Bitcoin Could Free Hong Kong From China – Bitcoin Magazine

This is an opinion editorial by Margarita Groisman, a technology engineer who has invested in the power of Bitcoin to help people around the world.

Many remember the intensity and incredible spirit of the people of Hong Kong during the 2019 protests that went viral all over our screens. Thousands of ordinary citizens took to the streets to protest China’s use of excessive force and an aggressive takeover of the law that went against Hong Kong’s constitution. Beginning in March 2019 with a sit-in at government headquarters following a change to the extradition policy to mainland China, demonstrations continued and continued with increasing grievances.

Hong Kong, once a beacon of free economic activity, a center of trade and commerce, and a democratic and free state with a level of sovereign control, would quickly be taken over by mainland China.

The outbreak of COVID-19 largely ended the protests, and the West turned away from the plight of the people of Hong Kong. A 2020 document from Beijing declared that “comprehensive jurisdiction” would be achieved by the Chinese Communist Party (CCP) over Hong Kong, with people’s compliance with the COVID-19 restrictions giving China the ability to quickly sweep away the opposition by force and without interference by foreign powers.

Freedoms that those in the West take for granted, such as the right to protest and freedom of expression, no longer exist in Hong Kong, and all forms of political opposition are now silenced. The new National Security Law, designed to prevent “secession, foreign interference, terrorism and subversion against the central government” was passed in May 2020, bypassing the local legislative process and allowing China to take unprecedented control of Hong Kong.

Hong Kong’s once enshrined constitution, which gave it a “capitalist system and way of life” and provides “a high degree of autonomy”, including executive, legislative and independent judiciary powers for 50 years, has been broken and terminated by the will of the CCP.

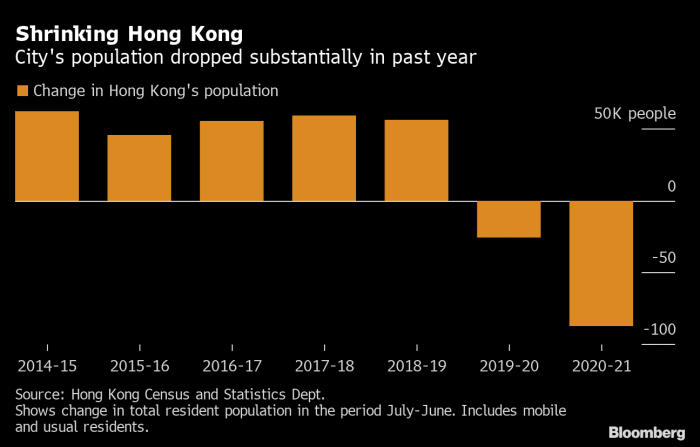

Since then, we have seen a mass exodus of the people of Hong Kong, as basic freedoms that citizens used to enjoy have almost all been taken away. We have also seen a weakening of the economic strength of Hong Kong

COVID-19 and the continued suppression of freedom in Hong Kong

While Hong Kong has implemented a strict response to the COVID-19 pandemic with a “zero COVID” policy, in March 2022 it reported one of the highest Covid death rates in the world.

This fascinating Atlantic article described the situation in Hong Kong, where COVID-19 has been used by the government to justify and demand absolute control over the population. Hong Kong faced extreme and consistent lockdowns and continues to dramatically fail and yet relentlessly defends a zero-covid policy:

“With opposition voices silenced, Hong Kong’s rulers claimed they could govern more effectively. But in the city code, which was revised last year to ensure that nationalism and obedience are valued over competence and political savvy, suggestions for how to tame the outbreak have included the wildly impractical (using cruise ships as temporary isolation facilities) and the patently absurd (releasing fresh food to Hong Kong by drone). Even this newfound sense of urgency on the part of lawmakers and the government has emerged only after Chinese President Xi Jinping spoke last month of the ‘supreme mission’ to bring the current outbreak under control.”

“‘Hong Kong’s pandemic response definitely shows NSL [national-security law] new order is not just about elections and activists, but extends to all areas of life,” Ho-Fung Hung, a professor at the Johns Hopkins School of Advanced International Studies and the author of the forthcoming book City on the Edge: Hong Kong Under Chinese Rule, told me by email.”

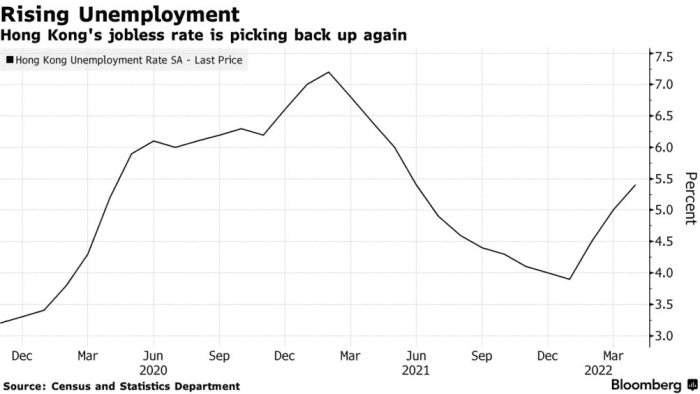

This strategy has had significant effects on unemployment and economic problems for the city:

The Hong Kong dollar is pegged to the US dollar

Despite all the authoritarian changes, Hong Kong still operates on a currency pegged to the US dollar. The Hong Kong Monetary Authority aims to keep the currency trading at HK$7.75 to HK$7.85 per $1. But as the United States has begun to raise interest rates, Hong Kong lost significant liquidity even as the city struggled to maintain the bond. In fact, between May and July alone, the Hong Kong dollar balance shrank by more than half.

“For example, the gap between the Hong Kong Interbank Offered Rate (Hibor) and its US counterpart (dollar Libor) widened significantly after the Fed began its aggressive rate hikes, because liquidity in Hong Kong was still very good. (Hibor and Libor represent a daily average of (what banks say they will charge to lend to each other.) This gap makes it attractive for traders to borrow in Hong Kong dollars to buy US dollars to earn higher returns.The so-called carry trade can push the local currency against its weak end at HK$7.85, prompting the HKMA to intervene.”

-Washington Post

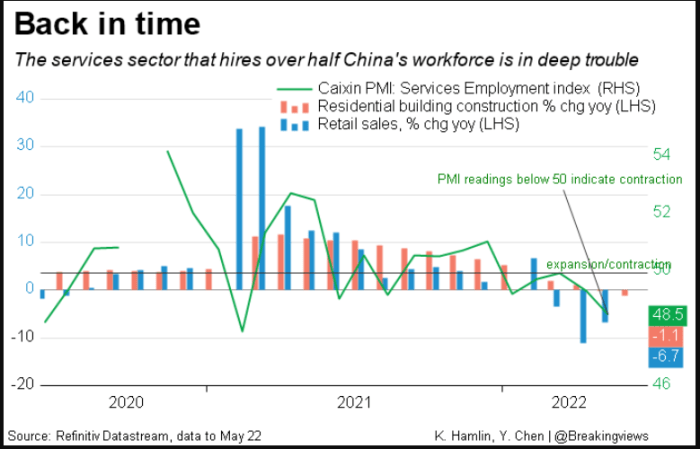

In some ways, this means that Hong Kong is caught between the political control of the Chinese Communist Party and economic dependence on the US dollar and fiscal policy. Despite Hong Kong seeing a stable currency, as Hong Kong’s inflation rate for 2021 was 1.57%, an increase of 1.32% from 2020, it saw a significant increase in borrowing costs due to this significant selloff. And although the peg to the US dollar means that Hong Kong remains at least economically semi-autonomous, the combination of the population decline hitting property prices in Hong Kong so significantly due to reduced demand and increased borrowing costs to maintain the peg. hit the economy hard. Hong Kong faced very significant COVID-19 restrictions, and as a result unemployment is mirroring the trends in China.

Speaking to Bloomberg, George Magnus, an economist and associate professor at the University of Oxford China Centre, made it very clear: “It’s China’s choice whether to keep the spigot in place.”

And it seems clear that the CCP now has soft power over the local government in Hong Kong and may decide to move Hong Kong under complete economic control. Especially as China and Russia work together to create a new reserve currency and the long-term future of the dollar’s reserve capacity hinges on the Federal Reserve’s success in curbing rising inflation, it appears that Hong Kong’s days of financial autonomy may be limited.

Is Bitcoin a way out for Hong Kong?

Interestingly, considering this precarious economic and political position, Hong Kong was listed as the most “crypto-ready” country in 2022.

This statistic was determined by “factors such as crypto-ATM installations, pro-crypto regulations, startup culture, and a fair tax regime signal a country’s readiness to adopt cryptocurrencies.” Taking these factors into account, a Forex Suggest study revealed Hong Kong’s position as the best-prepared country for widespread cryptocurrency adoption, with a crypto-readiness score of 8.6,” per CoinTelegraph. And as previously reported in Bitcoin Magazine, Hong Kong saw a surge in bitcoin trading during the 2019 protests, which demonstrated a need for an efficient peer-to-peer exchange that would not be controlled by the Hong Kong government (now a chip of the CCP).

Those who live in Hong Kong stay because it is their home. But as China tightens its grip on the region more and more, the COVID-19 restrictions seem endless, and even the most basic freedoms for the people of the city continue to be eliminated. Hong Kong’s long-term outlook looks increasingly bleak.

This will become increasingly clear if China moves Hong Kong to a currency pegged to the yuan or one under a Chinese state-sponsored digital currency. In fact, China has already made efforts to move Hong Kong under the state-backed e-CNY, or CCPS, a centralized digital currency. After all, however, “Experts close to the People’s Bank of China and state-owned bank officials believe that e-CNY will ultimately contribute to the yuan’s internationalization in the long term,” according to Carnegie Endowment Scholar Robert Greene.

This would signal a complete end to Hong Kong’s autonomy.

The people of Hong Kong have few options available to them in terms of hope for regional autonomy or any kind of freedoms granted to individuals. If citizens are to act quickly, they may choose to move toward a different path than the one they are currently tumbling down. If the incredible talent and intelligence of the people of Hong Kong harness the Lightning Network to conduct peer-to-peer exchange on top of Bitcoin, for example, they may be able to chart a difficult but promising path out of China’s full control.

The alternative is the current path that Hong Kong is on, where it loses regional autonomy, individual freedoms and the ability to make its own destiny.

This is a guest post by Margarita Groisman. Opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.