitcoin’s best shot at addressing scalability at the moment is the Lightning Network.

Lightning network

Joseph Poon and Thaddeus Dryja published the Lightning Network white paper back in 2016 specifically to address Bitcoin’s scalability issue. Acknowledging that cheap Bitcoin micropayments only possible through escrow solutions defeat the entire purpose of a peer-to-peer network, the authors proposed a “channel”-based alternative that doesn’t use the base chain for every transaction:

Instead, using a network of these micropayment channels, Bitcoin can scale to billions of transactions per day with the computational power available on a modern desktop computer today. Sending many payments within a given micropayment channel allows one to send large amounts of funds to another party in a decentralized manner. These channels are not a separate trusted network on top of bitcoin. They are real bitcoin transactions.

The channels are a bit like a tab at a bar. When the customer gives the bartender their credit card, the two parties have agreed to open a “channel” that will not close until the customer decides to leave the bar. If a Lightning user wants to pay for a coffee with Bitcoin and the coffee shop has a Lightning Network node, the two parties can open a channel between each other that allows the customer to pay for coffee any number of times at a cost which corresponds to less than one kroner per transaction.

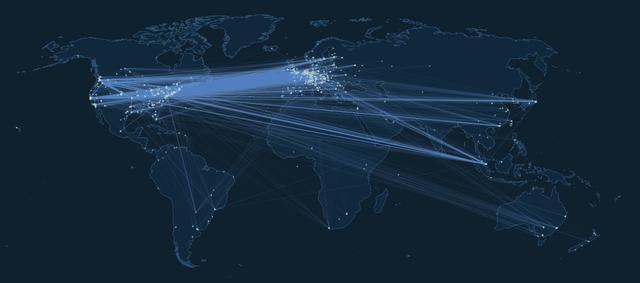

Lightning Network channel map (acinq.co)

What’s also interesting about the network is that users don’t necessarily need to open channels with every seller they do business with. The map above shows the channels currently active on the Lightning Network. If adoption reaches a critical mass, Lightning can route payments through channels that have multiple degrees of separation. This means that the network will allow transmissions between two users who do not have an open channel as long as there is a connection somewhere in the network that links the parties together.

For example, let’s say “Customer 1” has a Lightning channel with a grocery store, but not with a restaurant. The restaurant has an open channel with “Customer 2” and “Customer 2” also has a channel with the same grocery store, “Customer 1” and the restaurant can shop without opening a channel because the Lightning Network will route the payment through “Customer 2” and the grocery store .

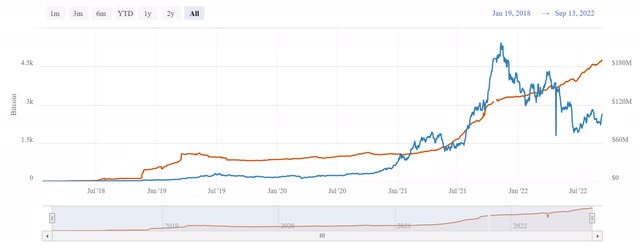

Lightning Network channels (Bitcoin Visuals)

Currently, there are approximately 81,000 channels on the network. While the channel trend has stagnated since the crypto market peaked late last year, the total number of channels on Lightning is up about 19% year-over-year. The real growth on the Lightning network is in the capacity, or the amount of Bitcoin available for transactions on the layer:

Lightning network capacity (Bitcoin Visuals)

There are now 4,740 Bitcoins available for transactions on the network, or approximately $105 million in funds. While BTC capacity has grown 91% year-over-year, the dollar purchasing power of that capacity is down 5% due to Bitcoin’s price struggle so far this year.

So why would a merchant have any desire to do this? Transaction costs on Lightning are drastically cheaper than traditional payment processors such as Visa. We are already seeing seller fatigue from these processing fees. Just this week, we’re seeing reports of Target ( TGT ) and Walmart ( WMT ) supporting a bill to lower credit card fees.

The bill, which Sen. Richard Durbin (D., Ill.) and Sen. Roger Marshall (R., Kan.) introduced in July, would give merchants the right to route many credit card payments over networks other than Visa and Mastercard. In a letter this week to all members of Congress, the merchants said the proposed legislation would increase competition and lead to a reduction in the fees they pay when accepting credit cards.

Instead of trying to fight price wars through the state apparatus, companies like Target and Walmart might instead start running Lightning nodes and building integrations with their B&M chains and e-commerce stores. Show consumers the benefits and you will likely get the results you want; especially with consumer price inflation still hot.

But the general point is that there is a corporate appetite for cheaper transactions, and Bitcoin’s Lightning network can be used to serve that demand. It is important to mention that this type of blockchain network can be used to trade more than just native assets. If Circle supported USDC Stablecoin (USDC-USD) on Lightning, users could trade dollars on Lightning for fractions of a penny per transaction with the BTC “rate” essentially acting as lubricant to keep the engine running.

Base team activity

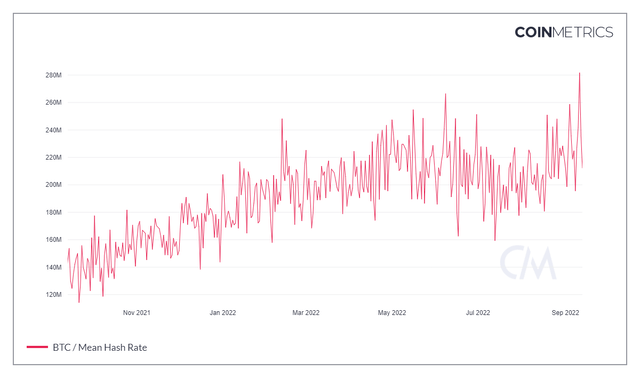

As for the base layer, we still see highs in hash rate and in several other areas:

CoinMetrics

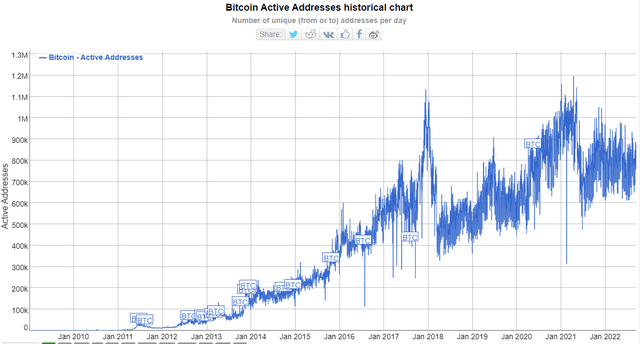

The average hash rate made another new all time high a few days ago. This suggests that the network remains secure as an increasing number of miners compete for the block reward. In addition, active addresses are still near highs and usually fluctuate between 700-900,000 daily users on the chain.

BitInfoCharts

Despite the generally positive network usage and security metrics, the price of BTC still comes down to monetary policy.

Macro headwind

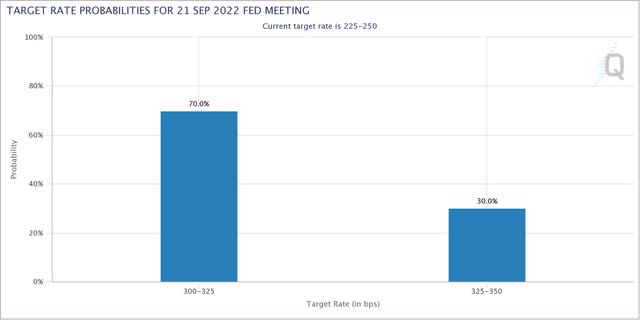

Like any other speculative digital trinket that trades in crypto (or on the Nasdaq for that matter), Bitcoin’s price will likely come down to the Federal Reserve’s monetary policy. On Tuesday, risk markets largely sold off due to an 8.3% annual CPI print that came in higher than the 8.0% forecasts. Many are now calling for interest rate increases in September, which are higher than expected just a few days ago:

Target rate probabilities (CME Group)

The market is now pricing in a 30% chance of a rate hike of 100 basis points next week. This is up from 0% on Monday. Bitcoin has survived several bear cycles that have led to extreme moves. But Bitcoin has yet to be tested in a legitimate tightening cycle like the one currently being guided. While I personally question how much higher interest rates can go without causing systemic problems, all risk markets are going to struggle until there is a clear indication that the Federal Reserve is taking its foot off the gas on interest rates.

Summary

Bitcoin has a tough road ahead of it. In addition to monetary policy headwinds, the current administration is reportedly weighing action against domestic Bitcoin mining. Furthermore, the narrative of energy consumption that comes with Proof-of-Work mining is likely to be higher after Ethereum’s merger with Proof-of-Stake. But Bitcoin’s Lightning network theoretically also addresses this concern because the transactions are off-chain.

As I’ve explained here and in a previous article, it’s in the seller’s best interest to use something like Lightning if the user interface can be simplified. It is undeniably cheaper for the seller of goods and services to use Lightning for payment rather than a credit card. We’re already seeing top U.S. retailers support a bipartisan bill aimed at reducing credit card transaction fees. The market demand for alternatives seems to be there. The question is whether the demand will find its way to Bitcoin’s Lightning Network. And if so, does that mean the BTC price differs from the rest of the market? If it does, bulls should see phenomenal gains. If it doesn’t, Bitcoin will continue to trade as a risky asset. In a tightening cycle, long-term bulls should pick their spots and add falls like the one we got on Tuesday.