Bitcoin: Bull Run Begins As Inflation Expectations Reverse (BTC-USD)

Torsten Asmus

Exploring the relationship between Bitcoin and inflation

The prices of just about everything — gas, groceries, homes, cars, clothes, even TVs — have increased in the past two years. Inflation, which had been barely noticeable for decades, is suddenly the biggest concern most people have about the economy.

Not long ago, prominent investors and hedge fund managers such as Paul Tudor Jones, Ray Dalio and Stanley Druckenmiller supported the thesis that Bitcoin (BTC-USD) would be a good hedge against “Great Monetary Inflation”, a study from May 2020. At the time the study was published, Bitcoin was below $10,000 and a remarkable bull market had started which led to the price of Bitcoin reaching almost $70,000 in 2021.

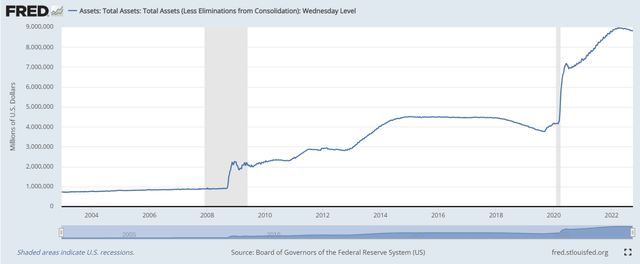

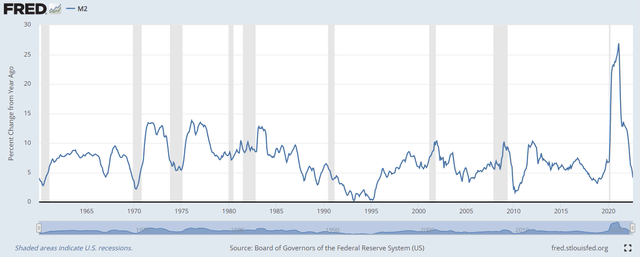

We can observe the effects of what Paul Jones referred to in the two charts below provided by the Federal Reserve Bank of St. Louis:

*Fed balance sheet expansion during the covid crisis by a factor of 2.

*M2 expansion of 25% YoY, a measure not seen since the 1960s.

FED balance sheet (fred.stlouisfed.org/) M2 (fred.stlouisfed.org/)

In 2022, we are experiencing an environment with high inflation that forces central banks to act and raise interest rates at a historic pace. Consumer prices are jumping at a pace not seen since the 1980s. Inflation that should have been temporary, according to Fed officials, is becoming more persistent and more severe.

In this environment, Bitcoin has performed poorly, falling 70% from its peaks. This reopens the debate: Is Bitcoin an inflation hedge or not?

Realized vs. Expected Inflation and the Relationship to Bitcoin

Realized inflation

While the CPI (Consumer Price Index /ie: realized inflation) is a good measure for looking at realized inflation, it is not necessarily a good indicator for the future. Historically, high CPI numbers have been met with rising Fed funds rates, which slows down economic activity. These interest rate increases are aimed at reducing inflation. The Fed and other central banks, Bloomberg quotes: “from Ulaanbaatar to Washington”, have declared the fight against inflation and the market is discounting a more restrictive monetary policy for the coming months and years.

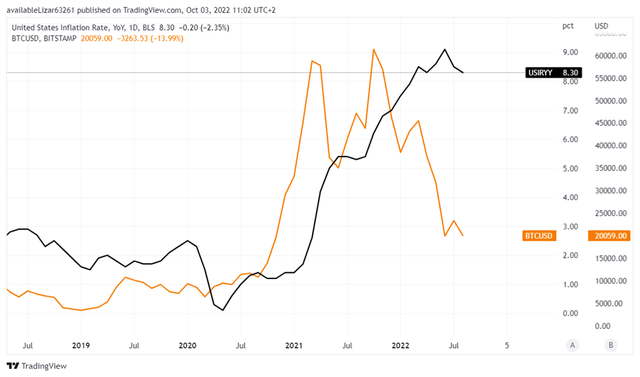

While the CPI interest rate and Bitcoin moved in a synchronized manner during 2021, this relationship broke down in early 2022. We can observe in the chart below that the parabolic movement of Bitcoin from $10,000 to its highest levels was mirrored by the inflation lift from 0 % line, but the correlation could not be sustained into 2022.

Bitcoin (orange). Inflation CPI (black) (tradingview.com)

Conclusion on realized inflation rates: Using realized inflation figures (KPI data) we can conclude that Bitcoin has not been an effective hedge.

Expected inflation

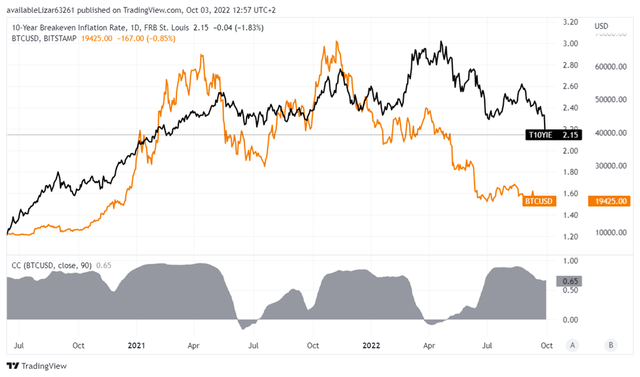

A still imperfect but arguably better option for analyzing the relationship between inflation and Bitcoin is to focus on inflation expectations embedded in the US financial market or the so-called breakeven inflation rates. These prices are the market’s expectations of future inflation. They tell us that inflation should fall and stabilize in the 2% region (chart below). Similar expectations can be found in economist surveys (Bloomberg Sep 2022). According to them, inflation in the 1st quarter of 2024 is expected to average 2.4%, somewhat closer to the central bank’s target of 2%.

M2 YoY (chart we have posted at the top) confirms this possibility. Historically, a rapid fall in M2 expansion has been followed by falling inflation, which is understandable.

Bitcoin (orange). Inflation expectations (black). Correlation (grey) (tradingview.com)

As inflation expectations rose dramatically in late 2020 and 2021, the price of Bitcoin largely followed suit. Since then, inflation expectations waves have been mirrored by the Bitcoin price in a correlated manner. Although the relationship is not perfect, it is still significant. The correlation between the two is largely positive and is represented in the chart above in the gray area. In short, the price of Bitcoin will fall in 2022, as inflation expectations have been falling.

Conclusion

We are experiencing a higher realized inflation environment with falling Bitcoin price. In hindsight (realized inflation: CPI), Bitcoin is not a good hedge against inflation.

But investors should focus on the road ahead. By measuring and tracking inflation expectations, we can observe that the relationship between Bitcoin and inflation has been strong and is still intact. A decline in inflation expectations in 2022 with a subsequent fall in the price of Bitcoin.

Forward-looking statements: The rapid slowdown in M2 supply will have the desired effect of lowering inflation by slowing the money supply and economic activity. At this point, it is most likely only a matter of time before we see CPI (realized inflation) come down to pre-pandemic levels. We even see the possibility of the inflation rate falling below the 2% mark. After all, why would inflation magically come down to the 2% level and then stabilize? Since monetary policy has a significant time lag effect, we argue that the Fed is overshooting with its rate hikes, just as it overshot with rate cuts and QE during the post-pandemic period, which generated a glut of M2 supply with higher inflation as a consequence.

In the coming months, the Fed will transition from a restrictive to accommodative turn around the sharp fall in M2 growth. At that point, inflation expectations and the price of Bitcoin will be supported again and we could see both trend higher.