Bitcoin Continues To Trade Sideways, Will BTC Break Out Of Limbo With US PPI Data Release?

- The Bitcoin price has been largely unaffected by concerns plaguing the traditional US PPI issuance market.

- Bitcoin may witness an increase in volatility and move towards the limits of the current consolidation phase.

- The price outlook for Bitcoin is currently bearish and a move below $16,900 could validate the thesis.

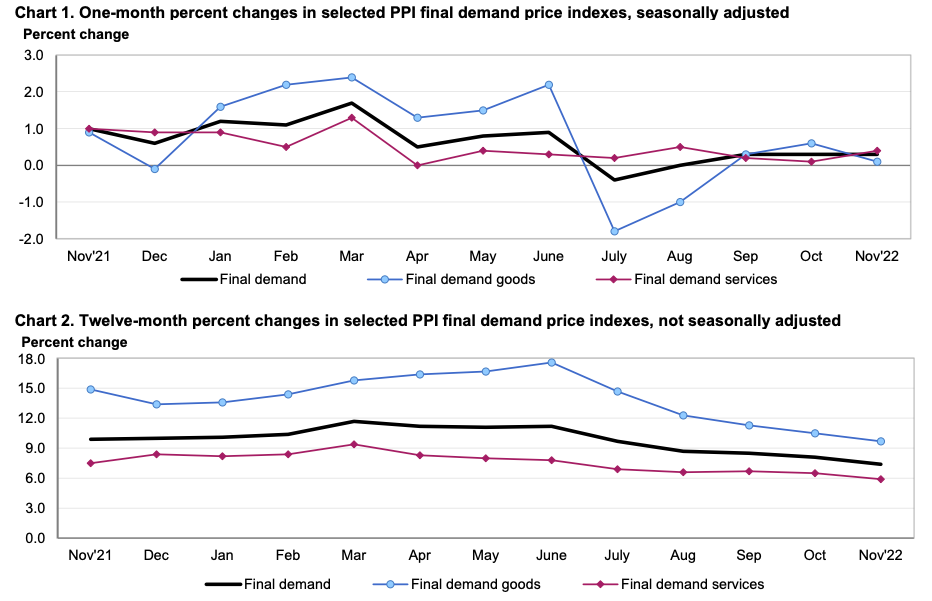

The US producer price index (PPI) for final demand rose 7.4% on an unadjusted basis. The upside surprise suggests that inflation is elevated and cryptocurrencies are expected to fall. Traders may pull out of risky assets like Bitcoin as the US Federal Reserve moves ahead with a continued interest rate hike. Bitcoin price is currently in an uptrend on the daily chart, but for bulls to realize their benefits, BTC needs higher volatility.

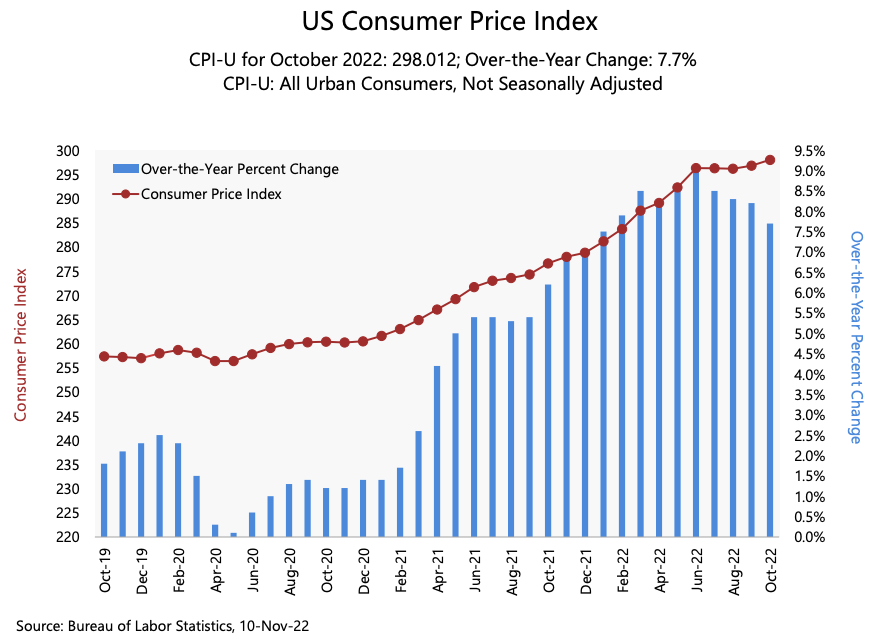

In the past, the US Consumer Price Index (CPI) data release has acted as a trigger for large fluctuations in the Bitcoin price. The next release is scheduled for December 13. The largest asset by market capitalization may therefore break out of its limbo and sideways price action near the release date.

Also read: SEC order seeks to assess health of crypto industry after FTX exchange fallout

Bitcoin price may fall with US PPI data release

Bitcoin traders brace for impact as US PPI data is released. The producer price index measures the average change over time in the selling prices that domestic producers receive for their production.

With a higher than forecast increase in PPI, it is imperative that inflation is here to stay and risk assets such as Bitcoin could suffer negatively from bearish sentiment among traders. In November, most of the increase in the final demand index is due to an increase of 0.4%

in prices for final demand services. Prices for final demand less food, energy and trade services rose 0.3% in November after rising 0.2% in October.

US PPI data one-month and twelve-month percentage changes

The consumer price index (CPI) measures the change in the prices of goods and services in a basket of consumer goods. The US Federal Reserve, the country’s central bank, watches this figure very closely as it plays a key role in maintaining price stability.

CPI data affects sentiment among traders in traditional stock markets, as do risk assets such as Bitcoin and cryptocurrencies. Historically, in the days before the release of CPI data there is an increase in trading volume and the Bitcoin price makes gains. A rise in inflation wipes out gains in the days following the announcement, and trading volume declines until another catalyst gives bulls the edge.

An increase in the price of consumer goods and services results in capital outflows from risk assets such as Bitcoin and increases selling pressure on BTC, combined with large price swings. Bitcoin is currently trading sideways with the CPI data release a week away.

Jim Wyckoff, Senior Technical Analyst at Kitco notes that,

Prices are now stalling, but are still in a new uptrend on the daily bar chart. Bulls have a very small technical advantage in the short term, but will need to show fresh power soon to keep it.

Expert Opinion on US CPI Expectations

Clifford Bennett, chief economist at ACY Securities, believes the US central bank can slow the pace at which they raise interest rates with a moderate CPI print. This will have a weakening of the US dollar, which in turn will have a positive effect on the prices of assets and commodities priced in US dollars, such as Bitcoin and other cryptocurrencies.

US CPI data released on November 10, 2022

Michael Hewson, market analyst at CMC markets claims that given Federal Reserve Chairman Jerome Powell’s comments at the Brookings Institute last week, the pace of interest rate increases will likely slow from 75 to 50 bps per meeting.

Traders will also get an insight into consumer inflation expectations with the latest University of Michigan inflation expectations figures for December for 1 year and 5-10 years, scheduled to be released at 18:30 GMT later on Friday the 9th. November, with the previous forecasts at 4.9% and 3% respectively.

What to expect from the Bitcoin price

A deep dive into the Bitcoin price trend reveals that the asset is currently trading between the $16,000 and $17,500 levels. After a successful retest of the $17,100 level, bulls gained an advantage and pushed BTC to $17,260.

If Bitcoin price extends its gains, it may target resistance at the 50-day exponential moving average (EMA) at the $17,744 level. A decline below $16,600 could send BTC to the $16,000 lows and invalidate the bullish thesis.

BTC/USDT exchange rate chart

With the rapid spread of FTX contagion and crypto firms filing for bankruptcy, the key price levels to watch out for are between $18,000 to $19,700 and $16,000 to $17,500. Bitcoin price could fall to the low $15,900 area based on the PPI data release. BTC needs buyers to line up for bulls to gain an advantage and push Bitcoin higher ahead of the CPI data release.

Once CPI data is out, Bitcoin price may witness large swings and complete the limits of consolidation from the above price levels.