Bitcoin Bulls Get Excited as Key On-Chain Values Trend Higher – Further BTC Price Rally Coming?

Bitcoin bulls are licking their lips as they look at various widely followed metrics for on-chain activity. The world’s first cryptocurrency and largest by market capitalization is already up over 40% this year, but that rally could extend in the months ahead if positive trends in the chain continue, subject to macro headwinds as the US Federal Reserve continues to tighten monetary policy. don’t get too serious.

On-chain Metrics Trending in a Bullish Direction – A Look Under the Hood

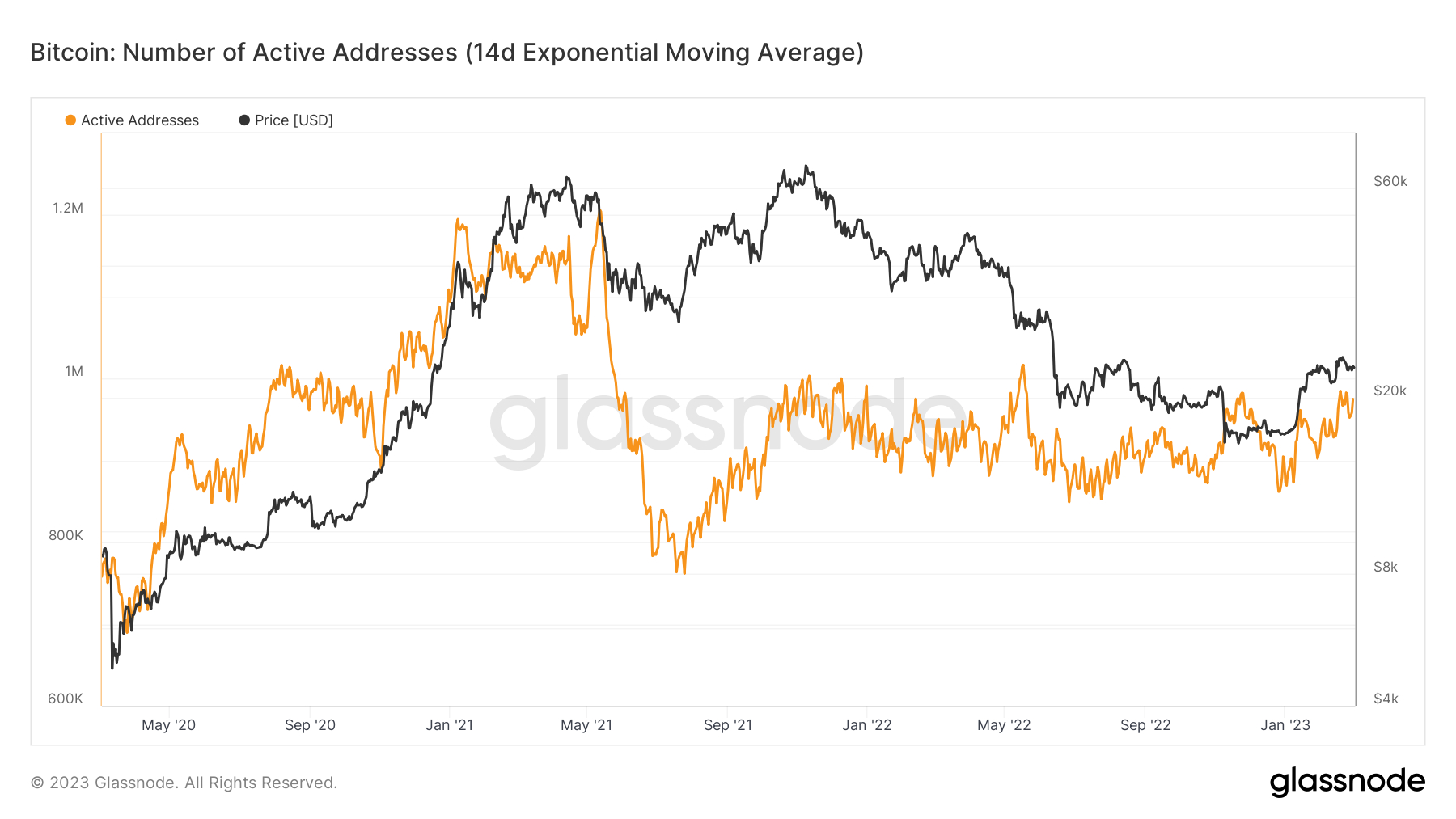

According to data presented by crypto-analytics firm Glassnode, the 14-day exponential moving average (EMA) of the number of active addresses interacting with the Bitcoin network was around 975,000 on Wednesday, after trending steadily higher since late last year to well below 900 000. If this calculation can continue to rise and push above 982,000, active addresses will be at their highest since last May. The number of active addresses on the network can be seen as a rough proxy for BTC demand.

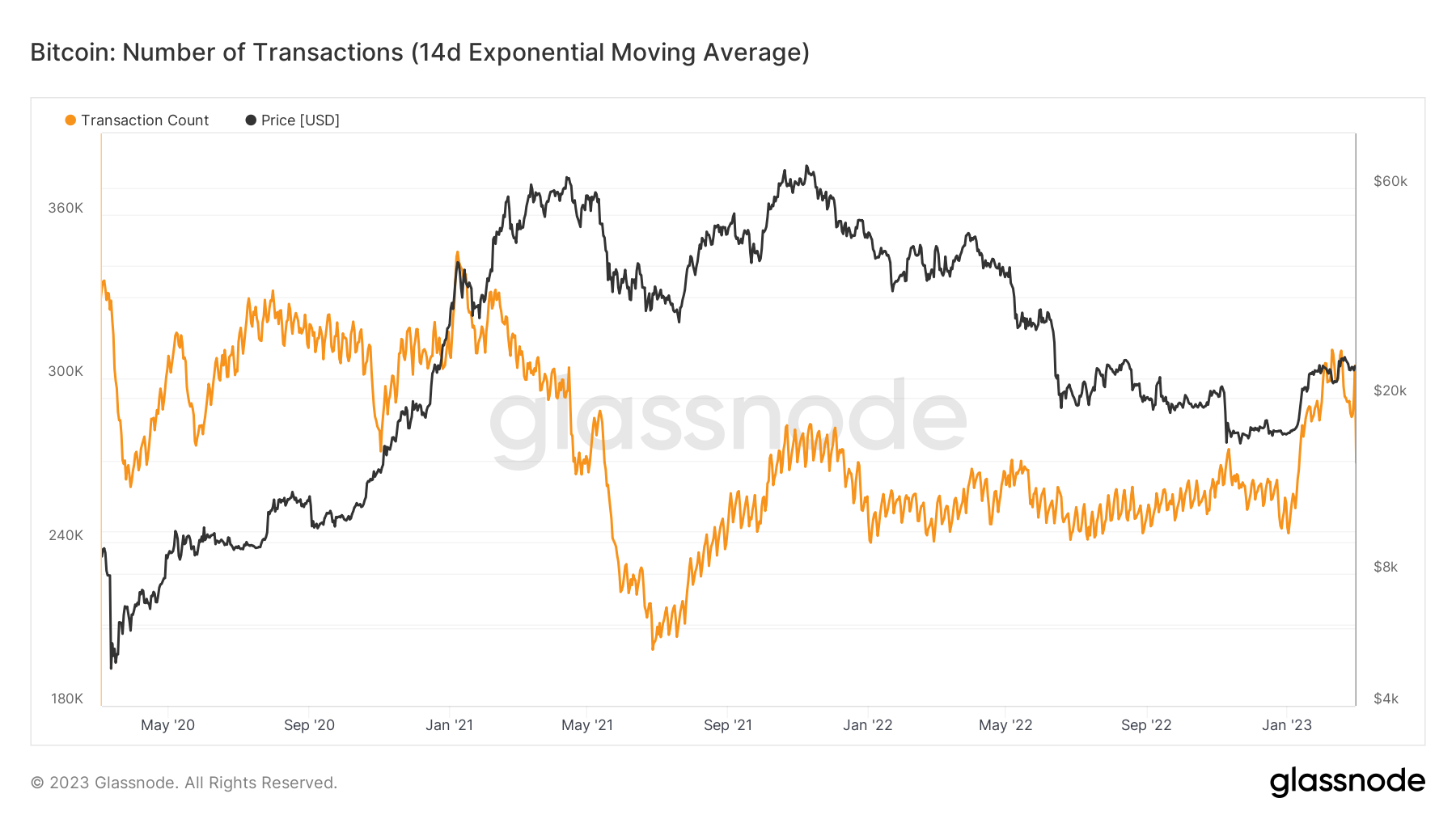

Elsewhere, the 14-day EMA of the number of transactions taking place on the network recently came close to its highest levels since early 2021, nearly reaching 305,000 on Wednesday. That’s an increase of roughly 50,000 since the end of 2022. Rising transaction numbers can also be used as a rough proxy for an increase in BTC demand.

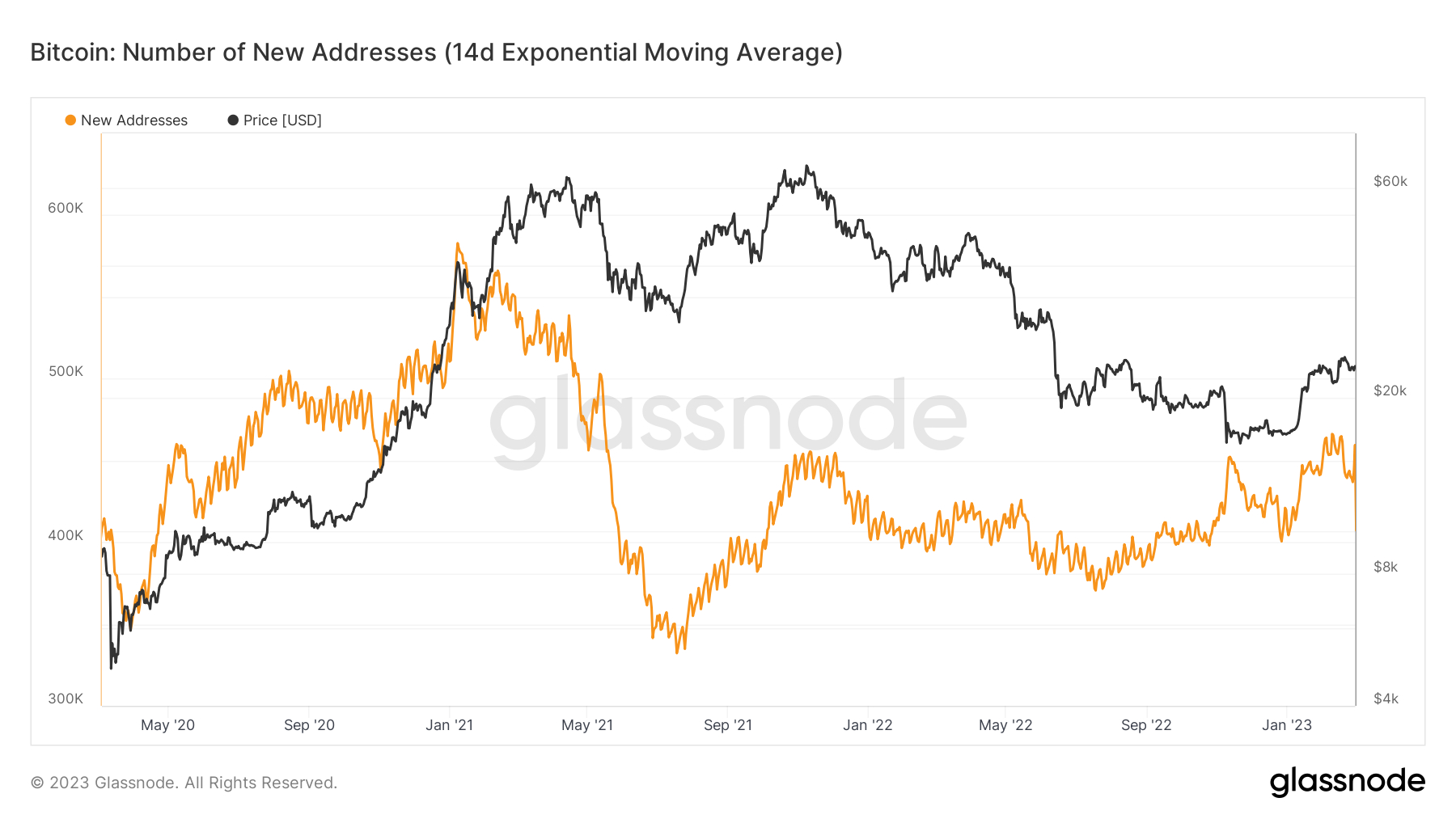

Likewise, the 14-day EMA of new Bitcoin addresses created recently rose near its highest since mid-2021, clocking in at 459,000. That’s up about 40,000 since late December. An acceleration in the number of new addresses interacting with the Bitcoin network suggests an acceleration in Bitcoin’s “adoption,” another proxy for demand.

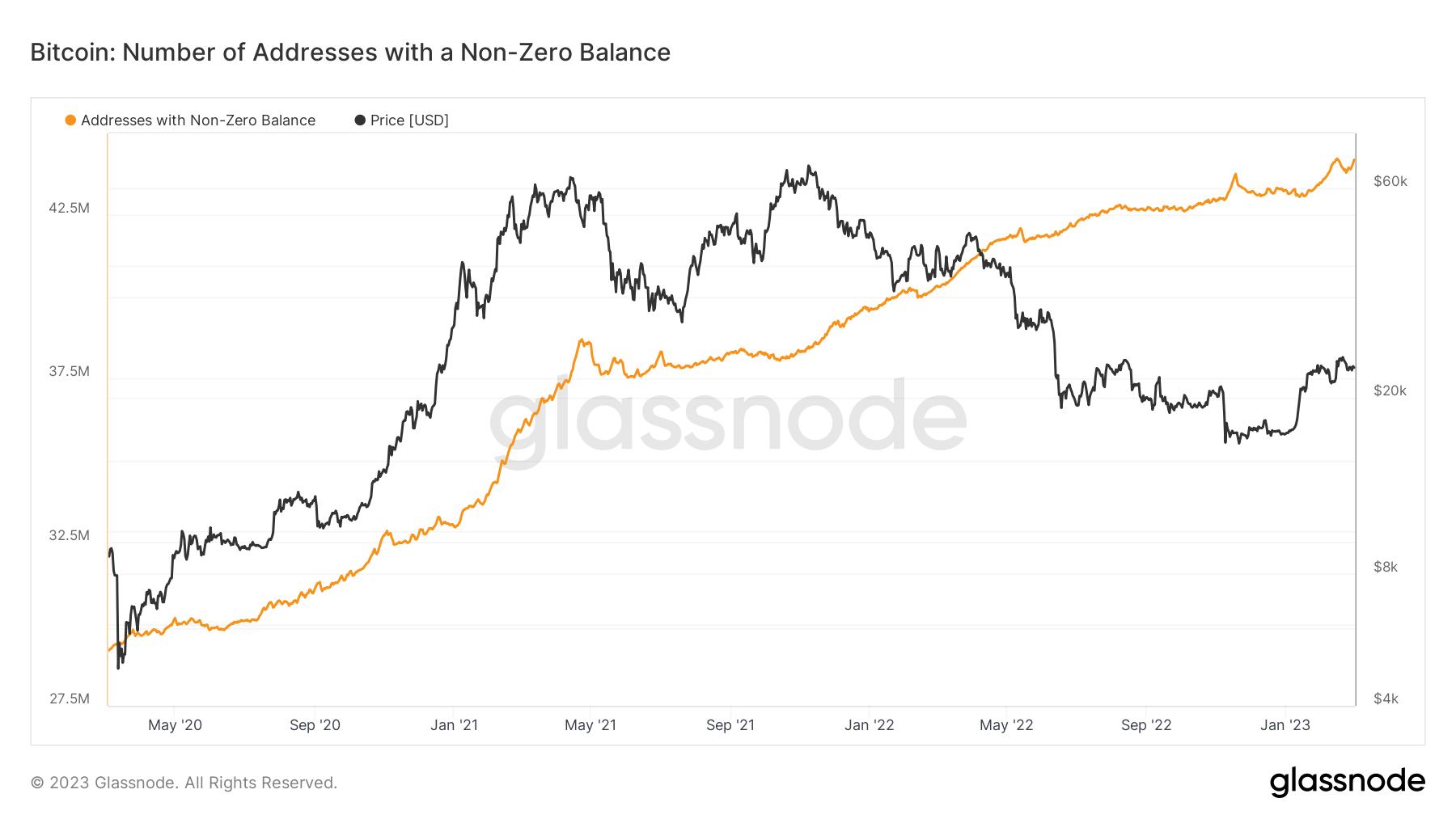

The increase in the rate of new address creation can also be seen in the recent increase in the number of Bitcoin addresses that have a non-zero balance, which last stood at 44.193 million on Thursday, near a record high. set last month above 44.2 million. While addresses with a non-zero balance have historically risen in both bull and bear markets, meaning that the short-term correlation to price is largely non-existent, most still interpret rising non-zero address numbers as a positive sign of long time. -term, given it still implies Bitcoin “adoption”.

The laundry list of bullish technical signals and signals on the chain is growing

Positive trends in the above technical metrics come as a number of on-chain alternatives and technical metrics all scream that 2022’s bear market is likely now over. As discussed in a recent article, the majority of chain and technical indicators tracked by Glassnode in their “Recovering from a Bitcoin Bear” dashboard are flashing green.

The dashboard tracks eight indicators to determine if Bitcoin is trading above key price patterns, if network exploitation momentum is increasing or not, if market profitability is returning and if the balance of USD-denominated Bitcoin wealth favors the long-term HODLers.

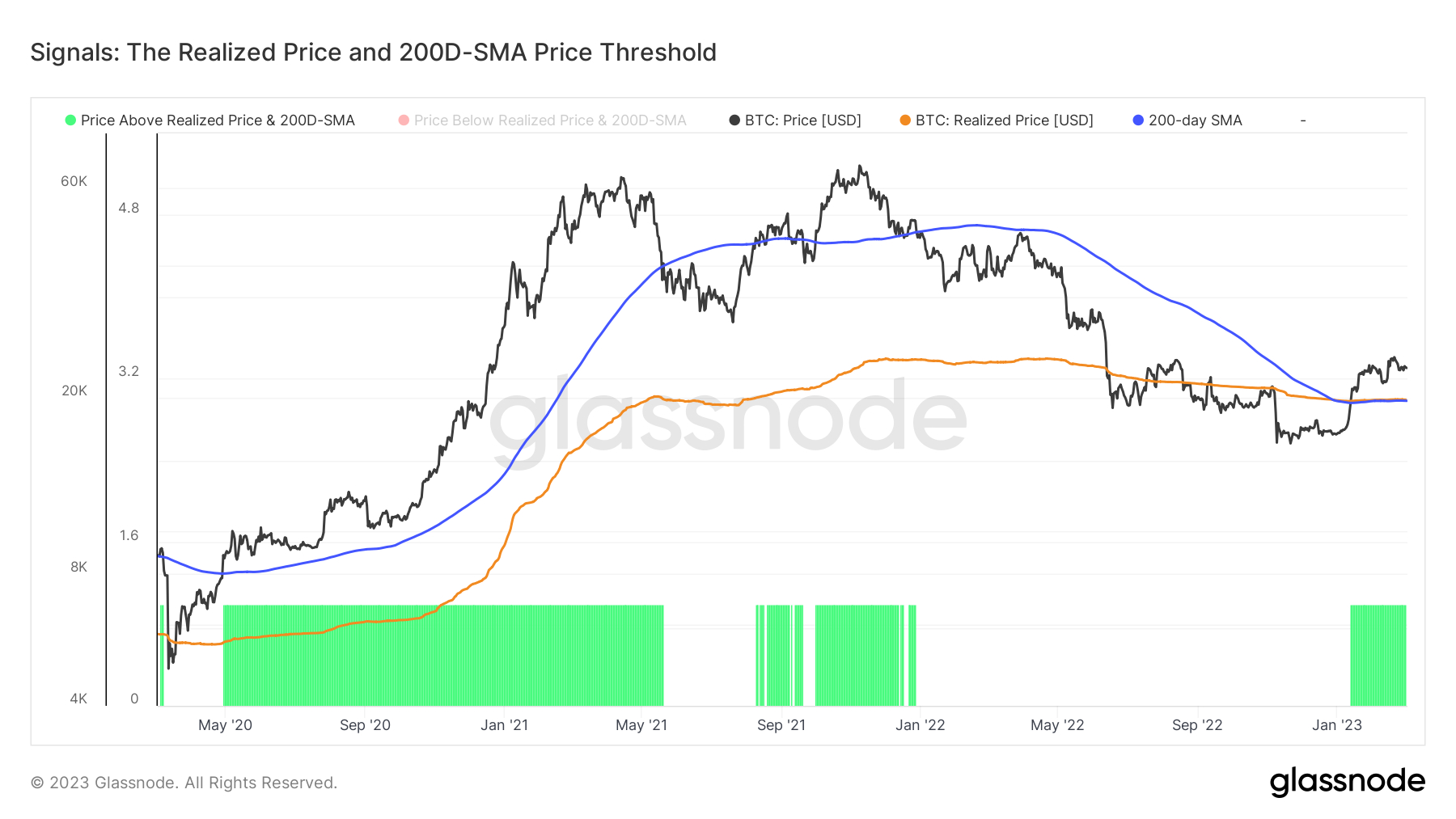

In terms of where Bitcoin is trading relative to key price patterns, this year BTC rose above its 200-day moving average and realized price, both of which are below $20,000, a doubly bullish sign on the technical front. Another recent technical buy signal that excited the bulls was that Bitcoin experienced only its seventh “golden cross” in the last 10 years.

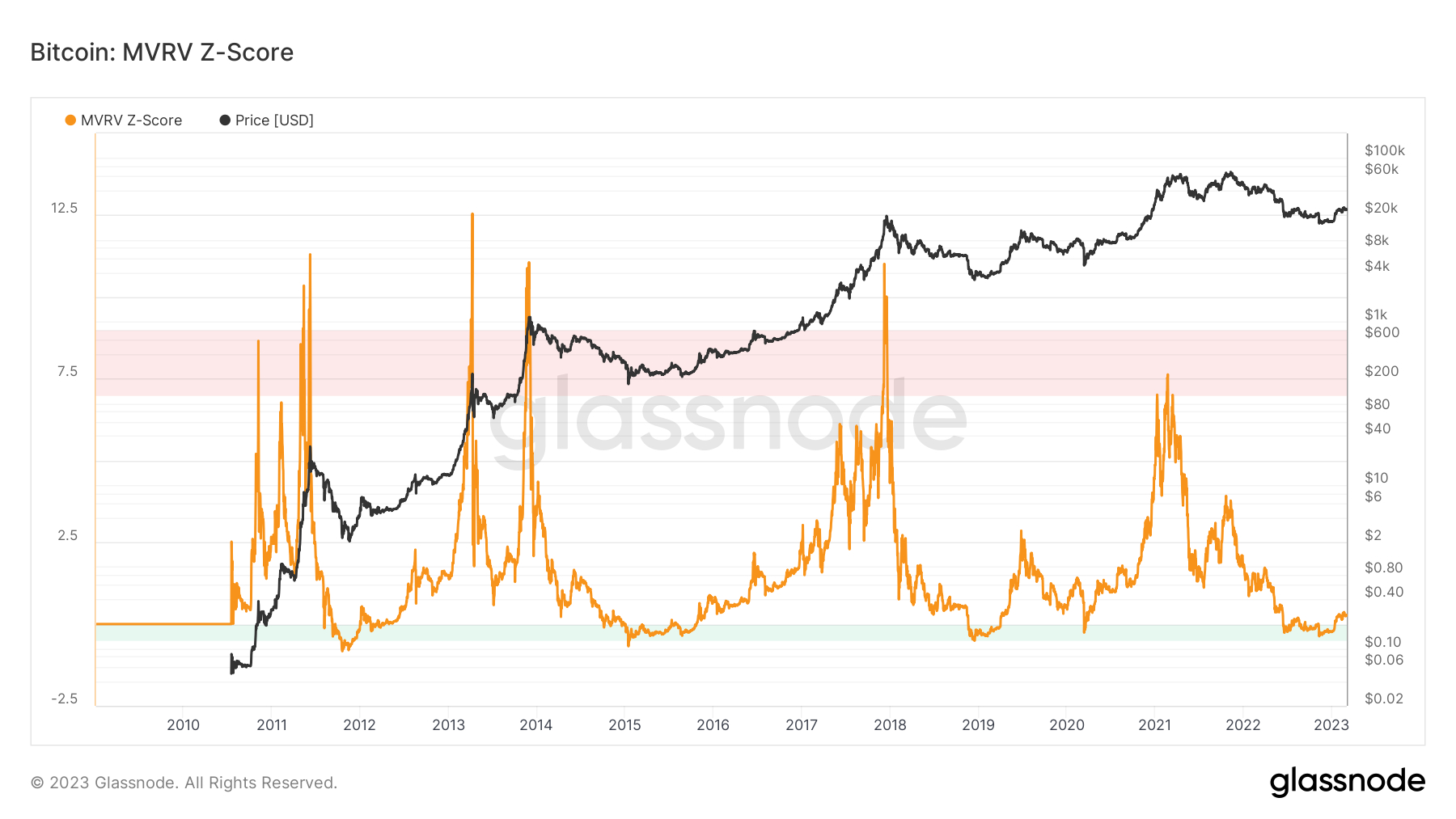

Other on-chain indicators tracked by Glassnode such as Bitcoin’s Reserve Risk, as discussed in this recent article, and the MVRV-Z score, which “compares market capitalization and realized value to assess when an asset is overvalued or undervalued,” are also screaming bull. signals. The latter recently mustered a sustained recovery back above zero after an extended period below, which has historically occurred at the start of bull markets.

Elsewhere, another market profitability indicator tracked by CryptoQuant, another crypto analytics firm, is giving a definitive buy signal for the first time since 2019.

Market cycle analysis also signals incoming bull market

Bulls also find comfort from analysis of the market cycles that the world’s largest cryptocurrency by market capitalization has historically followed. In early January, the crypto-focused Twitter account @CryptoHornHairs identified that Bitcoin follows almost exactly the path of a roughly four-year market cycle that has been perfectly respected now for over eight years.

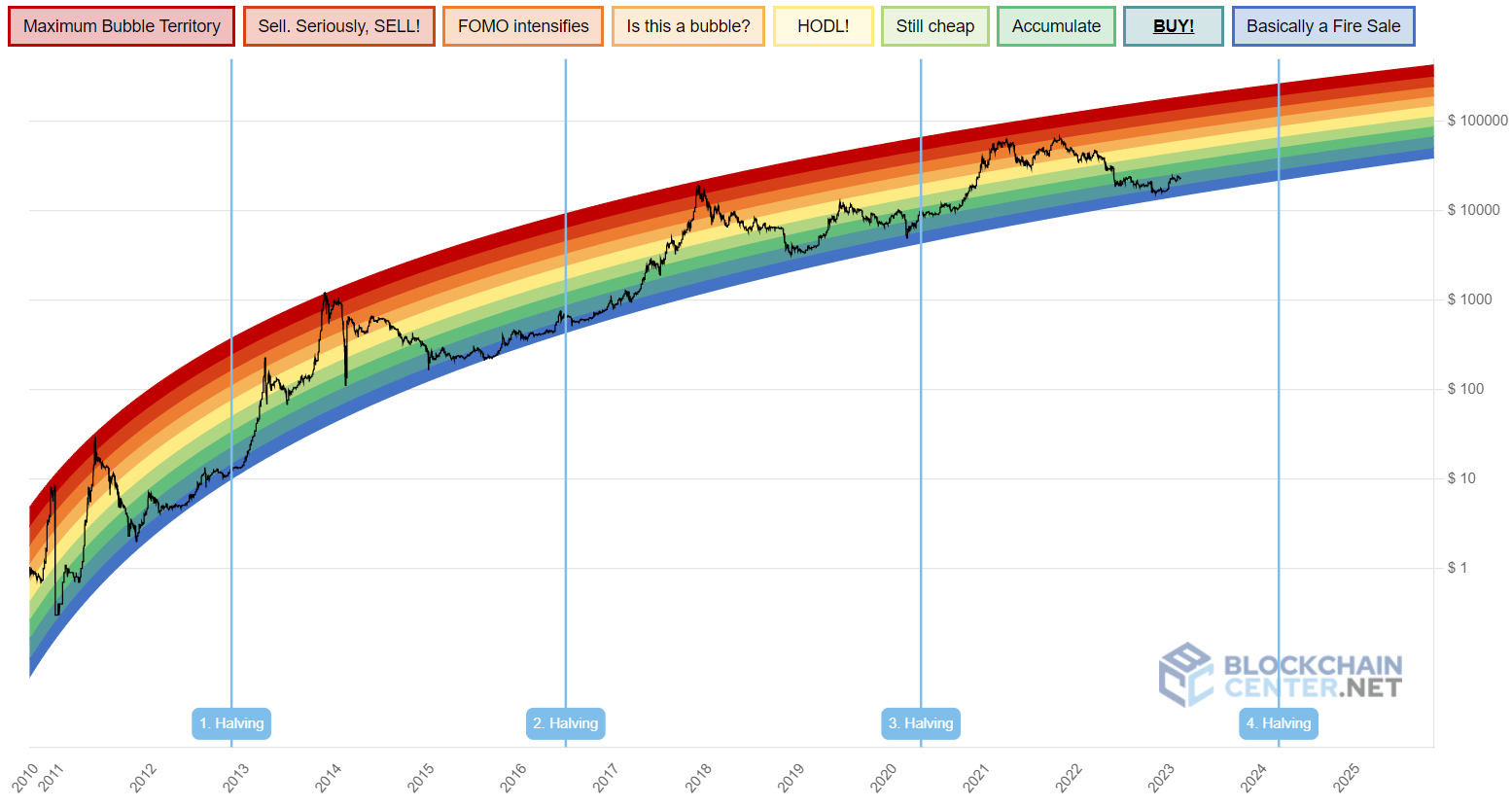

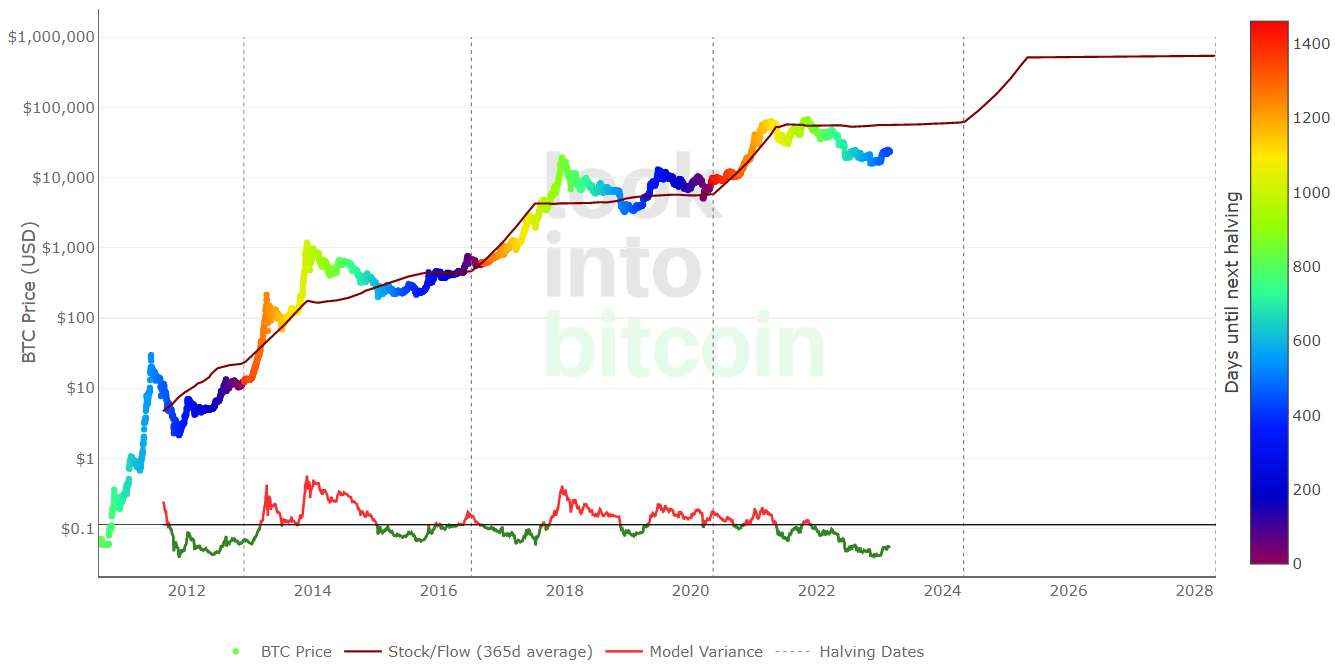

Elsewhere, a widely followed Bitcoin price model is sending a similar story. According to the Bitcoin Stock-to-Flow pricing model, the Bitcoin market cycle is approximately four years, which shows an estimated price level based on the number of BTC available in the market relative to the amount mined each year, Bitcoin’s fair price entitlement. now is around $55K and could rise above $500K in the next market cycle after the halving. That is around 20 times the gain from today’s level.

Finally, Blockchaincenter.net’s popular Bitcoin Rainbow Chart shows that at current levels, Bitcoin is in “BUY!” zone, after recovering from the “Basically a Fire Sale” zone at the end of 2022. In other words, the model suggests that Bitcoin is gradually recovering from being heavily oversold. During the last bull run, Bitcoin was able to reach “Sell. Seriously, SELL!” zone. If it can repeat this feat in the next post-halving market cycle within one to one and a half years after the next halving, the model suggests a possible Bitcoin price in the $200-$300K region. That is around 8-13 times the gain from today’s levels.