Bitcoin: Crypto Winter or Crypto Extinction?

D-Keine/iStock via Getty Images

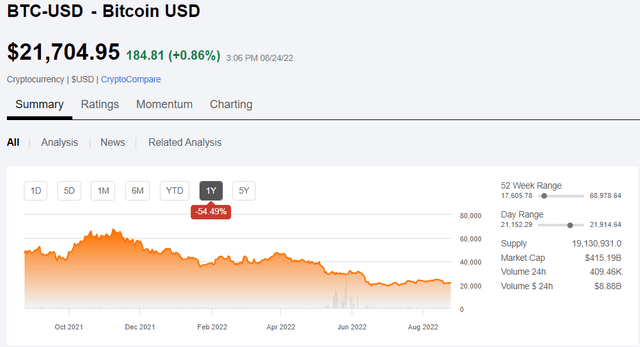

As I’m sure you already know, Bitcoin (BTC-USD) has fallen to less than 1/3 of its peak value.

SO

The relevant question is whether there will be an improvement, or whether this is the beginning of the end.

Those of us who work in the broader stock market refer to market declines as cyclical, implying that there is some inevitability to an eventual recovery. Crypto providers, whether currencies or ancillary services, have adopted similar language, referring to the unprecedented crash as a downturn, downturn cycle or “Crypto Winter”.

After winter inevitably comes spring and summer, and they want to convey that kind of inevitability to a crypto recovery.

I guess Crypto Extinction would be a more accurate term.

In this article I intend to use reasoning to show 2 things:

- Why the S&P 500 Will Always Recover (Barring Extreme Circumstances)

- Why We Think The Crypto Decline Is Permanent

I think examining the reasons why the broader stock market has always recovered from crashes will help illuminate the flimsiness of the assumption that crypto will have a similar cyclical recovery.

Why the broader stock market always recovers

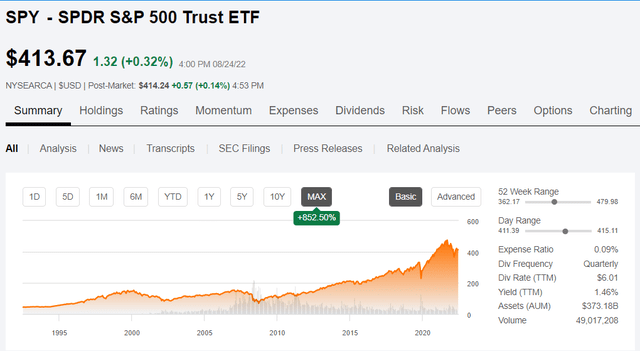

Let’s start with the actual observation. The stock market has crashed dozens of times over its long history, but it has always bounced back to reach new highs.

Every market crash there are doomsday signs that this time is different. This will be the end of the upmarket for reasons XYZ. In all cases, these doomsayers have been proven wrong as the stock market continues to reach new highs in not too long.

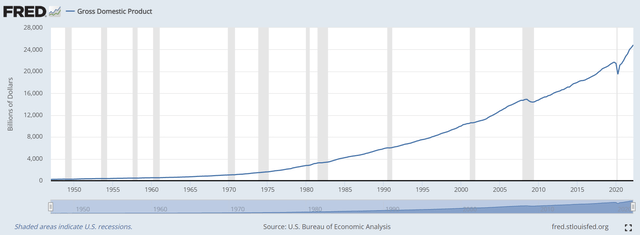

There is an underlying mechanism that makes the recovery so reliable and seemingly inevitable – the steady rise of US GDP.

PEACE

Individual companies can and do fail. Even entire sectors can become obsolete, but the economy is a large and diverse mechanism. While some companies struggle, others grow. As overall GDP grows, the market does and should go up.

As the economy grows, the earning power of the companies that make up the stock market increases, which in turn causes their market prices to rise.

So when investment professionals talk about market downturns as if they are merely cyclical and that a recovery is almost inevitable, it is not hubris. It is not a sale. It is a researched understanding of the durability of the underlying economic mechanisms.

Why Crypto Vendors Are Trying To Convince You It’s Cyclical

Of course, I cannot know other people’s intentions. I can only examine financial incentives. Those who own crypto are financially motivated to encourage others, prices will go up because it increases the value of their portfolio.

Those who perform crypto-related services are encouraged to say that crypto will recover because when Bitcoin is higher, transaction volume is higher and fee income is higher.

Coinbase (COIN) is one such crypto service provider. CEO Brian Armstrong said in an interview on CNBC:

“the decline is not unusual, as Coinbase has been through four decline cycles in 10 years”

he also said.

“Hopefully it (the downturn) will be 12-18 months with a nice recovery”

This is about par for the course in terms of how crypto insiders describe the “downturn”

Brian Armstrong’s feelings may be very real. I can’t know his internal thoughts, but I think it’s worth noting that COIN’s business is dependent on a crypto rebound, and thus he has more or less no choice but to be bullish publicly.

I disagree with the language used to describe the fall of crypto on 2 points:

- It fails to capture the scale of the carnage

- It assumes it is down for cyclical reasons and will pick itself back up

Crypto crashes are far worse than even the severe crashes in the broader market. The Internet bubble burst in 2000, the Great Financial Crisis and COVID were the three biggest falls in modern stock market history.

None of them are close to the size of the drop in crypto.

SO

Coinbase is the biggest exchange and it is down 80%. Bitcoin is the largest and most stable cryptocurrency, but it is down over 66% from its peaks. Many of the other coins are already extinct. Many of the other exchanges and services declare bankruptcy.

This is absolutely carnage, but the suppliers call it a cyclical downturn.

A cyclical downdraft is what happened to the broader market in the first half of 2022. The major indexes were down 10%, 15% or maybe 20% depending on which index you’re looking at.

It is a cyclical downturn. Crypto 60%-80% down is a disaster.

Why Crypto’s Downturns Are Not Cyclical

As crypto participants are quick to point out, cryptocurrencies have been through down cycles before and recovered. So this time should be no different, right?

Well, as it turns out, the previous recoveries were a result of expanding the potential investor base via accessibility.

Cryptocurrencies themselves do not have fundamental properties because they do not produce earnings or even have a path to produce earnings, but the securities that people own them from have fundamental properties in the form of supply and demand of the securities/coins.

Anytime you increase the pool of buyers for a security, even if only a small percentage of the new potential investors end up buying, it has a positive impact on the price of the stock or in this case the coin. Bitcoin and other cryptos simultaneously hit peak buyer pool and peak adoption as a percentage of said buyer pool. That, I think, made the highs seen last year an all-time high, and I don’t think it’s plausible to return there because that level of hype can’t be repeated.

Perfect storm of hype and access

When bitcoin first started, it was only available to the most tech-savvy and was mostly held only by the miners. The violent price increase was a result of continuous expansion to the investor group via availability.

Crypto is now held by people who until very recently didn’t even have investment accounts. One can trade crypto on the phone with just a few clicks. Availability has reached a point of ubiquity so I don’t see a way for there not to be more gains via increased investor pool. The hype hit a high when billions of dollars were spent by crypto vendors, filling up a huge percentage of advertising space on the internet, TV and even billboards. I don’t think you can throw more ad dollars at the space than LeBron James advertising crypto in a Superbowl ad.

The hype was not only a product of advertising, but also a momentum-driven phenomenon. People love to brag, and the huge crypto wins provided an opportunity to brag. I had a strong feeling that crypto is nearing its peak when I started overhearing gym bros telling each other about their sick Ethereum (ETH-USD) gains.

Bragging is just part of human nature. It is evolutionarily bred into us as a way to increase social status. I also like to brag, which is why I’m going to tell you that I wrote a short essay on Shiba Inu when it was more than double today’s price and a short essay on Coinbase when it was almost triple today’s price.

However, after the crypto collapse, I think the hype train is dead. Bragging about crypto gains has been replaced by grudging admissions of past ownership, the same way one would admit to doing some stupid thing in college.

Perhaps one area of remaining expansion to the investor pool is for larger institutions such as BlackRock to become involved. That may actually be a source of increased demand, but I don’t see it as likely to offset any headwinds from reduced hype.

As such, the investor pool expansion mechanism that led to previous crypto rebounds from lows seems weak.

I don’t see any replacement mechanisms that could lead to recovery. Unlike the S&P, crypto doesn’t have the earnings to pull it back up. See, when the S&P gets cheap, income yields get higher, leading to bigger dividends and more capital retained to further increase those earnings and dividends.

Thus, the S&P’s cheapness means that investments become increasingly attractive, and thus prices rise again.

Crypto doesn’t come cheap on valuation when it falls. It doesn’t have the earnings to pull it back up. I see no reason why it shouldn’t just go to zero. While I’m sure the crypto extinction has begun, I’m also fallible, so let’s look at the risks of shorting Bitcoin.

Risks of shorting BTC

One of the challenges with shorting in general is that to make it work, not only do you have to be right, but the path is important. For example, even if I am correct that BTC eventually goes to zero, if it were to go back to say $100,000 per coin sooner, it could cause significant financial stress and force short sellers to cover.

Therefore, to profit from a card, one must not only be right about the destination, but also be able to handle the vicissitudes of the road. As such, you may want to keep short positions fairly small.

This path risk is perhaps greater with Bitcoin than it would be with a regular stock because it is a momentum-driven story, meaning it can have large movements over short periods of time.