Bitcoin clings to $28K as turbulent week draws to a close

Join the most important conversation in crypto and web3! Secure your place today

This article originally appeared in First MoverCoinDesk’s daily newsletter that contextualizes the latest moves in crypto markets. Subscribe to get it in your inbox every day.

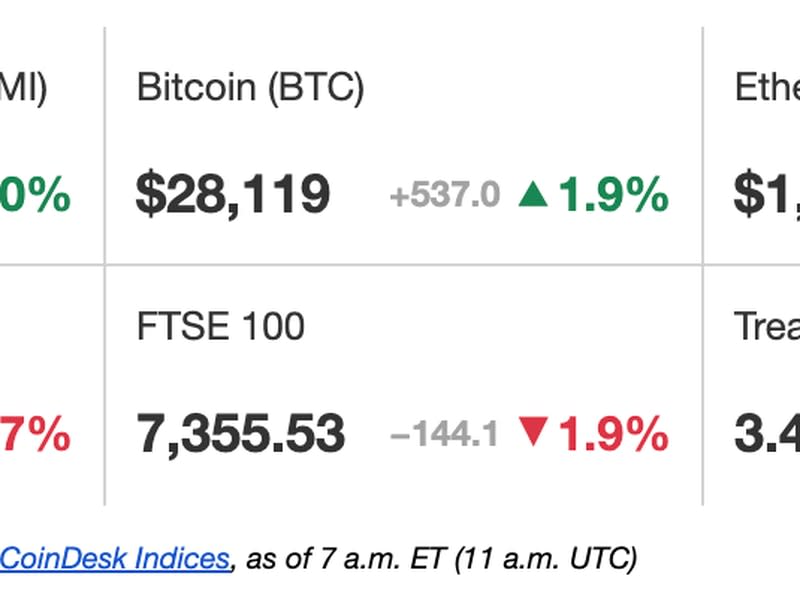

Latest prices

The main things

After a week of negative regulatory news and macroeconomic events, bitcoin has remained quite strong. The cryptocurrency is up 3% on the week and has managed to hold the $28,000 mark on Friday after hitting highs of $28,700 earlier in the week. Ether gained 2% on the day and hit $1,800 earlier this week for the first time since August. The US Securities and Exchange Commission on Thursday urged investors to exercise caution when investing in crypto assets and issued a Wells Notice to crypto exchange Coinbase earlier this week. Coinbase’s stock fell as much as 20% in early trading Thursday following the news.

Federal prosecutors in New York charged Terraform Labs founder Do Kwon with fraud hours after he was arrested by police in Montenegro. “Montenegrin police have arrested a person suspected of being one of the most wanted fugitives, South Korean national Do Kwon, co-founder and CEO of Singapore-based Terraform Labs,” Montenegrin Interior Minister Filip Adzic tweeted on Thursday. Kwon has been the target of multiple investigations and was even on Interpol’s red alert after stablecoin terraUSD (UST) and its $40 billion ecosystem imploded last year, sending shockwaves through crypto markets.

Some Binance staff and trained “volunteers” help users in China and other countries avoid Binance’s Know Your Customer (KYC) checks, CNBC reported Wednesday, citing Chinese-language messages from a Binance-controlled Discord server and Telegram group. The message group’s participants, called “Angels,” share techniques such as forging bank documents, falsifying addresses and hiding their country of origin to allow users to bypass checks and obtain a Binance debit card, according to the report. China banned crypto exchanges in 2017 and cryptocurrencies altogether in 2021.

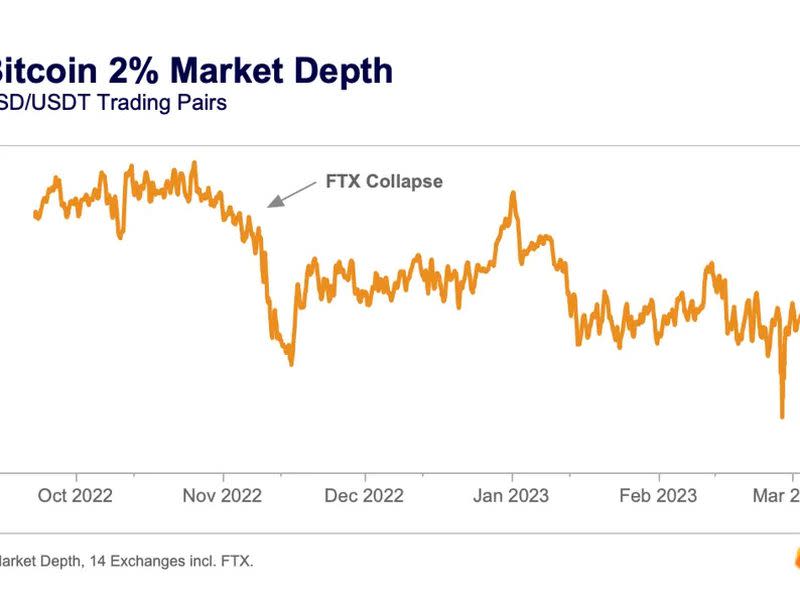

Today’s chart

-

The chart shows liquidity in the bitcoin market, measured by a metric called 2% market depth – a collection of buy and sell orders within 2% of the average price.

-

Market depth has fallen to 10-month lows, indicating a tough time for traders looking to execute large buy and sell orders at stable prices.

-

“The closure of the Silvergate Exchange Network and the decommissioning of Signature Bank’s real-time crypto payment network, some of the only USD payment rails for crypto, resulted in US exchanges being hit harder from a liquidity standpoint that market makers in the region are facing unprecedented challenges for their operations,” Connor wrote Ryder, a research analyst at Kaiko, in a market update.