Bitcoin Demand on Coinbase Stacked, Flashing March 2020 Bottom Vibes, According to Popular On-Chain Analyst

Widely followed chain analyst Will Clemente says Bitcoin (BTC) buy orders on crypto exchange Coinbase are reminiscent of BTC’s March 2020 bottom.

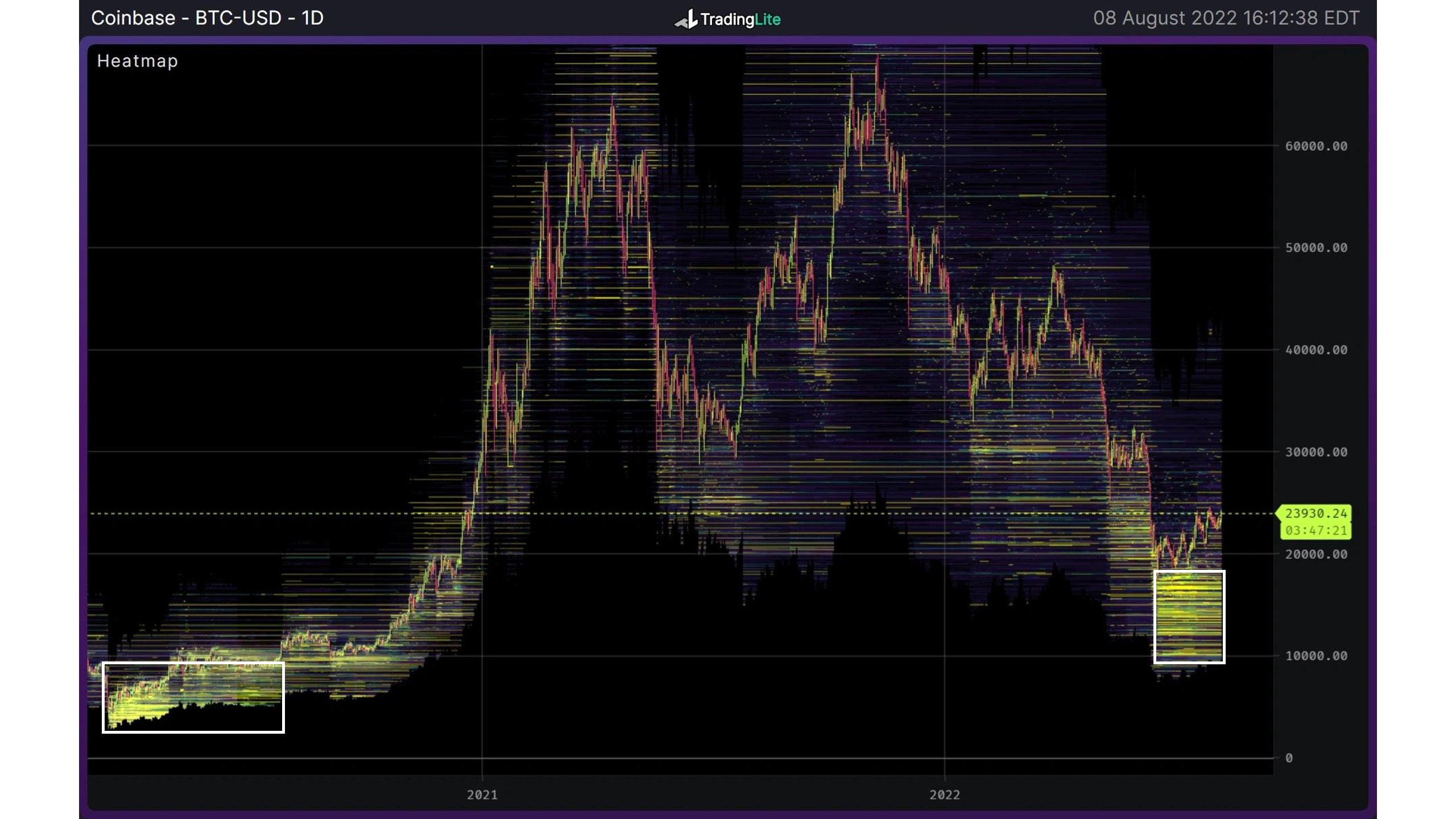

Clemente tells his 657,400 Twitter followers that BTC bulls on Coinbase have placed thick buy orders from $17,000 and below.

According to the analyst on the chain, market participants’ eagerness to capture BTC at lower prices bodes well for the royal crypt.

“Bitcoin order book bids on Coinbase are stacked down from $17,000 and below. Many people are hoping to buy BTC lower. The last time the order book was so skewed to the bid side was the rally from the bottom in March 2020.”

In March 2020, Bitcoin crashed to around $3,700 before launching a massive rally that drove BTC to $64,000 about a year later.

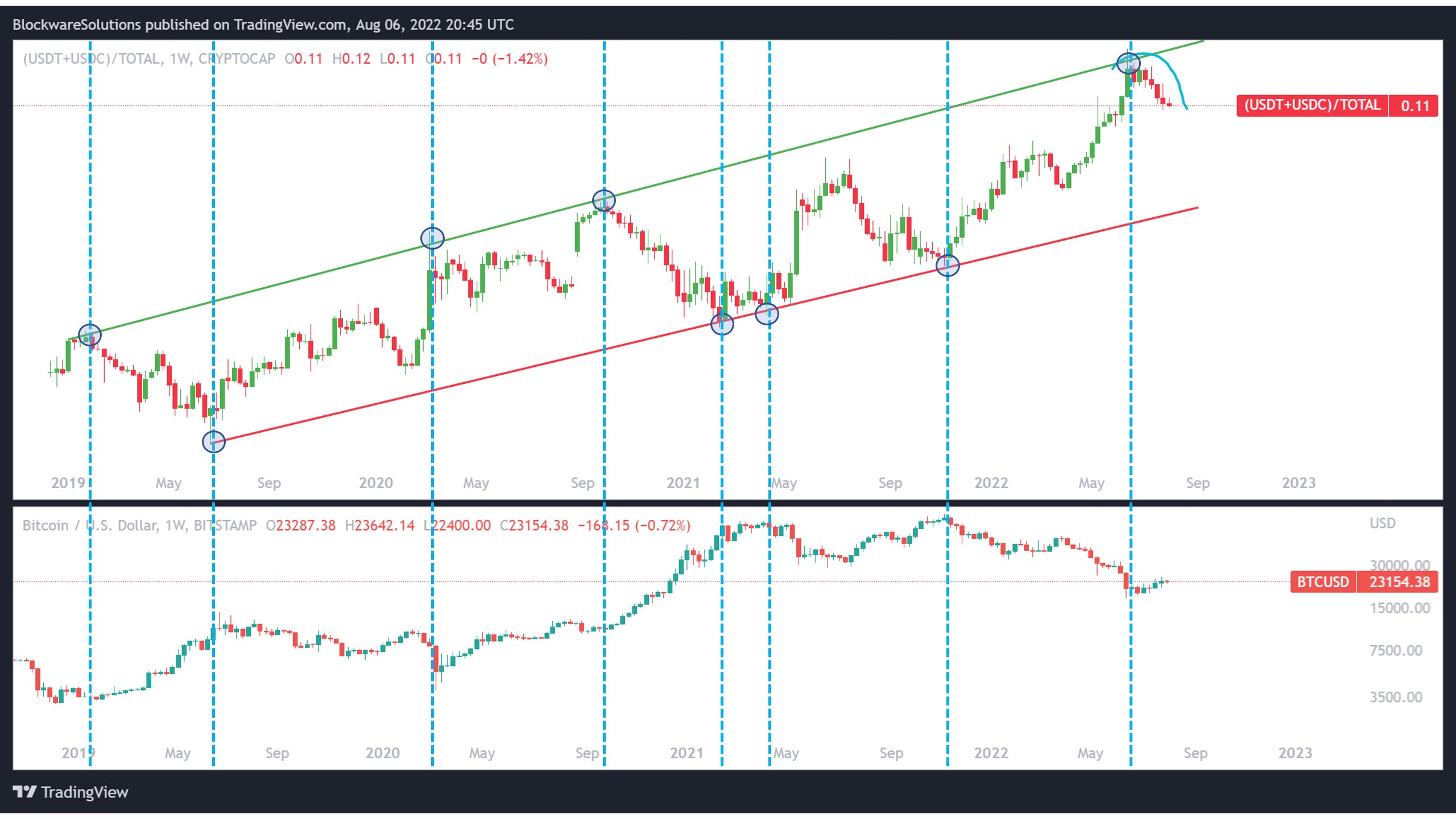

Clemente also has his eye on another metric that has previously marked Bitcoin’s top and bottom. According to the analyst on the chain, the ratio between the total market value of the two largest stablecoins and the total crypto market value is also blinking.

“The USDC+USDT market cap/total crypto market cap ratio continues to roll off the historical bottom area, respecting the channel limits…General idea is that when the ratio is high and at the channel limits, a large percentage of stalls [are available] shall be distributed in proportion to crypto market value. When [ratio is] low, there are many stables already deployed.”

Although on-chain signals seem to favor BTC bulls, Clemente warns that macroeconomic data scheduled to be released today could derail Bitcoin’s bounce.

“The CPI (consumer price index) announcement on Wednesday dictates whether this bear market rally risk continues in the near term.”

The CPI is a broad-track measure of the US inflation rate. Says Clement,

“Inflation rolls over = Fed can take its foot off the gas. Inflation stays higher = Fed needs to keep its foot on the gas.”

The US Federal Reserve has raised interest rates in an effort to fight inflation, a macroeconomic policy that has kept crypto markets bearish in recent months.

At the time of writing, Bitcoin is changing hands at $22,838, down 3% on the day.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated image: Stack diffusion